What I Learned Last Week 2.21.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - Buying a Franchise?

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

How to Value a Service Business: Methods, Key Factors & More

The article from Exitwise explores methods for valuing a service business, which can be more complex than product-based businesses due to intangible assets. It outlines different valuation methods and key factors that influence a service business's worth.

Key insights include:

Valuation Methods: Common approaches include the Seller’s Discretionary Earnings (SDE) method, Asset-Based method, EBITDA multiple method, and Discounted Cash Flow (DCF) method.

Financial Health: Analyzing profitability, liquidity, and efficiency is crucial before valuation.

Tangible & Intangible Assets: Factors like brand reputation, intellectual property, and vendor relationships significantly impact value.

Liabilities Assessment: Evaluating debts, taxes, and other financial obligations is essential.

Growth Potential: Expansion opportunities and market position influence valuation.

Industry Comparables: Comparing with similar businesses provides a benchmark for accurate valuation.

Market Position: A strong competitive edge and customer retention can increase value.

— — — — — — — — — — — —

Individual Business Buyers Are Flooding The Market

The article discusses the increasing number of individual buyers entering the market for small businesses, while the supply of quality businesses for sale remains stagnant. Despite the high demand, business sale prices have only slightly increased. Several factors are contributing to this market imbalance.

Key insights include:

Baby Boomer Business Sales Haven't Materialized: The expected surge of retiring business owners selling their companies has not happened as predicted.

Social Media Misinformation: Many inexperienced influencers promote misleading claims about acquiring businesses with no money down, creating false expectations.

The ‘Searcher’ Myth: Many individuals label themselves as "Searchers" without the necessary capital, causing brokers to dismiss them.

Limited Funding for Individual Buyers: Outside of SBA 7(a) loans, banks rarely fund acquisitions for buyers with no collateral or operational experience.

Online Communities Offer Little Real Value: Many business-buying forums consist of inexperienced individuals offering advice to others in the same position.

MBAs Have No Special Advantage: The article argues that business buying is a hands-on process where practical experience matters more than formal education.

True Success Comes from Expertise: Buyers should seek mentorship from experienced professionals and align their skills with the right business opportunities.

— — — — — — — — — — — —

Dead Deal Report: Breaking Down 2024’s Broken LOIs

The article from Axial analyzes why 65 executed LOIs (Letters of Intent) for business acquisitions failed in 2024, offering insights into common deal-breakers across industries and buyer types. Key reasons include financial discrepancies, due diligence findings, seller behavior, and financing challenges. The report also compares 2023 and 2024 trends, highlighting shifting challenges in deal execution.

Key insights include:

Top Reasons Deals Fell Apart: Non-QoE (Quality of Earnings) diligence findings (21.5%), QoE EBITDA discrepancies (15.4%), and business underperformance (12.3%) were the leading causes of failed LOIs.

Decrease in Financing Failures: The percentage of deals failing due to financing issues dropped from 21.3% in 2023 to 13.8% in 2024, possibly indicating improved credit access or stronger buyers.

More Deals Breaking Due to Business Performance: Business underperformance as a deal-breaker nearly tripled from 4.3% in 2023 to 12.3% in 2024, reflecting challenges in meeting financial projections.

Variations by Buyer Type: Private equity and independent sponsors saw more failed deals due to due diligence issues, while search funds struggled with financial misrepresentations.

Industry-Specific Issues: Industrials, healthcare, and business services saw higher average deal multiples, while consumer goods and financial services had more valuation discrepancies.

Shorter Deal Lifecycles in Some Sectors: Technology and transportation deals fell apart in under 70 days on average, while food & hospitality transactions lingered over 200 days before collapsing.

The analysis suggests that increased financial scrutiny and operational struggles contributed to more broken deals in 2024, despite improved financing conditions.

🧵 Online Highlights

I scroll, so you don’t have to.

The independent sponsor path is brutal—no income for years, constant setbacks, and tough competition. If you’re not resilient, well-funded, and ruthless, don’t bother…

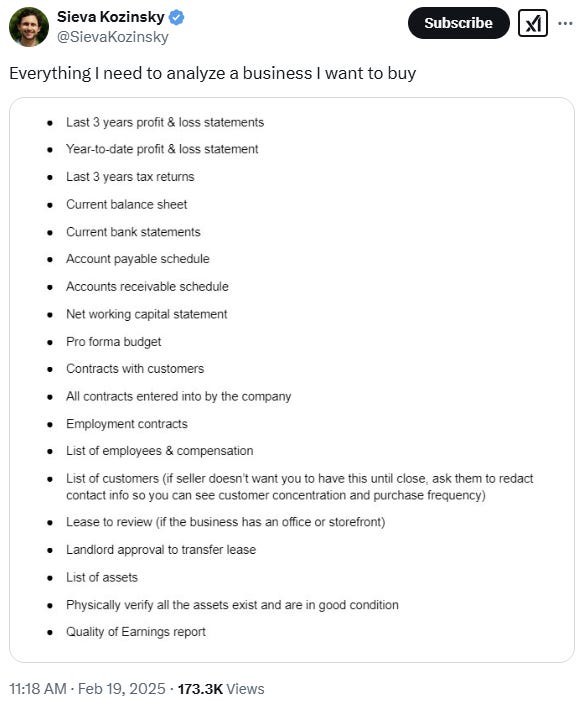

Include these in your due diligence process…

Franchising isn’t a passive income shortcut—it’s a whole new business. You’ll need 50+ units to break even and $2M+ for a national brand. Not for everyone…

Private equity isn’t the unstoppable force it once was—fundraising is tougher, big names are folding, and firms must evolve or fade…

Start investor talks way before you find a deal. Build trust, align goals, know your industry cold — clarity wins investors, not complexity…

FedEx routes seem like passive income—until you’re dealing with shrinking margins, driver turnover, and endless truck repairs. Like buying a job, not a business…

🤔 Other

Has Anyone Successfully Broken into Entrepreneurship by Buying a Franchise?

At DueDilio, I’m seeing an increasing number of clients pursuing franchises. This Reddit thread discusses whether buying a franchise is a good path to entrepreneurship. The original poster, a finance professional, has saved money and is considering a franchise for its structured business model and support. Responses from franchise owners, business buyers, and industry professionals offer a mix of positive and cautionary perspectives.

Key takeaways include:

Franchises Can Offer Training & Structure: Many first-time owners find franchises helpful as they provide branding, systems, and support, reducing startup risk.

High Fees & Royalties Hurt Profitability: Some franchisees regret their decision due to ongoing fees (e.g., 8-12% of revenue) that eat into profits.

Buying an Existing Business May Be a Better Option: Several commenters recommend purchasing an independent business with proven cash flow instead of a franchise.

Franchise Success Depends on Brand Strength: Well-known brands with strong operational support can work, but lesser-known franchises may not justify their costs.

Many Franchisees End Up ‘Buying a Job’: Without a strong brand or semi-passive model, owners often work long hours while paying high royalties.

Do Extensive Research Before Buying: Talking to multiple franchise owners (not just the ones the franchisor recommends) can reveal the real risks and potential downsides.

Financing Options Exist: SBA 7(a) loans and ROBS (using retirement funds) are common ways to finance a franchise purchase.

Overall, while franchises can be a viable entry point into business ownership, many experienced business owners suggest exploring alternative options like acquiring an independent business or starting one from scratch.

🗓️ Events

MIT EtA Conference (Feb 28) - Cambridge, MA

iGlobal Independent Sponsors (Mar 4-5) - Miami, FL

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

2nd Annual UCLA ETA Search Fund Roundtable (Apr 9) - Los Angeles, CA

🎵 Listening: “Darling (with Aloe Blacc)“ by Shimza, Aloe Blacc 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?