What I Learned Last Week 2.23.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - Franchise Experience

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Build Your Snowball. Compound what matters.

Snowball is a private community of experienced entrepreneurial investors creating meaningful wealth.

How?

By building companies for the long term.

By investing directly in the SMB ecosystem.

By creating a life where personal growth, health, and strong relationships compound over the decades.

If you’re looking for a like-minded community of accomplished doers, a place for SMB deal flow, and a place for long-term thinkers... you’ve found it.

👋 Join the club at Snowball

SnowballClub.com

📰 Articles

2023 SaaS M&A Year in Review

The article from BloomVP's Substack provides a comprehensive overview of the SaaS M&A landscape in 2023, highlighting its momentum and key trends.

Key insights include:

The overall software industry M&A volume decreased by approximately 9% year-over-year from 2022, while SaaS M&A activity increased by 9% over 2020 levels.

The fourth quarter of 2023 saw a decline in M&A activity due to a lack of transaction catalysts and macroeconomic uncertainty.

SaaS deals accounted for 56% of all software deals, with a significant number of transactions in Sales & Marketing and Analytics and Data Management.

Vertical SaaS deals, particularly in Healthcare, Financial Services, and Real Estate, showed strong activity, highlighting the demand for mission-critical applications.

Private equity remained a major player in SaaS M&A, though strategic buyers are expected to become more active with the rebound of public equities.

Global IT and enterprise software spending are projected to surpass significant milestones in 2024, with software spending doubling as a percentage of overall IT spending since 2017.

— — — — — — — — — — — —

10 Lessons I Learned From Failing My First Acquisition

The article shares the author's reflections on the lessons learned from the failure of their first business acquisition, a cemetery management and operation business. Despite initial success, the COVID-19 pandemic severely impacted the business, leading to its eventual shutdown. These insights are valuable for entrepreneurs, franchise owners, and small business owners navigating similar challenges.

Key lessons include:

Explore Non-Traditional Financing Options: Consider creative financing methods to reduce personal credit and cash use.

Maintain Healthy Relationships with Clear Boundaries: Establish clear boundaries and expectations in professional relationships.

Delegate Day-to-Day Operations: Focus on your strengths and hire talent for other roles to ensure business growth.

Diversify: Look for complementary businesses to grow or invest in alongside your primary business.

Be Flexible with Your Timeframe: Be open to changing your business holding period based on circumstances.

Prioritize Personal and Family Well-being: Ensure financial decisions benefit you, your family, and your employees.

Team Success Over Individual Effort: Recognize the importance of a strong team over individual contributions.

Align Team Members' Success with Business Success: Understand and support your employees' personal and professional goals.

Transition from Individual Contributor to Leader: Focus on leadership and advisory roles rather than day-to-day management.

Be Conservative with Money: Adopt a cautious approach to spending and investments until contracts are secured.

— — — — — — — — — — — —

Purchase Price Allocation in Mergers and Acquisitions: Understanding its Value

The article Exbo Group delves into the critical role of Purchase Price Allocation (PPA) during M&A. PPA involves dividing the total purchase price of the acquired company into various components, including tangible and intangible assets, liabilities, and equity. This process is crucial for accurate financial reporting and tax purposes, ensuring the fair market value of the acquired assets and liabilities is reflected on the acquiring company's balance sheet.

Key insights include:

Definition and Purpose of PPA: PPA aims to determine the fair market value of the acquired company's assets and liabilities for accurate financial statement reporting.

Calculation of Purchase Price: The initial purchase price is influenced by several factors, including base price, rollover value/equity/interest, closing cash, closing indebtedness, net working capital adjustment, and seller transaction fees.

Adjustment of Purchase Price: Near the end of the diligence process, the purchase price may be adjusted based on a net working capital analysis to align with the actual financial state of the target company at closing.

Consideration Transferred: This refers to the total value paid to acquire the target company, including cash, stock, liabilities, or other valuable items, and may include contingent consideration (earn-outs) and deferred compensation.

Allocating Consideration to Assets & Liabilities: After finalizing the closing statement, the purchase price is allocated among assets and liabilities to determine the fair value and calculate goodwill.

Calculation of Goodwill: Goodwill is the excess of the purchase price over the fair value of the identifiable net assets acquired and is determined after proper allocation of the purchase price.

— — — — — — — — — — — —

The Evolution and Impact of Fundless Sponsors in the Lower Middle Market

The article from The Silver Wave Substack explores the rise and significance of fundless sponsors, also known as independent sponsors, in the lower middle market of Entrepreneurship through Acquisition (ETA) for small and medium-sized businesses (SMBs). Fundless sponsors, emerging in the 1980s, differentiate from traditional private equity by raising equity and debt financing on a deal-by-deal basis, typically after signing a Letter of Intent (LOI).

Key insights include:

Origin and Rise: The fundless sponsor model gained traction post-2008 due to regulatory changes like the Dodd-Frank Act and the Volcker Rule, which limited traditional bank financing for private equity transactions.

Market Role: Fundless sponsors are crucial in the middle market, especially at the lower end, by structuring deals that might not attract larger private equity firms. They act as intermediaries, leveraging expertise and relationships to facilitate transactions.

Benefits and Challenges: The model offers operational flexibility, direct control over investments, and potentially shorter investment horizons. However, challenges include proving credibility, the risk of insufficient fundraising, and regulatory uncertainties.

Strategic Approaches: Successful fundless sponsors establish strong relationships with mezzanine lenders, family offices, and other financing sources to secure necessary capital and expertise.

Compensation and Outcomes: Compensation for fundless sponsors typically includes acquisition fees, carried interest, and management fees, aligning their financial incentives with the success of the deal.

🧵 Best of X (Twitter)

The case for self-funded search…

Whatever the business, it’s important to pivot and adjust quickly…

The case for buying vs. building…

SMB meetups…

Grim realities of the solar panel cleaning business…

🤔 Other

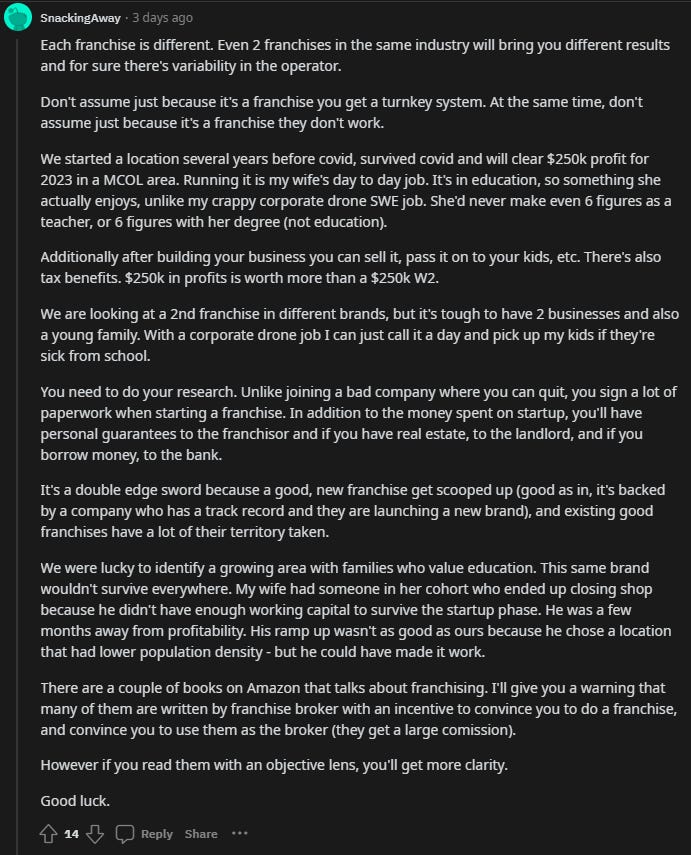

Franchise Purchase Experience

Stumbled across an interesting thread on Reddit where readers share their experiences with acquiring a franchise.

🗓️ Events

Wharton ETA Club (Spring 2024) - Philadelphia, PA

ACG Texas Capital Connection (Apr 2-3) - Dallas, TX

West Coast Capital Summit (Apr 9-11) - Huntington Beach, CA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

M&A Launchpad Conference (May 11) - Houston, TX

IBBA 2024 Annual Conference (May 11-12) - Louisville, KY

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Self-Funded Search Conference (Sept 30-Oct 1) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

🎵 Listening: “Moth To A Flame (with The Weeknd, Moojo)“ by Swedish House Mafia, The Weeknd, Moojo

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been the M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?