What I Learned Last Week - 1.19.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Build Your Snowball. Compound what matters.

Snowball is a private community of experienced entrepreneurial investors creating meaningful wealth.

How?

By building companies for the long term.

By investing directly in the SMB ecosystem.

By creating a life where personal growth, health, and strong relationships compound over the decades.

If you’re looking for a like-minded community of accomplished doers, a place for SMB deal flow, and a place for long-term thinkers... you’ve found it.

👋 Join the club at Snowball

SnowballClub.com

📰 Articles

SDE vs EBITDA vs Cash Flow

Updated article from Big Deal Small Business. Some key insights:

SDE is a measure of profitability that adds back the owner’s salary and personal expenses to EBITDA. It is used to compare small businesses regardless of how the owner chooses to take out their profits.

Buyer’s EBITDA is the EBITDA that the buyer will generate after replacing the seller and accounting for new costs such as management salary, insurance, and other adjustments. It is used to compare the operating performance of different businesses on an apples-to-apples basis.

Cash Flow is the amount of cash that the business generates after paying for operating expenses, taxes, capital expenditures, and debt service. It is used to assess the ability of the business to service debt and provide returns to the buyer. There are two types of cash flow: levered and unlevered, depending on whether debt payments are included or not.

— — — — — — — — — — — —

Citizens 2024 M&A Outlook

The 2024 M&A Outlook presented by Citizens Bank offers an in-depth analysis of the M&A landscape, reflecting a cautiously optimistic sentiment among industry leaders. The report, based on a survey of 400 mid-market CEOs, CFOs, and private equity principals in the U.S., sheds light on the shifting dynamics of the M&A market, the strategic intentions of private equity firms, and the broader economic influences shaping the industry.

Key Insights:

Market Transition: There's a noticeable shift from a seller's market to a more balanced or buyer's market, indicating a change in power dynamics and potentially more favorable conditions for buyers.

Private Equity Engagement: Private equity firms are showing a strong readiness to engage in acquisitions, suggesting a robust investment activity and a strategic approach to capitalizing on market conditions.

International M&A Interest: There's a renewed interest in international M&A opportunities, pointing towards a global expansion of investment horizons and strategic growth initiatives.

Influence of U.S. Election: The upcoming U.S. election is seen as a tailwind for M&A activities, with industry leaders closely monitoring the political landscape and its potential impact on the market.

Economic Predictions Driving M&A Intentions: A significant portion of mid-market companies expect U.S. economic growth to notably influence their M&A plans, highlighting the interplay between macroeconomic factors and corporate strategy.

— — — — — — — — — — — —

Deal Breakdown: What I think about when buying a service business...

Sieva Kozinsky of Enduring Ventures and The Business Academy newsletter shares his analysis of a security service business that’s for sale.

— — — — — — — — — — — —

Funding a business acquisition with equipment financing

The article from Mainshares offers a comprehensive guide on using equipment financing as a strategic option for funding business acquisitions, especially when traditional routes like SBA loans are not feasible. It particularly caters to equipment-heavy businesses, offering a deep dive into the mechanics of equipment financing, including its various forms such as loans, leases, and sale leaseback options. The article thoroughly compares the economic aspects of equipment financing with more conventional financing methods like SBA loans, acknowledging its potential higher costs while highlighting its indispensability in certain scenarios where traditional financing falls short.

🧵 Best of X (Twitter)

This is spot on. Searchfunder has a great list of conferences and local meetups.

Multiples listed on BizBuySell don’t matter but the ones you use to model the acquisition do. Check out this framework…

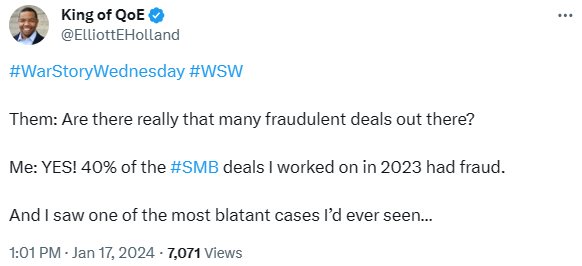

Importance of proper financial due diligence…

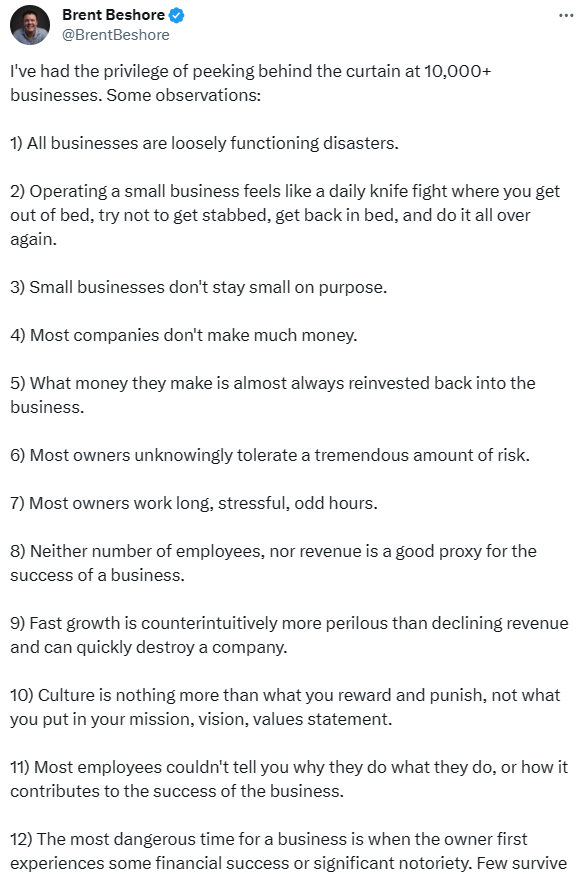

A few observations…

Great post on the journey and reality of owning a plumbing business…

How a business broker analyzes a listing…

🤔 Other

AMA: I bought a small business 6 months ago

I keep running into insightful posts on Reddit about EtA and small business ownership. Here is a new business owner of a specialty contractor sharing their observations and answering questions…

🗓️ Events

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?