What I Learned Last Week 1.3.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Everything I've learned about buying small software businesses over the past 4 years

The article from XO Capital reflects on lessons learned from four years of acquiring small software businesses, detailing both successes and challenges. It emphasizes the realities of deal sourcing, valuation mismatches, operational difficulties post-acquisition, and the importance of focusing on growth and sustainable business models.

Key insights include:

Most listed businesses have significant flaws or declining performance.

Diligence often uncovers hidden problems, and instincts should be trusted.

Cash flow and operational margins are typically lower than advertised.

Growth expertise might yield better results from starting a business than acquiring one.

Successful acquisitions require patience, capital, and resilience.

— — — — — — — — — — — —

Is The Juice Worth The Squeeze?

The blog post from Big Deal Small Business explores the author's approach to investing in self-funded search deals, emphasizing alignment with personal core values over maximizing financial returns. While traditional private equity focuses on profit dollars, the author prioritizes connection, curiosity, and shared joy when backing searchers, valuing relationships and personal growth alongside financial outcomes.

Key insights include:

Smaller deals often aren't appealing to large investors due to limited profit potential.

Self-funded search deals align better with smaller personal investment sizes.

The author's investment decisions prioritize relationships and shared experiences over pure financial returns.

🧵 Online Highlights

I scroll, so you don’t have to.

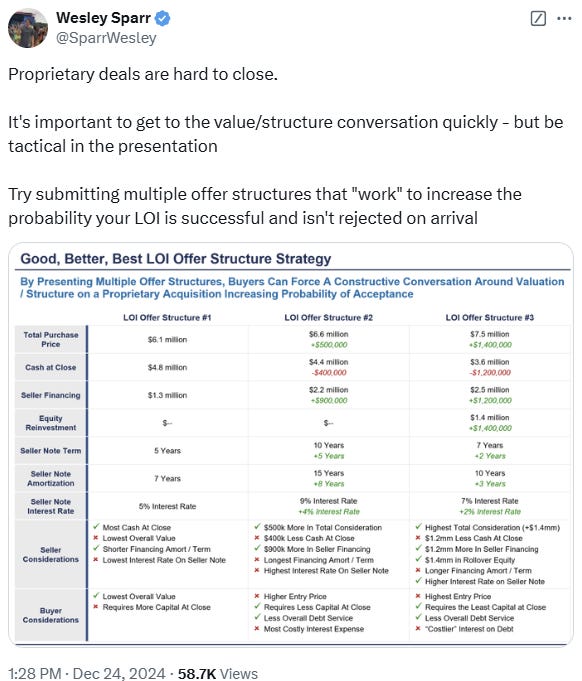

Offer multiple LOI structures to spark constructive value talks and increase success chances…

The building blocks of starting your business acquisition journey…

Turn neglected car washes into cash machines: accept credit cards, optimize pricing, upgrade amenities, and capitalize on seller quirks for massive ROI flips…

Want to buy a $3M business with $100K? Cash flow, structure, and leverage are key…

Top tips to prevent and uncover fraud…

Learn to read a CIM like a seasoned PE professional…

🗓️ Events

SBIA Northeast PE Conference (Jan 8-9) - New York, NY

UM Ross EtA Conference (Jan 23-24) - Ann Arbor, MI

Babson College EtA Conference (Feb 7) - Boston, MA

SBIA Southeast PE Conference (Feb 13-14) - Nashville, TN

MIT EtA Conference (Feb 28) - Cambridge, MA

iGlobal Independent Sponsors (Mar 4-5) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

🎵 Listening: “Drive“ by Black Coffee, David Guetta, Delilah Montagu 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

CapitalPad - An investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard-to-find asset class.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?