What I Learned Last Week 3.14.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - SBA Rule on Foreign Ownership

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

How to Use an F Reorganization When Buying a Business

The article explains the concept and benefits of an F reorganization in business acquisitions, particularly when purchasing an S corporation. It highlights how this restructuring allows buyers to gain the tax advantages of an asset purchase while avoiding the liabilities of a stock purchase. The piece also compares F reorganizations to Section 338(h)(10) and Section 336(e) tax elections, outlining when each might be preferable.

Key insights include:

An F reorganization involves restructuring an S corporation into an LLC before the sale, enabling asset purchase tax treatment.

It mitigates risks associated with invalid S elections, which could otherwise lead to unexpected C corporation tax liabilities.

Unlike stock purchases, this method allows buyers to receive a stepped-up tax basis on assets.

It offers post-sale flexibility, allowing the buyer to choose how the acquired business is taxed.

However, F reorganizations are complex, costly, and require seller cooperation, making early discussions and experienced legal counsel essential.

— — — — — — — — — — — —

HVAC Valuations Too High? PE Firms Look Upstream to Distributors

Private equity firms are shifting their focus from HVAC service companies to distributors due to soaring valuations in the service sector. While HVAC services remain attractive for their recurring revenue and resilience, high competition and consolidation have pushed valuations to unsustainable levels. By investing in distributors, PE firms can still gain exposure to the sector at lower multiples.

Key insights include:

HVAC Service Valuations Are Too High: Private equity firms find it increasingly difficult to justify new investments in service companies due to inflated prices.

PE Firms Are Investing Upstream: Investors are turning to HVAC distributors, which remain fragmented and offer lower valuation multiples.

Recent PE-Backed Acquisitions: Firms like Genstar Capital, Investcorp, Kian Capital, Graycliff Partners, and Platinum Equity have all acquired HVAC distribution platforms since 2021.

Fragmented Distribution Market: With over 5,000 independently owned distributors, there is ample opportunity for consolidation.

Growth Drivers: Industry modernization, environmental regulations, and first-generation business owners seeking succession plans are fueling further M&A activity.

— — — — — — — — — — — —

How to Make Smart Offers on Risky Deals

The article by Walker Deibel outlines strategies for making smart offers on businesses with inherent risks, such as revenue imbalances and customer concentration. He introduces the Weighted Average Valuation (WAV) technique, which helps buyers break down risks, quantify them, and structure fair deals.

Key insights include:

Separating Risky Revenue Streams: If a business has earnings tied to fundamentally different products or customer bases, they should be valued separately to reflect different risk levels.

Customer Concentration Risk: A business overly reliant on one customer should have that portion of earnings treated separately, often structured with an earn-out or contingent payments.

Valuation Adjustments: The core, diversified business can receive a standard multiple, while riskier revenue streams should have lower multiples or alternative deal structures.

Using Earn-Outs for Risky Deals: Pegging payments to revenue instead of profit ensures transparency and reduces post-sale disputes.

Personal Case Study: The author bought a business with 20-25% revenue concentration from a single customer but justified the risk based on long-term relationships and service stickiness.

The approach helps buyers confidently structure offers while ensuring risks are accounted for in the valuation and deal terms.

— — — — — — — — — — — —

Why Your MBA Didn't Prepare You to Run a Business

The article critiques the effectiveness of MBA programs in preparing individuals for real-world business ownership, arguing that traditional business education focuses on corporate leadership rather than entrepreneurship.

Key insights include:

MBA Programs Are Designed for Corporate Roles: They teach finance, strategy, and case studies of large companies but fail to address small business realities like cash flow struggles and hiring decisions.

The Importance of Learning from Owners Just Ahead of You: Seeking advice from entrepreneurs slightly further along in their journey provides more practical, relevant guidance.

Peer Groups and Coaching Are Invaluable: Engaging with other business owners and working with knowledgeable coaches accelerates learning and decision-making.

Books by Practitioners Are More Useful Than Business Bestsellers: Recommended reads include Simple Numbers by Greg Crabtree, Profit First by Mike Michalowicz, and Traction by Gino Wickman.

Real Business Education Comes from Experience: The best way to learn is by running the business, making mistakes, and continuously seeking knowledge.

🧵 Online Highlights

I scroll, so you don’t have to.

Two searchers closed a $7.5M SBA loan in just 20 days by being proactive — speed comes from preparation, not luck…

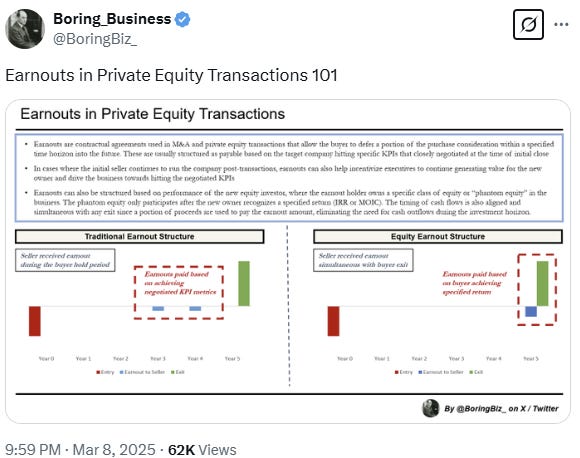

How PE thinks about earnouts…

Seller financing + franchising = the ultimate growth hack for buying businesses without banks…

SMB deal evaluation in six steps: quick filtering, AI-powered research, Searchfunder insights, and a seller-first approach to close the right deal…

PE’s accounting roll-ups are doomed — pissed-off employees, shrinking margins, and zero exit options mean they’re burning cash without a way out…

Certain sectors have less risk…

🤔 Other

New SBA Rule on Foreign Ownership

The SBA 7(a) loan program has long been a critical source of financing for small business acquisitions. Outside of this program and SBIC funds (which cater to slightly larger businesses), there are few debt options available for entrepreneurs looking to buy a business.

Recently, the SBA has been undergoing significant policy shifts, and a new rule change will have a direct impact on searchers, sponsors, and operators in the SMB acquisition space. SBA Policy Notice 5000-865754 introduces new restrictions on ownership eligibility, specifically barring foreign individuals from having any ownership stake in businesses financed with SBA loans.

What the New Rule Means

Under this updated SBA Standard Operating Procedure (SOP), any business receiving SBA funding must be 100% owned by U.S. citizens, U.S. nationals, or Lawful Permanent Residents (LPRs, or green card holders).

To enforce this, SBA lenders and borrowers must meet the following new requirements:

Lenders must document and report at least 81% of Beneficial Owners in the SBA’s E-Tran system.

Lenders must certify that no Beneficial Owner is considered ineligible under the new policy.

Borrowers must also certify that none of their Beneficial Owners fall under the ineligible category.

Defining Beneficial Ownership

The SBA SOP 50 10 7.1 defines a Beneficial Owner as anyone who owns a business either directly or indirectly through another entity. For example, if a person owns 100% of Company A, and Company A owns 50% of a business applying for an SBA loan, that person is considered a 50% Beneficial Owner of the applicant.

Key Takeaway: No Foreign Ownership in SBA-Backed Deals

This rule change means that foreign investors, partners, or shareholders can no longer have an equity stake in any business receiving SBA financing. For anyone structuring an acquisition deal with foreign capital, this is a major shift that will require careful restructuring of ownership stakes.

If you have any questions on how this impacts your acquisition strategy, it’s best to consult with legal counsel, SBA lenders, or loan brokers who are actively navigating these changes.

🗓️ Events

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

London Business School EtA Conference (Mar 28) - London, UK

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

NOVA SBE EtA & SF Conference (Apr 3) - Carcavelos, Portugal

2nd Annual UCLA ETA Search Fund Roundtable (Apr 9) - Los Angeles, CA

M&A Launchpad Conference (May 3) - Houston, TX

Mittelstand Summit 2025 (May 20) - Berlin, Germany

🎵 Listening: “Future“ by Goodboys 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?