What I Learned Last Week 3.15.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - Capital Intros

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Assemble Your Dream M&A Team!

Whether you're a searcher, a private equity firm or family office, or an ambitious SMB, DueDilio is your go-to platform for assembling your dream M&A deal team.

Why Choose DueDilio?

A Vast Network: Discover your ideal M&A advisors, due diligence providers, and post-acquisition support from our curated collection of M&A service providers.

Customized Matchmaking: Skip the stress. Submit your project and receive tailored proposals from qualified M&A service providers that match your needs and budget.

Expertise Where It Counts: Specializing in transactions ranging from $1M to $25M in enterprise value, we speak your language.

Free Resources: Gain an edge with free access to our professionally written templates, checklists, and guides.

🌐 Visit us at DueDilio.com to learn more and start your journey towards a seamless M&A transaction.

📰 Articles

SBM 17 - Brian Beers: franchise, franchise, franchise

There’s an increased awareness of buying into a franchise as part of EtA. This article explores Brian Beers' journey in the auto repair franchise industry, highlighting the growth and strategies of his business, Prenlyn Automotive Group, which owns 33 Midas Auto Repair locations. Beers, with a family history in franchising since 1976, expanded the business significantly from 2010 onwards, overcoming challenges like the financial crash and the COVID-19 pandemic. Beers is now venturing into That 1 Painter franchises, aiming to dominate the Philadelphia market.

Key insights include:

The US franchise industry's substantial economic contribution and employment.

The importance of selecting a franchise brand that matches one's goals and skill sets.

Strategic growth and diversification as crucial factors for success in franchising.

The potential for consistent quality and brand recognition to differentiate and scale in competitive markets.

— — — — — — — — — — — —

The Shopify app store is becoming more competitive amid rising costs: 'People are fighting it out on the margins'

A good read for anyone interested in the Shopify app space. The Shopify ecosystem is seeing heightened competition with over 10,000 apps, up from about 7,000 in 2021. Developers must now demonstrate the value of their apps more than ever due to increased choice and Shopify's subscription price hikes. The piece also addresses challenges such as app saturation, the necessity for apps to offer substantial value, and the impact of Shopify's in-house feature development on third-party apps.

— — — — — — — — — — — —

The Least Risky Industries to Buy a Business

Adam Hoeksema of ProjectionHub analyzes SBA loan data to identify the least risky industries for business acquisition, finding that medical-related businesses, car washes, gas stations, and self-storage have the lowest default rates. However, considering personal skills and interests, they conclude that investing in complementary businesses offers the potential for higher returns with less risk compared to entering unfamiliar industries.

— — — — — — — — — — — —

My Thoughts on Building a 6 figure HoldCo.

Dev Shah discusses his strategy and experience in building a holding company to a six-figure value by acquiring micro-startups. He highlights the efficiency of utilizing startup marketplaces for discovering deals, the advantages of targeting less saturated markets, and the significance of smaller, strategic acquisitions. Shah stresses the importance of leveraging one's unique competitive edge, specializing in niche areas, and recognizing the pivotal role of effective distribution in the current competitive landscape.

Key insights include:

The strategic use of startup marketplaces for finding investment opportunities.

The benefit of focusing on less competitive markets and smaller acquisitions.

The importance of identifying and leveraging a personal competitive advantage.

The critical role of distribution as a differentiator in business success.

— — — — — — — — — — — —

Stock or Asset Transaction?

The article from Silverwave discusses the differences between stock and asset transactions in business sales. In a stock sale, the buyer acquires all assets, liabilities, and operations, which can simplify the transfer of agreements but may include hidden liabilities. Sellers often prefer stock sales for tax advantages. Asset purchases allow buyers to select specific assets and liabilities, offering tax benefits for buyers but potentially complicating the transfer of leases and contracts. The article illustrates these points with real examples, highlighting the varied implications for buyers and sellers.

🧵 Best of X (Twitter)

Using sales/leaseback…

Be a good person and focus on the things that matter…

Buyers should think about this as well…

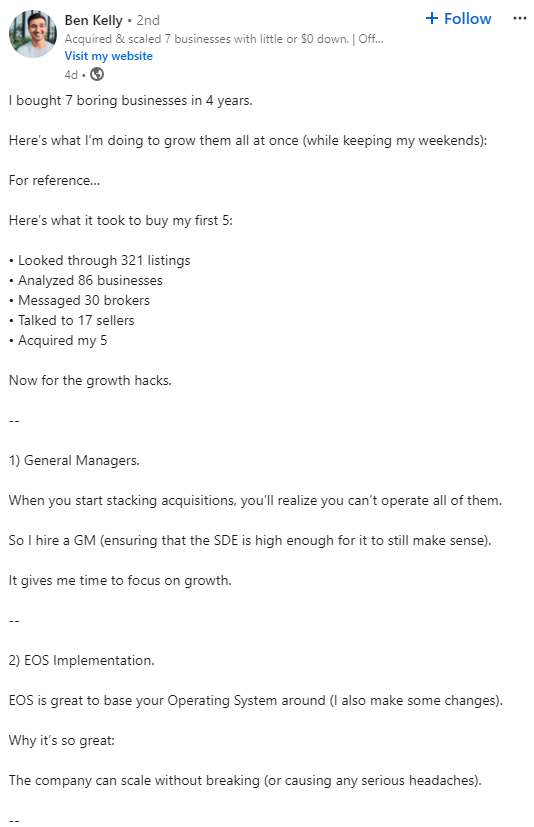

Post-acquisition growth hacks…

Not M&A related but I thought this was a great post…

🤔 Other

Capital Intros

Recently, a project was presented to us at DueDilio involving a client pursuing a modest healthcare sector acquisition valued at $1M. The client, a Canadian citizen acquiring a business in the United States, sought approximately $350k in traditional financing. Given their ineligibility for SBA loans, they expressed willingness to provide a personal guarantee for the loan and demonstrated a degree of flexibility regarding the loan terms.

Typically, for SBA loans, many brokers (Pioneer Capital, Multifunding) assist in identifying the most suitable lender and navigate the entire loan process at no cost. For traditional loans exceeding $2M, platforms like Cerebro Capital effectively match borrowers with lenders. However, for lesser financing needs, there seems to be a lack of automated platforms facilitating this borrower-lender connection. If you’re aware of one, please let me know.

At DueDilio, we connected the client with multiple M&A advisors proficient in securing financing. These advisors generally request an upfront fee ranging from $2,000 to $5,000, followed by a commission of approximately 2% on the capital raised. While the client was satisfied with the outcome, it feels to me like there is a need for a more streamlined, automated solution to tackle this type of project.

🗓️ Events

Wharton ETA Summit (March 21-22) - Philadelphia, PA

ACG Texas Capital Connection (Apr 2-3) - Dallas, TX

UCLA Anderson ETA & Search Fund Roundtable (April 3) - Los Angeles, CA

West Coast Capital Summit (Apr 9-11) - Huntington Beach, CA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

M&A Launchpad Conference (May 11) - Houston, TX

IBBA 2024 Annual Conference (May 11-12) - Louisville, KY

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Self-Funded Search Conference (Sept 30-Oct 1) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

🎵 Listening: “Human (feat. Echoes)“ by John Summit, Echoes

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?