What I Learned Last Week 2.2.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Build Your Snowball. Compound what matters.

Snowball is a private community of experienced entrepreneurial investors creating meaningful wealth.

How?

By building companies for the long term.

By investing directly in the SMB ecosystem.

By creating a life where personal growth, health, and strong relationships compound over the decades.

If you’re looking for a like-minded community of accomplished doers, a place for SMB deal flow, and a place for long-term thinkers... you’ve found it.

👋 Join the club at Snowball

SnowballClub.com

📰 Articles

SaaS Valuations: How to Value a SaaS Business in 2024

The article from FE International provides an in-depth look at the unique considerations for valuing SaaS businesses. It discusses various metrics and factors that influence SaaS valuations, such as revenue, customer churn, and market trends.

Key points include:

The valuation of SaaS businesses can involve different metrics like SDE, EBITDA, or Revenue, depending on size and growth.

Important factors affecting SaaS business valuation include business age, owner involvement, growth trends, customer churn, and funding status.

The article emphasizes the significance of metrics like Churn, Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and the LTV/CAC ratio.

The valuation spectrum and multiples vary based on the company's revenue and other operational aspects.

Additional factors like customer acquisition channels, product lifecycle, and technical knowledge also play a crucial role.

— — — — — — — — — — — —

When to centralize… and when you shouldn’t

The article discusses the strategic decisions involved in centralizing or decentralizing operations within a company. It emphasizes the importance of considering various factors before making such decisions.

Key insights from the article include:

Centralization can lead to efficiency and uniformity, but may also cause rigidity and slow decision-making.

Decentralization can promote flexibility and quicker decision-making but might lead to inconsistency and reduced control.

The choice between centralization and decentralization depends on the company's size, industry, and specific circumstances.

The article suggests evaluating the pros and cons of each approach in the context of the company's objectives and challenges.

— — — — — — — — — — — —

The $7 Billion dollar acquisition strategy, and what I learned from it

The article shares insights into Justin Ishbia's unique approach to acquisitions through his firm, Shore Capital. Ishbia focuses on smaller, often overlooked deals, leveraging them into significant growth opportunities.

Key insights include:

Ishbia's strategy of targeting smaller deals creates an arbitrage opportunity in a market dominated by larger transactions.

Emphasis on rigorous documentation and standard operating procedures to manage numerous small acquisitions efficiently.

The importance of assembling a knowledgeable board for each company acquired, ensuring expertise and guidance.

🧵 Best of X (Twitter)

Journey & process of selling a SaaS…

Simple framework for deal sourcing…

You bought a business. Now what?

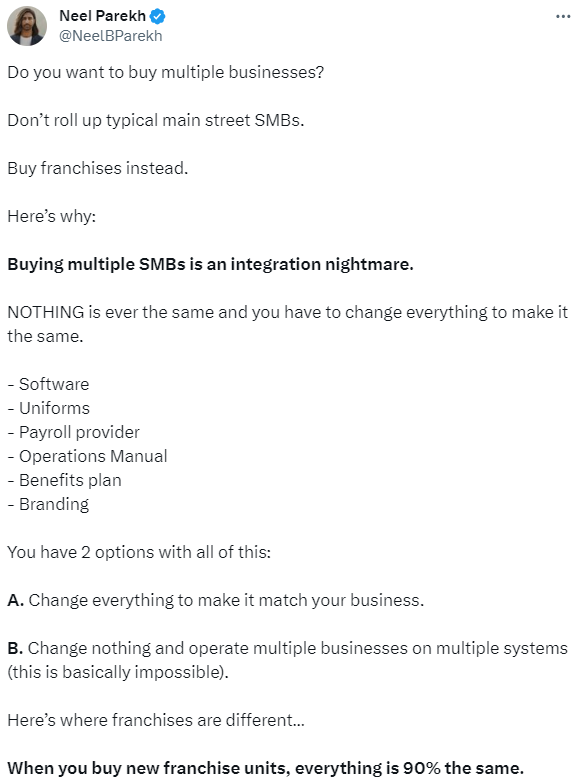

Franchises are a shortcut to building a holdco…

Transitioning from PE to SMB ownership…

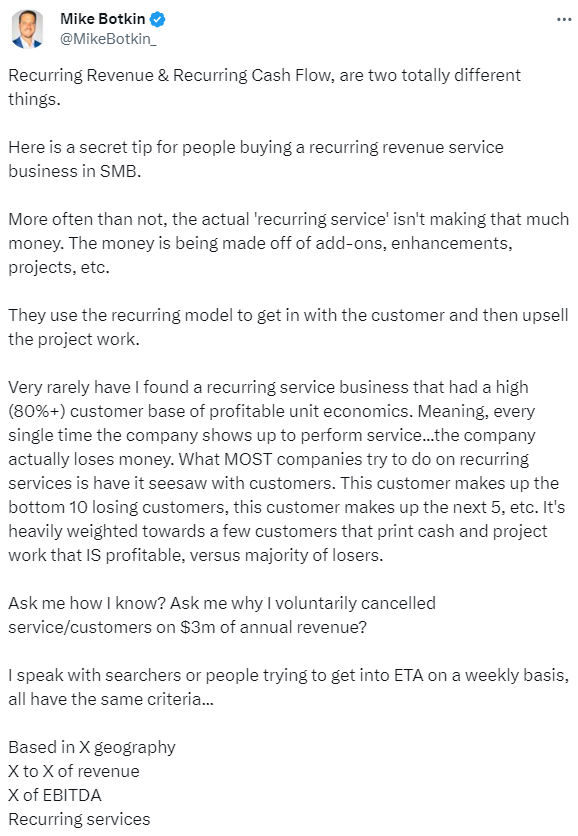

Key insight for analyzing a business with recurring revenue…

🤔 Other

Domain for Sale

Last week, I got a tip from a domain broker about a potentially interesting opportunity. It involves the domain 'searchfundlender.com,' currently available for a negotiable price of $350. While it's not the right fit for me, it could be relevant for a newsletter subscriber. If this piques your interest, reach out directly to liamdomains@gmail.com for more details.

— — — — — — — — — — — —

Deal Flow is Slowing

Earlier this week I tapped into readers’ insights on current deal flow trends. Here are the results…

🗓️ Events

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

Capital Camp (May 21-24) - Columbia, MO

Main Street Summit (Oct 9-10) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?