What I Learned Last Week 11.3.2023

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Smash.vc

Buying a business with the SBA?

Would having a capital partner help?

At Smash.vc, they do two things:

Buy minority stakes in existing small businesses.

Partner with entrepreneurs trying to acquire new ones.

If you're actively looking to buy a cash-flowing business using an SBA loan, hit them up if you'd like a partner.

They contribute capital, give advice, or help with growth when asked... but stay out of the way the rest of the time.

Silent partners there to help when necessary, nothing more.

If interested👉 go say hi.

📰 Articles

The Downturn in M&A Spending Worsened in Q3

The Q3 2023 trends in mergers and acquisitions (M&A) reveal a downturn in spending, although deal activities continue. Here are the key insights:

Deal Size and Volume:

The M&A deals are happening but they are much smaller in value.

The total number of deals decreased by about 2.5% in 2023, with the total deal value reaching $1.04 trillion in Q3, marking a 14% decline from the $1.2 trillion recorded in the previous quarter. This total was the lowest since Q4 2020.

Deal volume hit 10,118 in Q3, down roughly 3.3% from the previous quarter which recorded 10,463 deals

Financing:

While financial sponsors like Venture Capital (VC) and Private Equity (PE) firms have in some cases struggled to access debt, corporate buyers have other tools available for financing M&A, such as cash from operations

Recovery Projections:

The recovery in the global M&A market has been pushed to 2024 due to a near 10-year low in global M&A deal value in Q3 2023.

However, several market conditions are pointing to a potential recovery in the M&A market next year, with trillions of dollars in dry powder for private equity sponsors and cash piles kept on hand by corporations positioned for new deals

These insights reflect a cautious yet hopeful outlook towards recovery in the M&A market, with a notable decrease in deal size and volume but a potential for improvement given the financial resources available.

— — — — — — — — — — — — — — —

CEO Confidence Index: Brace for Recession?

Chief Executive Group highlights a recent survey that reveals a sharp decline in CEO optimism regarding economic growth for 2024, driven by fears of a looming recession. The October CEO Confidence Index showed a majority of the 240 polled CEOs believe a recession in 2024 is likely, with economic conditions expected to be flat or negative. Sector-wise, retail, real estate, and consumer manufacturing CEOs are most pessimistic, while pharmaceutical CEOs are optimistic about a recovery. The anticipation of a slowdown is affecting profit forecasts, hiring, and capital expenditure plans for the upcoming year

— — — — — — — — — — — — — — —

Detailed Letters of Intent (LOIs) Make Closings More Likely

Barlow Williams emphasizes the importance of detailed Letters of Intent (LOIs) in successful business closings. It contrasts two LOI approaches: a quick, less detailed approach and a thorough, more detailed one.

The benefits of a detailed LOI:

A detailed LOI minimizes retrading and ensures clarity on critical deal terms, making closing more likely.

It aids in psychological anchoring, where parties become attached to the terms set in the LOI, reducing discrepancies later.

Detailed LOIs maintain deal momentum by addressing major issues early, reducing the time between LOI and purchase agreement signing.

They help in reducing legal costs by minimizing back-and-forth negotiations during the purchase agreement phase.

Engaging an attorney while drafting the LOI is advisable to ensure a well-structured agreement, aiding a smoother transaction process

🧵 Best of X (Twitter)

For Canadian business buyers, this is a helpful list of lenders…

Reach out to Ben if you’re raising capital for an acquisition and fit his investment criteria…

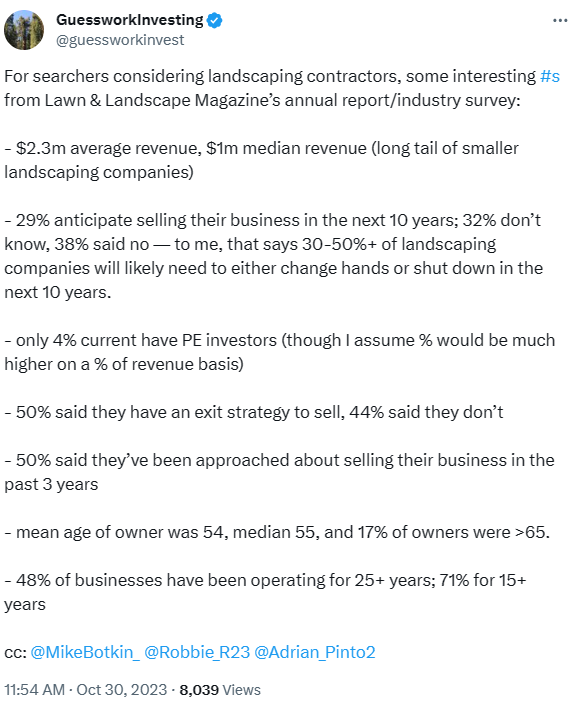

Ownership statistics of landscaping businesses…

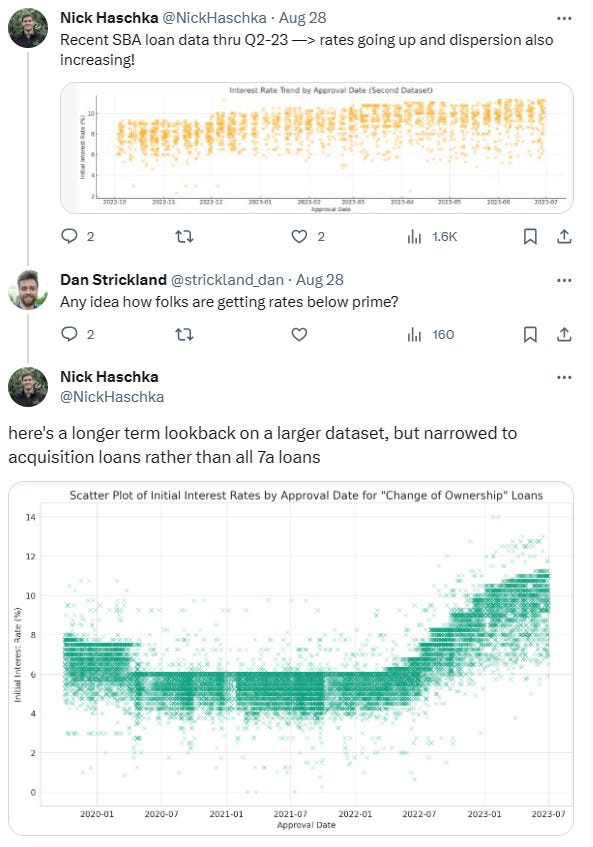

SBA loan rates vary widely. An illustrative example of why it’s important to shop around when pursuing an SBA loan…

Takeaways from last week’s Harvard EtA conference…

Using your 401k to fund a business acquisition…

Good discussion around the nuances of HoldCo’s…

On hiring the right CPA…

🤔 Other

High-Net-Worth Art Market

Not related to M&A but a bit of fun…

UBS & Art Basel just released their Survey of Global Collecting in 2023. This comprehensive report examines the attitudes and activities of high-net-worth (HNW) collectors in mid-2023, providing insights into their behaviors, perspectives on the art market, spending trends, and interactions with artists, galleries, institutions, and their surroundings.

Key findings

In 2022, HNW collectors spent a median of $65,000 on art and antiques, a 19% year on year increase. Spending remained steady in the first half of 2023, hinting at potential annual growth.

Mainland Chinese collectors outspent all international groups in the first half of 2023, surpassing the previous year and signaling robust spending recovery.

In 2023, HNW collectors allocated 3% of their budget to digital artworks, making up 8% of their collections, down from 15% in the previous year.

43% of HNW collectors used credit or loans for art purchases, with 30% doing so in 2022 and 2023, showing a steady trend despite the economic context.

🗓️ Events

Main Street Summit (Nov 8-9) - Columbia, MS

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?