What I Learned Last Week 3.1.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🧐 Other - B2B SaaS Community

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Build Your Snowball. Compound what matters.

Snowball is a private community of experienced entrepreneurial investors creating meaningful wealth.

How?

By building companies for the long term.

By investing directly in the SMB ecosystem.

By creating a life where personal growth, health, and strong relationships compound over the decades.

If you’re looking for a like-minded community of accomplished doers, a place for SMB deal flow, and a place for long-term thinkers... you’ve found it.

👋 Join the club at Snowball

SnowballClub.com

📰 Articles

11 mistakes I've made buying businesses

In the article, Sieva Kozinsky shares personal insights from his experiences in acquiring businesses, focusing on the critical mistakes to avoid. These lessons stem from a range of strategic missteps to misjudgments about the intrinsic qualities of a business and its operational dependencies.

The key takeaways include:

The importance of integrity and trustworthiness in partners and sellers.

Distinguishing genuinely outstanding businesses from merely great ones.

Recognizing the value of constructive conflict in decision-making processes.

Avoiding businesses excessively reliant on their current owners.

The significance of patience and the strategic virtue of allowing investments to compound over time.

— — — — — — — — — — — —

How do earnouts, including contingent consideration, affect the financial results of an acquired business?

The article explores how earnouts, including contingent consideration, impact the financial outcomes of businesses involved in M&A. It delves into the complexity of determining whether earnouts should be classified as compensation for employment or as consideration for the acquisition, highlighting the factors that influence this classification and the accounting implications for each scenario.

Key insights include:

Earnouts are used to adjust the purchase price based on the acquired company's future performance.

The classification of earnouts as either compensation or consideration affects the financial reporting and valuation of the acquisition.

Several factors, including employment continuation and the nature of earnout payments, guide this classification.

Accounting for earnouts involves significant complexity, requiring careful evaluation of each transaction's unique circumstances.

— — — — — — — — — — — —

Clint Fiore: Breaking down the broker business

The podcast episode and article feature Clint Fiore's transition from being a pilot to establishing Bison Business, a brokerage firm leveraging social media and a specialized team for differentiation. It addresses the brokerage industry's challenges, including entry ease, variable cash flows, and the significance of unique customer experiences. Clint's story exemplifies overcoming these challenges through innovation.

Key insights include:

Transitioning career paths to entrepreneurship.

Challenges in the brokerage industry.

Importance of differentiation and customer experience.

Overcoming industry challenges with innovative approaches.

🧵 Best of X (Twitter)

Breakdown of opportunities in health care. I like the MedSpa space personally…

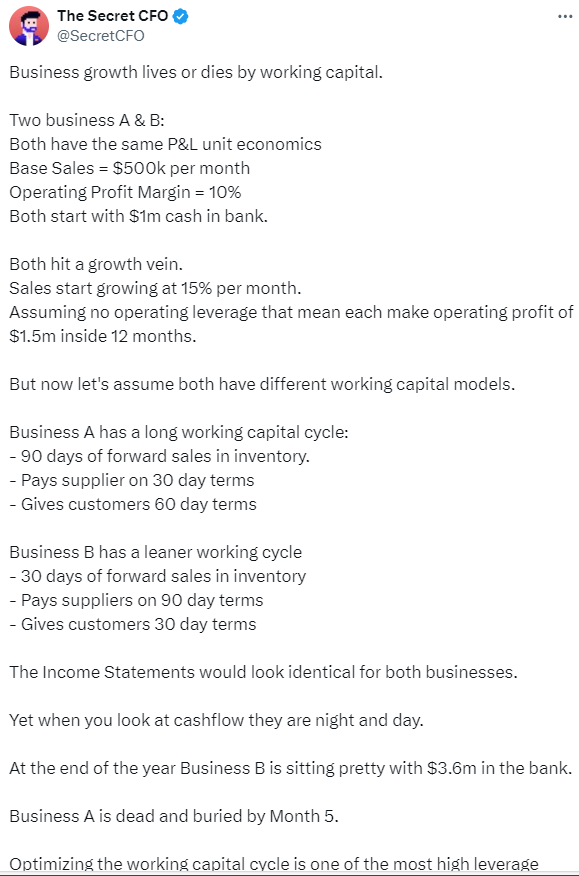

NWC can be the differentiator between success and failure…

Tips on negotiating a seller note…

A lot of good EtA insights in this thread…

Purchase price allocation should be discussed more often…

🗓️ Events

Wharton ETA Club (Spring 2024) - Philadelphia, PA

ACG Texas Capital Connection (Apr 2-3) - Dallas, TX

West Coast Capital Summit (Apr 9-11) - Huntington Beach, CA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

M&A Launchpad Conference (May 11) - Houston, TX

IBBA 2024 Annual Conference (May 11-12) - Louisville, KY

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Self-Funded Search Conference (Sept 30-Oct 1) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

🧐Other

B2B SaaS Community

It’s no secret that I’ve been a big fan of the team at XO Capital. They’re launching a paid ($300/yr) community for those interested in acquiring a B2B SaaS business. Below are the details:

Value:

Calls - weekly community calls with XO. Get your specific questions

Cohorts - get in small groups. meet folks.

Team Up - Find others to buy and operate businesses with

Course - go from zero to acquisition with our extremely practical course on acquisitions (in progress)

It's $300 a year.

If you join and don't like it and want your $$ back, no worries, this isn't going to be a meaningful revenue thing for us.

I’m not affiliated with them in any way. Just like what they’re doing and how they’re doing it.

🎵 Listening: “Peru - Peace Control Remix“ by Fireboy DML, Peace Control

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?