What I Learned Last Week 12.22.2023

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

I want to wish everyone a very happy holiday season! Much health, wealth, and happiness to you and your family for the new year.

I’m going to be taking a writing break next week so the next newsletter will come out January 2nd.

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Building wealth is step one for success.

Wealth creates freedom, but personal growth, health, and strong relationships compound that success.

Snowball is a private community of experienced entrepreneurial investors who realize financial success is only one piece of the puzzle.

Looking for a like-minded community of people committed to growth in all aspects of life and business?

👋 Come see if you're a good fit.

📰 Articles

The Best Inventory is No Inventory

The article from John Wilson argues that managing inventory can be a burden, incurring costs and diverting focus from core business activities. Instead, John suggests outsourcing non-critical inventory tasks while focusing in-house efforts on key areas like marketing and sales. Three types of Vendor Managed Inventory (VMI) solutions—stocked, consignment, and staffed—are explored, each with distinct advantages and challenges. John emphasizes the importance of choosing the right inventory strategy to streamline operations and improve efficiency.

Key insights:

Managing inventory in-house is complex and costly.

Outsourcing inventory management can free up resources for core business activities.

Three main types of VMI solutions are stocked, consignment, and staffed, each with its pros and cons.

Adopting VMI is a significant change but can lead to improved operations and learning opportunities.

— — — — — — — — — — — —

16 questions to ask when buying a business

The article "16 Questions to Ask When Buying a Business" by Ben Tiggelaar provides a comprehensive checklist for potential buyers to assess various aspects of a business before making a purchase. The questions delve into understanding the business's purpose, analyzing its financial health, evaluating the strength and replaceability of the team, assessing risks related to customers and suppliers, gauging industry dynamics, and ensuring personal and financial alignment with the business. These questions are designed to help buyers make informed decisions and avoid potential pitfalls in the acquisition process.

Key insights:

Understanding the problem the business solves and its cash flow is crucial.

Assessing the durability of cash flow and personal fit with the business model is important.

Evaluating the team's strength, owner's replaceability, and risks related to customers and suppliers is necessary.

It's essential to consider industry trends, third-party opinions, valuation alignment, personal connections, and any peculiarities of the business.

— — — — — — — — — — — —

How To Actually Bid For A Business

The article "How To Actually Bid For A Business" by Dominic Wells provides a nuanced guide to making strategic offers in business acquisitions. It focuses on the balance between offering enough to entice the seller, outbidding competitors, and ensuring a comfortable investment for the buyer.

Key insights include:

The importance of balancing offer levels to meet various strategic objectives.

Consideration of deal structures like seller notes and earnouts to optimize the bid.

The significance of understanding market rates and the true value of the business.

Navigating negotiations with creativity and insight to make a successful bid.

— — — — — — — — — — — —

Marketplace Pulse Year in Review 2023

The "Year in Review 2023" by Marketplace Pulse reflects on the enduring aspects of e-commerce, like Amazon's dominance due to its unwavering focus on selection, low prices, and fast delivery, despite the evolving retail landscape. It also explores the rise of alternative platforms like TikTok and Shopify, the impact of Chinese commerce through Shein and Temu, and the growing significance of retail media networks in advertising. The report underscores that while the surface may seem static, the dynamics within and around Amazon and the broader e-commerce sphere are continually shifting.

🧵 Best of X (Twitter)

How to properly allocate the acquisition price to minimize taxes…

The impact of higher rates on the SMB market…

Great thread on the industries that makeup the top-earning businesses…

Rocky road to a car wash acquisition…

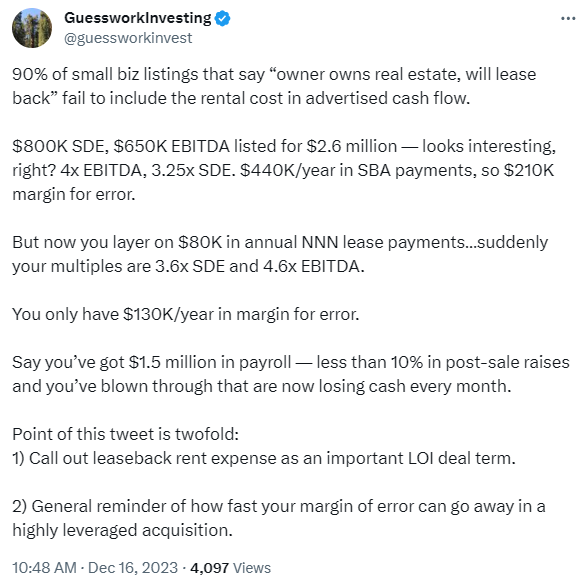

Pay attention to leasebacks when analyzing listings…

Conducting proper due diligence when choosing a partner…

🤔 Other

Allocation Available in SaaS Acquisition

This post is copied from Searchfunder and I thought might be of interest to the audience. From by Andrew Swiler…

We acquired Lanteria.com in June 2022, it's an HRMS focused on Mid market Microsoft users.

We raised just enough money to close the deal with a small group of investors and an SBA.

We started with $100k in working capital, so we have essentially operated bootstrapped the past 18 months. We have managed to grow revenue from $1.5 million to $2.3 million in that time.

We are raising a $1 million growth round to hire a marketing director, an AE, two senior developers, and a PM.

We had the round closed, however we had one investor drop our last week, and we have a $250k allocation available now.

DM me for more details, happy to share our data room. Minimum check size is $100k.

If you don’t have access to Searchfunder, ping me and I’ll connect you with Andrew.

🗓️ Events

University of Michigan ETA Conference (Jan 18-19) - Ann Arbor, MI

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?