What I Learned Last Week 12.20.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Serial Acquirers in M&A: Who’s Closing Multiple Deals?

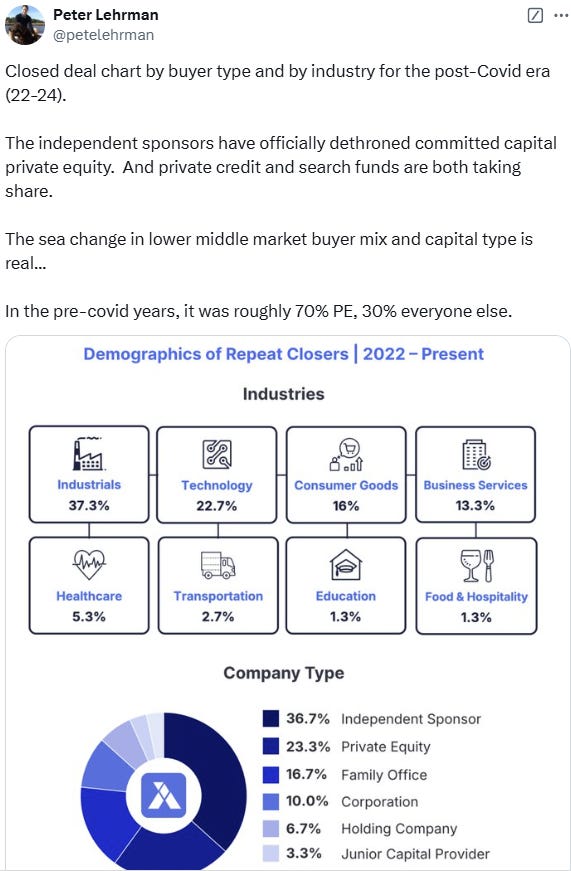

The analysis from Axial highlights the growing influence of repeat buyers in the lower middle market M&A space, particularly on the Axial platform, where they accounted for ~22% of closed deals in 2023-2024 YTD. These buyers leverage experience, efficient processes, and diverse capital sources to drive sustained deal activity, challenging assumptions about firm size and structure.

Key insights include:

Buyer Diversity: Independent sponsors (36.7%) are prominent, often raising funds deal-by-deal, contrasting with the traditional reliance on private equity and family offices.

Lean Operations: Many repeat buyers operate with small teams (often 2-50 employees), relying on focused expertise and streamlined processes.

Industry Breadth: Deals span various sectors, including technology, industrials, healthcare, and consumer goods.

Capital Structure Flexibility: Capital sources include balance sheets, personal wealth, and committed capital, reflecting adaptive financing strategies.

Deal Metrics: EBITDA multiples ranged widely, reflecting industry-specific valuations and deal structuring efficiencies.

This dynamic landscape underscores that sustained M&A success hinges on strategy, not size.

— — — — — — — — — — — —

Retiring Baby Boomers Can Turn Workers into Owners: Securing American Business Ownership through Employee Ownership

The Federation of American Scientists (FAS) highlights the potential of broad-based employee ownership (EO) to preserve American small businesses, especially as many owners approach retirement—a phenomenon termed the "Silver Tsunami." With 2.9 million businesses at risk, including 375,000 in critical sectors like manufacturing and trade, transitioning to EO can maintain local ownership, protect supply chains, and enhance job quality.

Key insights include:

Silver Tsunami Impact: A significant number of small business owners are nearing retirement, putting millions of jobs and substantial economic activity at risk.

Employee Ownership Benefits: EO offers a solution by enabling employees to acquire ownership, ensuring business continuity, fostering economic stability, and potentially reducing wealth inequality.

Financing Challenges: Current EO transitions are hindered by limited access to financing, often requiring owners to self-finance a significant portion of the sale, which contrasts with traditional mergers and acquisitions practices.

Legislative Proposals: The Employee Equity Investment Act (EEIA) aims to establish a credit facility within the Commerce Department to support private investment funds, facilitating EO transitions without taxpayer subsidies. Additionally, proposed changes to the SBA 7(a) loan guarantee program seek to remove personal guarantee requirements for worker cooperatives and Employee Ownership Trusts, enhancing access to necessary capital.

Implementing these measures could preserve numerous small businesses, safeguard jobs, and strengthen the U.S. economy by promoting employee ownership.

— — — — — — — — — — — —

How to Get the Most Out of Your Financial Due Diligence Engagement

The guide from DueDilio emphasizes the importance of clear communication and active collaboration when hiring a financial professional for due diligence in business acquisitions. Setting expectations, defining goals, and maintaining open communication help ensure actionable and relevant financial insights.

Key insights include:

Define Clear Objectives: Specify whether you need a high-level financial overview or a detailed GAAP-compliant report to avoid misaligned expectations.

Tailor Deliverables: Request reports formatted for your specific needs, such as simplified summaries for decision-making or detailed analyses for lenders.

Communicate Desired Outcomes: Clearly state goals like understanding cash flow, assessing EBITDA adjustments, or determining a fair purchase price.

Request a Project Plan: Ensure timelines, deliverables, and areas of focus are outlined in advance for transparency and accountability.

Ask for Simplicity: Don’t hesitate to request plain-language explanations or summary sections in reports for easier comprehension.

Course-Correct Early: Provide prompt feedback if reports are overly technical or not aligned with expectations to allow for adjustments.

Recognize Scope Limits: Understand that additional analysis may require expanding the engagement’s scope or incurring extra fees.

Stay Engaged: Actively collaborate by providing necessary documents and clarifications to ensure accurate and tailored analysis.

Respond to Negative Findings: Use concerning findings to renegotiate the purchase price, adjust contract terms, or terminate the process if risks are too significant.

🧵 Online Highlights

I scroll, so you don’t have to.

Imagine turning $40k into $7M through SBA financing for a $10M business acquisition. Here's how…

NWC is like the gas in your business's tank. Keep it full for smooth M&A deals…

The business landscape has shifted; independent sponsors now lead M&A over private equity. It's a new era in deal-making…

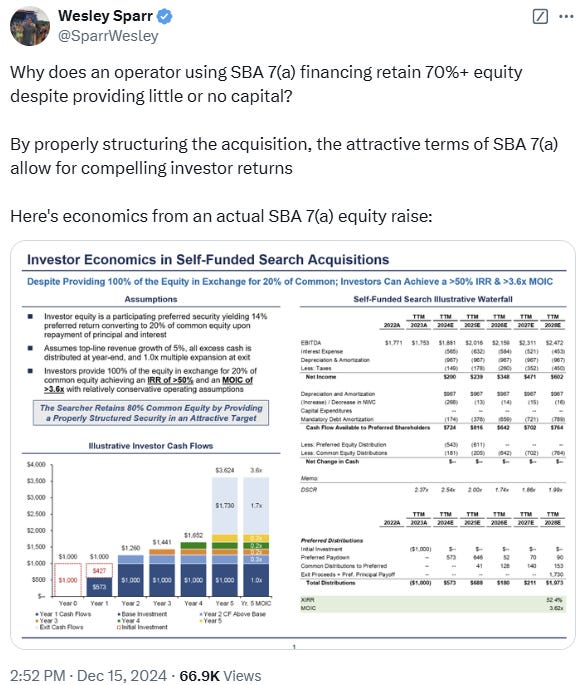

SBA 7(a) financing allows searchers to own 70%+ equity with minimal upfront capital, offering lucrative returns…

Don't let "one more year" ruin your exit strategy. The risk of holding onto your business could be more costly than you think…

🗓️ Events

SBIA Northeast PE Conference (Jan 8-9) - New York, NY

UM Ross EtA Conference (Jan 23-24) - Ann Arbor, MI

Babson College EtA Conference (Feb 7) - Boston, MA

SBIA Southeast PE Conference (Feb 13-14) - Nashville, TN

MIT EtA Conference (Feb 28) - Cambridge, MA

iGlobal Independent Sponsors (Mar 4-5) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

🎵 Listening: “Everlong“ by Foo Fighters 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?