What I Learned Last Week 12.8.2023

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Smash.vc

Buying a business with the SBA?

Would having a capital partner help?

At Smash.vc, they do two things:

Buy minority stakes in existing small businesses.

Partner with entrepreneurs trying to acquire new ones.

If you're actively looking to buy a cash-flowing business using an SBA loan, hit them up if you'd like a partner.

They contribute capital, give advice, or help with growth when asked... but stay out of the way the rest of the time.

Silent partners there to help when necessary, nothing more.

If interested👉 go say hi.

📰 Articles

Employee Communication Best Practices For Successful Acquisitions

The article from Forbes focuses on the importance of strategic communication for successful acquisitions, particularly emphasizing the integration of employees from the acquired company.

Key insights include:

Pre-Deal Communications: Address employee concerns about their roles, management changes, and cultural integration during the acquisition announcement and closing phase.

Acquisition Microsite: A recommended tool for engaging with employees, featuring elements like CEO messages, growth opportunities, cultural crossover, feedback loops, venting channels, and personalizing executive leadership.

Post-Closing Activities: Celebrate the acquisition with events and keep communications active to build connections and sustain excitement among employees.

Knowledge Empowerment: Continuously providing information to employees helps reduce their stress and facilitates their integration and alignment with the new company's vision.

This strategy aims to mitigate employee anxiety, maintain engagement, and ensure a smoother cultural and operational integration during acquisitions.

— — — — — — — — — — — —

3 Months In

The article is a firsthand account of an entrepreneur's experience acquiring and transforming an established HVAC company over three months. Despite lacking industry-specific knowledge, the author applied their diverse background to address various challenges.

— — — — — — — — — — — —

The Messy Middle of Small Business

The article from Big Deal Small Business details the experiences of 'Patrick' (a pseudonym), who acquired a residential contractor business. Despite initial success, he faces challenges such as managing crew changes and financial constraints due to debt. Buying a business is not always a binary outcome of success or failure. Sometimes you just get stuck in the middle.

How do you avoid these situations?

Buy bigger – Yes, you take on more debt, but you also have more margin for error. If you have 5 crews and lose one, the impact is lower than if you have 2 crews and lose one. Also, if you need to make one new hire at $65K, that’s 26% of a $250K profit business. It’s only 10% of a $650K profit business – making that one new hire is less risky in that sense.

Have more money set aside – You don’t want your last dollars going into your SMB deal as the downpayment. You may still need that money for the business later. Put it this way – if you have a $100K downpayment requirement, but $200K in the bank, you may not want to put all $200K in as a downpayment. The extra $100K of SBA debt costs you ~$16K/year in extra debt payments. Setting that extra $100K aside effectively covers that extra debt for 6 years! And it gives you the option to use it for growth investments or to cover debt payments in the short-run.

Buy cheaper – This is pretty obvious, but the cheaper price you pay (multiple of cash flow), the more cash flow you’ll have to play with as the operator. This is because the debt service will take a smaller slice of your cash flow than if you paid a higher multiple.

Buy based on EBITDA, not SDE – Budget in a reasonable salary for yourself to live your life, then see if the deal makes sense AFTER that expense is taken out.

— — — — — — — — — — — —

How to Dominate Google Searches for Home Services!

The article discusses strategies for enhancing online visibility in the home services industry. Similar concepts can be applied to any local business.

Key points include:

Local Service Ads (LSA): Immediate leads, increased competition, focusing on response times and service quality.

Pay-Per-Click (PPC): Bidding-based advertising, essential for lead diversification, and complementing LSAs.

Search Engine Optimization (SEO): Long-term strategy, focusing on content creation and website optimization.

Google My Business (GMB) and Map Pack: Emphasizing the importance of location, reviews, and maintaining a strong online presence.

🧵 Best of X (Twitter)

Great breakdown of the acquisition process. Importance of patience…

Tough to read these but important to share…

Read this if you’re looking at the restaurant space…

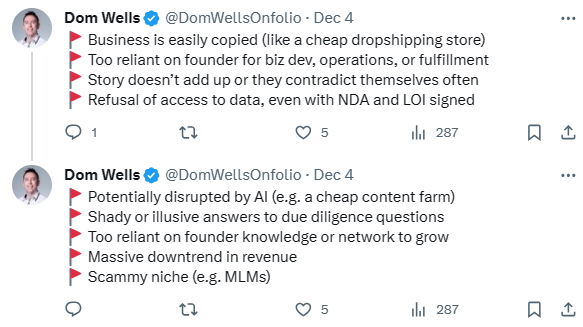

Avoid these red flags…

🤔 Other

Fractional CFO For Hire

A good friend of mine is a Miami-based fractional CFO and strategic advisor. He recently had a slot open up for an additional client. I’ve copied his details below…

Gunnar Link has served as CFO and strategic advisor at a variety of companies, successfully overseeing exits and exit preparation, fund-raising efforts, merger integrations, and turnarounds. Gunnar’s industry experience includes Software as a Service (SaaS), Technology, Professional Services, Medical, Media, Education, and Tourism. Gunnar advises companies and sits on boards in the Boston area as well as in London, UK.

If you are a company with revenues between $1M and $50M and could use assistance in the finance or strategy suite, please contact me and I’ll put you in touch with Gunnar.

— — — — — — — — — — — —

Who knows someone with a boring business that is killing it? What do they do

I ran across this great Reddit thread highlighting some boring but very successful businesses. Go read the actual thread but I’ve copied a few of the replies below…

Cutting Holes in Concrete…

I knew a guy who had a company that specialized in cutting holes in concrete. He had bought a very highly specialized machine that cut perfect holes of all sizes in concrete for all sorts of situations.

I never even knew that that could have been a thing and possibly wouldn't have ever been exposed to it if it wasn't for the fact that he had an office next door to mine.

That was all that his company did - they were called into locations/buildings/construction sites etc and shown where the hole was to be drilled and that was it. Simple and no fuss (from my totally inexperienced view - I don't think it was as simple as that).

It just seemed so mundane to me at the time (oh, what do you do? I drill holes in concrete!) but I know they did extremely well indeed. And in retrospect, I would trade my world for his in a heartbeat!

Plumbing…

My plumber friend.

You have to know that in my country, in the 80s and 90s, the students who had difficulties were sent to technical sections, where they were taught electricity or plumbing or mechanics. It was thought to be a complete failure for a kid to end up in these sections, and parents did all they could to help their kids not end up in there.

Friend of mine had dyslexia, which made it hard for him to read and understand stuff. He ended up in the plumbing section, and his parents were so sad about it.

He finished school at 16, started working for a small plumbing company, and a couple years later started his own little plumbing company.

When I finished studying and started working, he had already worked for 6 years,and we were earning pretty much the same salary. Which surprised me as I was in IT during the biggest IT surge of all times, and he was "just a plumber". But yeah, he was doing very well.

And he kept doing better and better. Me too, to an extent, but really not as good as him. 30 years later he has built an empire. He has dozens of employees, tends of thousands of customers, and his business growth doesn't show any sign of slowing down. He earns 13 times my salary as a well paid senior IT guy in a big telco/ISP company.

Funny thing he always says, is his most important skill was not plumbing or economics or marketing, but to show up when people called him for plumbing issues.

Building Services…

A lot of real estate in the world's most populated cities are collapsing. Plumbing, electrical, structure.

100 years ago Europe used news paper and straw instead of rebar and mesh to finish roofs and walls as an example.

This leads to an unimaginable demand for any maintenance/repair skill.

Also, these industries will not be at risk of AI and robots any time soon.

Our holding company works with building service and skill based businesses to 4-5 million in revenue. After that we don't push growty, only manage, or do exits.

Trash Hauling…

My uncle started a trash hauling business and begged and borrowed his way to buying a single garbage truck and started doing residential trash pickup about 40 years ago. He sold the business with six garbage trucks and retired a multi-millionaire in a beautiful home that was completely paid for in just 5 years. His son started hauling things to the dump for people who couldn't get rid of it any other way. He then started a dumpster business for small residential projects and is now a multi-millionaire with something like 150 small dumpsters. His son worked his way through college picking up dog poop in the country club neighborhoods near their house on his way to and from classes. Made it all the way through 4 years of college completely debt-free and now has a great job (although it is "working for the man" in an office somewhere). As you said, find something that people don't want to do themselves or they are just not able, and charge them lots of money to do it for them. There are boxes full of money out there just waiting for an ambitious and hard-working person to go and pick them up.

🗓️ Events

University of Michigan ETA Conference (Jan 18-19) - Ann Arbor, MI

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?