What I Learned Last Week 1.24.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - Perfect Industries

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

4 Trends Shaping the Home Services Industry

Home services are one of the most popular industries in the EtA space. Housecall Pro released a report highlighting the trends they’re seeing in this sector based on BLS data as well as a survey of 400+ professionals across the home services landscape.

Key insights:

Confidence in 2025 Growth: Despite economic uncertainties, nearly 80% of surveyed home service professionals anticipate business growth in the coming year, with 40% expecting increases exceeding 10%. This optimism is attributed to the essential nature of home services, as homeowners prioritize critical repairs and maintenance even during challenging times.

Labor Shortage Challenges: A significant concern is the shortage of skilled labor, with 60% of professionals reporting that it hampers their ability to meet customer demand and complete jobs promptly. The lack of qualified candidates is cited by 86% of respondents as the primary hiring challenge. Nonetheless, the trades offer robust job security and competitive wages, often surpassing those of non-trade professions.

Emphasis on Trade Education and Apprenticeships: To address the labor gap, 80% of surveyed professionals advocate for increased mentorship, education, and apprenticeship opportunities. Programs like the Trade Academy Scholarship have seen a 215% rise in applicants since 2021, indicating a growing interest in trade careers as viable and rewarding alternatives to traditional four-year degrees.

Adoption of AI and Continuous Learning: The integration of artificial intelligence is emerging within the industry, with 42% of professionals utilizing AI tools in the past year. Of these, 25% have experienced enhancements in revenue and job efficiency. Tasks such as automating customer follow-ups and summarizing service checklists are among the applications of AI, allowing professionals to focus more on client interactions and service delivery.

— — — — — — — — — — — —

Searcher Website: Crafting the Perfect Landing Page

Searcher landing pages are essential for SMB acquisitions and EtA, helping establish credibility, attract leads, and communicate goals effectively. These professional yet simple sites function as digital business cards, showcasing experience and investment criteria while facilitating outreach to brokers, sellers, and investors.

Key takeaways include:

Focus on clarity and professionalism over complexity.

Highlight your background, investment thesis, and contact details.

Platforms like Squarespace, Wix, WordPress, and Carrd cater to varying needs and budgets.

Ensure mobile optimization and integrate LinkedIn for added credibility.

Use feedback to refine your page iteratively.

🧵 Online Highlights

I scroll, so you don’t have to.

Rough valuation ranges based on SDE…

PE faced a 20% fundraising drop in 2024, longer fund timelines, and shrinking dry powder — yet LPs hint at a 2025 rebound…

How to stand out in a crowded EtA market…

As Charlie Munger said - “Fish where the fish are”…

Franchises are growing in popularity within EtA. Here’s how to turn a single franchise into a multi-million dollar empire…

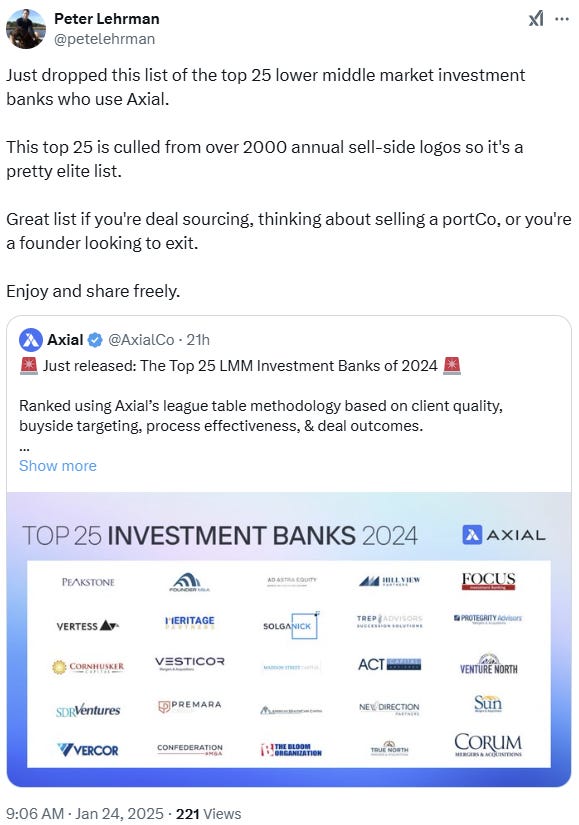

Check out the list of the top 25 lower middle market investment banks on Axial. It's perfect for deal sourcing or planning an exit…

🤔 Other

Perfect Industries

Here are the industries that fit this criteria:

1. Home Services

Why it fits: The home services industry, including HVAC, plumbing, and electrical services, is highly fragmented and recession-resistant. Demand is driven by maintenance and repairs, which are essential regardless of economic conditions.

Growth drivers: Aging housing stock, population growth, and increasing adoption of smart home technologies.

2. Pet Care and Services

Why it fits: This industry is booming due to increasing pet ownership and "humanization" of pets. It's fragmented, with many small grooming, boarding, and veterinary businesses.

Growth drivers: Rising disposable income, willingness to spend on pets, and growing pet insurance adoption.

3. Specialty Food Manufacturing

Why it fits: Specialty food companies catering to health-conscious or niche dietary needs are growing rapidly. These businesses are often smaller and family-run, leading to fragmentation.

Growth drivers: Consumer focus on healthy, organic, and artisanal foods.

4. Health and Wellness Services

Why it fits: Includes physical therapy clinics, fitness studios, and alternative health providers. The market is fragmented with a mix of small operators and franchises.

Growth drivers: Aging population, increasing focus on preventative healthcare, and consumer interest in wellness.

5. Childcare and Education Services

Why it fits: Childcare centers, tutoring services, and educational programs are fragmented and in demand. They're also considered essential services.

Growth drivers: Dual-income households and increasing focus on early childhood education.

6. Niche Manufacturing

Why it fits: Small-scale manufacturers in niche industries, such as custom components or packaging, often dominate specific markets.

Growth drivers: Increased demand for customization and domestic production.

7. Commercial Cleaning Services

Why it fits: Fragmented industry with predictable recurring revenue. Stable demand across economic cycles.

Growth drivers: Growth in commercial spaces and stricter cleanliness standards post-pandemic.

8. Waste Management and Recycling

Why it fits: Includes companies involved in specialized waste disposal and recycling. The industry is fragmented and benefits from growing environmental concerns.

Growth drivers: Regulatory mandates and consumer focus on sustainability.

9. Testing and Inspection Services

Why it fits: Includes non-destructive testing, environmental testing, and safety inspections. Highly fragmented and essential in many industries.

Growth drivers: Increasing regulatory requirements and infrastructure development.

10. Elderly Care and Assisted Living

Why it fits: Highly fragmented industry catering to a growing aging population.

Growth drivers: Demographic trends with the baby boomer generation and increasing longevity.

🗓️ Events

UM Ross EtA Conference (Jan 23-24) - Ann Arbor, MI

Babson College EtA Conference (Feb 7) - Boston, MA

SBIA Southeast PE Conference (Feb 13-14) - Nashville, TN

MIT EtA Conference (Feb 28) - Cambridge, MA

iGlobal Independent Sponsors (Mar 4-5) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

UCLA ETA Search Fund Roundtable (Apr 9) - Los Angeles, CA

🎵 Listening: “Mhm Mhm“ by Manuel Riva, Eneli 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?