What I Learned Last Week 12.1.2023

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Smash.vc

Buying a business with the SBA?

Would having a capital partner help?

At Smash.vc, they do two things:

Buy minority stakes in existing small businesses.

Partner with entrepreneurs trying to acquire new ones.

If you're actively looking to buy a cash-flowing business using an SBA loan, hit them up if you'd like a partner.

They contribute capital, give advice, or help with growth when asked... but stay out of the way the rest of the time.

Silent partners there to help when necessary, nothing more.

If interested👉 go say hi.

📰 Articles

How Research Helps You Avoid “Chlorophyll” In Business Acquisition

The article from Ben Kelly of Acquisition Ace highlights that many deals appear attractive on the surface but may have underlying issues that only become apparent through detailed research. Ben underscores the critical role of due diligence in avoiding rushed decisions and emotional biases.

Key Insights:

Importance of Due Diligence: The primary risk in business acquisition is insufficient research. Many acquisitions fail due to inadequate due diligence, which can lead to unexpected problems post-purchase.

Building Credibility with Sellers: Conducting thorough research not only uncovers potential red flags but also establishes the buyer's credibility. Sellers, often emotionally invested in their businesses, prefer selling to competent buyers who have demonstrated a deep understanding of the business.

Adopting a Process-Oriented Approach: Instead of viewing acquisitions as isolated win/loss events, treating them as part of a continuous process helps in maintaining perspective and building long-term success. This approach also leads to more opportunities over time, shifting from discovering deals to having deals brought to the buyer.

— — — — — — — — — — — —

Why I'm Betting Big on Residential Services

John Wilson of Owned & Operated highlights the importance of strategic focus and specialization in growing a business, with an emphasis on the advantages of catering to residential services in the plumbing, HVAC, and electrical sectors.

Key Insights:

Strategic Focus on Residential Services: John emphasizes the importance of being selective in business. By focusing on a specific area – residential plumbing, HVAC, and electrical services – his business aim is to grow bigger and more successful, rather than diluting efforts across multiple fronts.

Benefits of Specialization:

Distinct Sales Process: Tailoring their services and approach to residential customers ensures better problem-solving and customer service, differentiating them from businesses that cater to commercial clients.

Unique Lead Generation: Focusing on homeowners allows for scalable and effective marketing strategies, providing an edge over competitors who might rely on less scalable commercial lead generation techniques.

Enhanced Profitability: Residential services are significantly more profitable compared to new construction, remodels, or commercial work, contributing to the company's financial growth.

Optimized Payment Terms: Transitioning to a model with zero accounts receivable (AR) has been key to their growth, enabling them to get paid upfront and avoid the strain of delayed payments on their cash flow.

🧵 Best of X (Twitter)

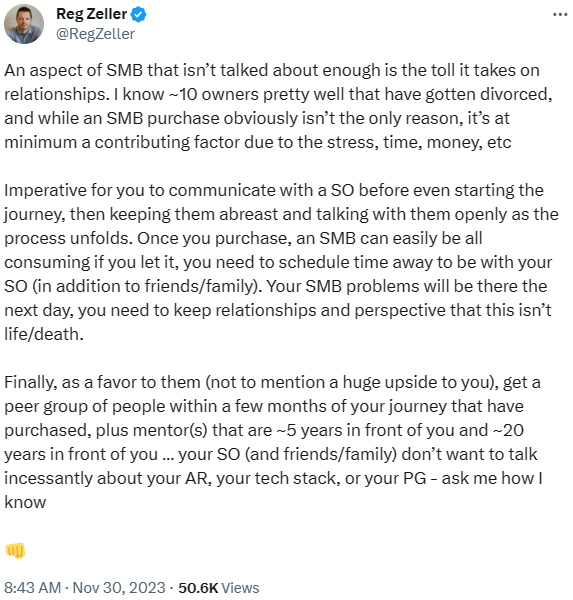

Navigating the relationship challenges in SMB…

Tips on leveling up your skills within the SMB space…

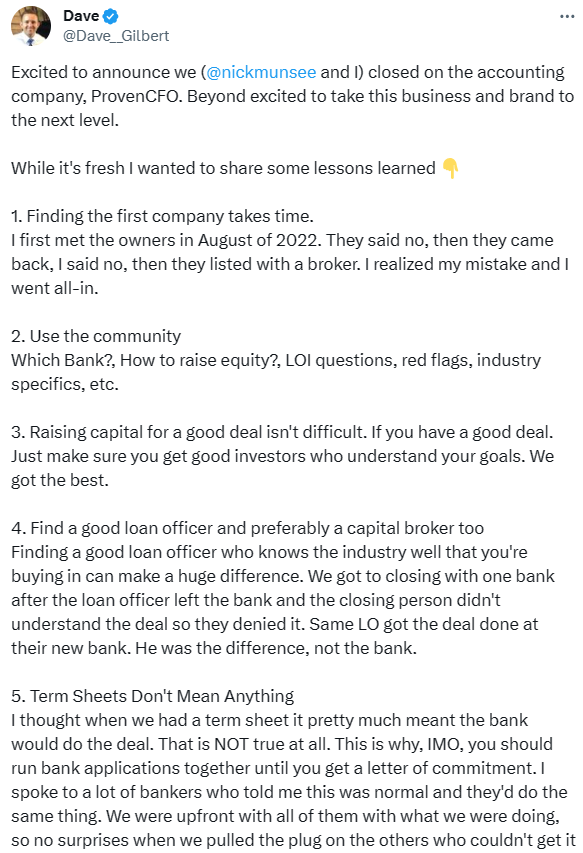

Lessons on buying a founder-led business…

Avoid these pitfalls…

The rollercoaster ride of acquiring and growing a dog daycare business

This is the way…

There’s no reward without the risk…

Helpful tips…

🗓️ Events

University of Michigan ETA Conference (Jan 18-19) - Ann Arbor, MI

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?