What I Learned Last Week 1.26.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Build Your Snowball. Compound what matters.

Snowball is a private community of experienced entrepreneurial investors creating meaningful wealth.

How?

By building companies for the long term.

By investing directly in the SMB ecosystem.

By creating a life where personal growth, health, and strong relationships compound over the decades.

If you’re looking for a like-minded community of accomplished doers, a place for SMB deal flow, and a place for long-term thinkers... you’ve found it.

👋 Join the club at Snowball

SnowballClub.com

📰 Articles

How to Write an Effective Search Fund PPM

The article from Goodwin outlines guidelines for crafting an effective Private Placement Memorandum (PPM) for search funds, emphasizing its importance as both an introductory and legal document for potential investors.

Key insights include:

The PPM should highlight the searcher's biography, background, and industry specialization.

It's crucial to articulate the investment thesis, industry focus, and financial projections clearly.

Including a detailed business description and investment rationale is paramount.

The PPM must contain risk factors, legal disclaimers, and align with securities laws.

Searchers should ensure the PPM reflects their organizational skills and attention to detail while safeguarding legal compliance and investor interests.

— — — — — — — — — — — —

What I learned selling my company

Harry Glaser sold his company, Periscope Data for $130M. This article provides a candid recount of his journey through the sale of his company, detailing the lessons he learned and the challenges he faced during the process.

Key insights include:

The importance of nurturing relationships with potential buyers long before considering a sale.

Being mindful of fundraising, as it might complicate or even hinder the potential sale of the company.

Acquisition offers are rare and often come unexpectedly, making it crucial to understand the real intent behind an offer.

Despite receiving offers, the actual closure rate is quite low, emphasizing the need for due diligence and proper negotiation.

Throughout the M&A process, it's essential to continue running the business efficiently to maintain or increase its value.

— — — — — — — — — — — —

13 lessons after 15 acquisitions

The article reflects on critical learnings from substantial experience in the M&A sector, offering a realistic perspective on the complexities involved in acquiring businesses.

Key insights include:

Acknowledging the unpredictable nature and inherent risks of small businesses.

Recognizing the rarity of finding exceptionally profitable companies that also make a significant community impact.

Understanding the crucial role of accurate business valuation in the acquisition process.

Dealing with the challenges posed by sellers' often unrealistic price expectations.

Emphasizing the need for thorough due diligence and strategic planning in every acquisition deal.

— — — — — — — — — — — —

Smart Shopping for Businesses: A Guide to Acquiring Diamonds, Not Dust

Good read from Roland Frasier. The article offers a guide on how to smartly navigate the market for business acquisitions, likening the process to online shopping with the use of strategic filters to find the perfect business 'diamonds' among the 'dust'.

Key insights include:

Utilizing acquisition criteria as filters to sift through business opportunities.

The importance of aligning business acquisitions with one's passion, experience, skill set, and network.

Creating a personalized business profile by merging these elements to identify and capitalize on the right business ventures.

🧵 Best of X (Twitter)

Fraud in SMBs is very prevalent. Watch out for these…

Be mentally prepared for margin & revenue contraction when you first buy a business…

Example of managing health care if you’re self-employed…

Sometimes we overcomplicate things and fail to see the forest from the trees. Here are some basic questions to ask…

Selecting the right industry is as important as the actual business. Here’s a good framework for choosing a market…

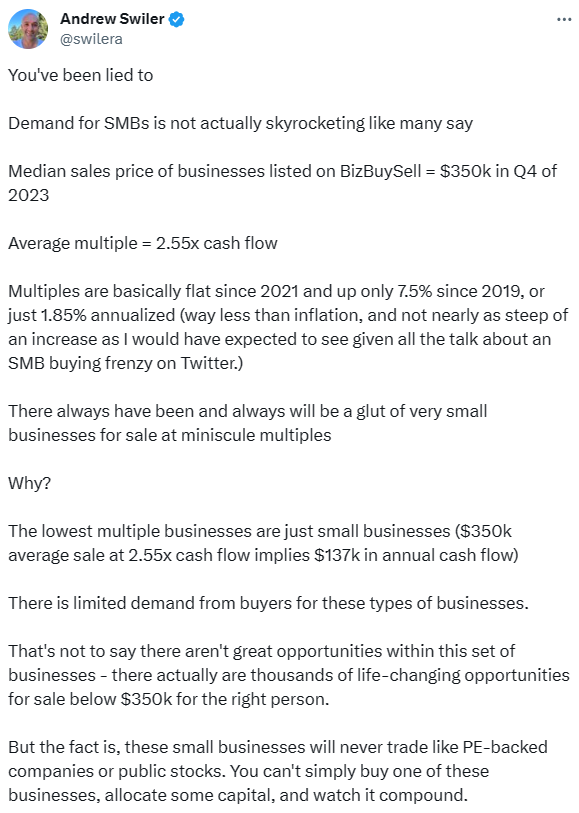

The buyer pool has an impact on valuations…

There’s a lot of opportunity in the lower end of the market but you have to get your hands dirty…

🤔 Other

New SaaS Marketplace

This week brought news of yet another marketplace debut. I stumbled upon the introduction of Dealwise, a marketplace with Y Combinator backing, aiming to link buyers with exclusive off-market SaaS opportunities. Coincidently, just last week, I had a conversation with another Y Combinator-supported marketplace that had ceased operations, so it seems that, overall, the count of marketplaces remains unchanged. 🤪

As always, I wish every new entrepreneur the best of luck and much success. Go check out Dealwise if you’re looking for opportunities within SaaS.

🗓️ Events

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?