What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

This issue of What I Learned Last Week is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

📰 Articles

Rex Woodbury of Digital Native published a really great post on the opportunities that lie in the long tail. The idea here is that capturing many niche markets is much more lucrative than winning a few big ones.

Let’s play a game. Take a look at the two companies below and tell me which is the better business:

Company A: Company A is a content platform founded in 1997. Last year, it did $30 billion in revenue, +18% year-over-year. It has 225 million users and spent $19 billion on content in 2021.

Company B: Company B is also a content platform. It was founded in 2005. Company B also did $30 billion in revenue last year, +46% year-over-year, and has 2.6 billion users—but unlike Company A, Company B didn’t spend money making that content. Instead, users produce content for the platform.

Which is the better business model? You probably answered Company B, which crowdsources content production instead of shelling out $19 billion a year.

Company B is YouTube and Company A is Netflix. They are the two leading content platforms in the world, and both companies did about $30 billion in revenue last year. But they did so with dramatically different business models.

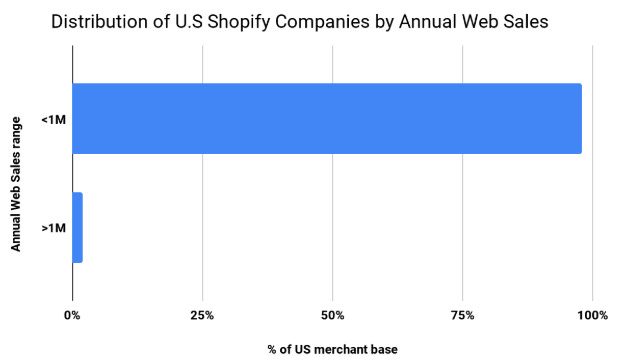

The most relevant example Rex points out is Shopify. Shopify built their business by capturing the long tail of e-commerce merchants…

The whole post is a great read…

— — — — — —

I invite you to visit the Knowledge Center on the DueDilio website. We’re constantly publishing new articles, templates, and due diligence checklists. We write some and others are guest posts.

Here are just a few of the recent additions:

The Comparable Valuation: The Building Block for Every Business Valuation

Buying an Online Business: Centurica’s Guide to Due Diligence

How to Structure Your Business Acquisition: An Insiders Guide

🧵 Twitter

Tips on optimizing your search part-time…

Great discussion on SBA vs. conventional financing options…

Marketing a local service business…

Buying a business isn’t the only way to take advantage of the “Silver Tsunami”…

Some of the pitfalls of seller financing…

DueDilio recently helped a client get a $1.3M check thanks to the ENC. Here’s what you need to know…

An interesting look at Toast…

🤔 Thoughts, Events, Other

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.