What I Learned Last Week 3.29.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Assemble Your Dream M&A Team!

Whether you're a searcher, a private equity firm or family office, or an ambitious SMB, DueDilio is your go-to platform for assembling your dream M&A deal team.

Why Choose DueDilio?

A Vast Network: Discover your ideal M&A advisors, due diligence providers, and post-acquisition support from our curated collection of M&A service providers.

Customized Matchmaking: Skip the stress. Submit your project and receive tailored proposals from qualified M&A service providers that match your needs and budget.

Expertise Where It Counts: Specializing in transactions ranging from $1M to $25M in enterprise value, we speak your language.

Free Resources: Gain an edge with free access to our professionally written templates, checklists, and guides.

🌐 Visit us at DueDilio.com to learn more and start your journey towards a seamless M&A transaction.

📰 Articles

Former Nextdoor exec raises $25 million for PipeDreams, a startup rolling up HVAC companies

Dan Laufer, a former executive at Nextdoor, launched PipeDreams, a startup that has raised $25 million to consolidate HVAC companies. The strategy involves acquiring small to mid-sized businesses, integrating them under the PipeDreams umbrella while maintaining their original brand identities. This approach provides a succession option for owners looking to retire. The company focuses on improving operational efficiencies through software, and currently operates in several locations including the San Francisco Bay Area, Tucson, and Denver.

Key insights include:

PipeDreams is focused on the HVAC and plumbing industry.

The company has a unique approach to preserving the identity and legacy of acquired businesses.

It uses software to enhance operational efficiency and customer service.

The startup is actively expanding in selected U.S. cities.

— — — — — — — — — — — —

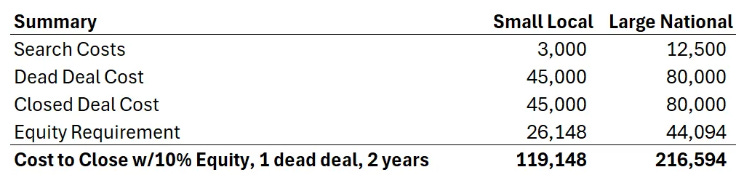

How Much to Budget for a Self-Funded Search

The article provides a comprehensive guide on budgeting for a self-funded search for acquiring a business. It breaks down the costs into three main categories: search costs, deal costs, and equity requirements, offering detailed insights into each. The guide also includes a realistic timeline for the search process, emphasizing the financial runway needed to avoid making hasty decisions.

— — — — — — — — — — — —

Where Do Buyers Actually Find Businesses to Acquire?

The article analyzes where buyers find businesses to acquire, based on a survey of successful acquisitions. It reveals a balanced mix of sources, including broker listings and personal networks, challenging the initial bias against listed opportunities. The article suggest that a diversified search strategy, encompassing both listed and unlisted businesses, enhances the chances of finding a suitable acquisition.

Key insights include:

Over half of acquisitions are sourced through brokers or listings.

Proprietary outreach and personal networks significantly contribute to discovery.

A multi-faceted approach, blending listed and unlisted searches, is recommended for potential buyers.

🧵 Best of X (Twitter)

Key insights from the Wharton ETA conference…

Online vs. reality…

DueDilio can quickly help you assemble a team…

Don’t just focus on valuation…

Simple yet effective industry thesis…

Creative solutions to mitigate issues found in due diligence…

🗓️ Events

ACG Texas Capital Connection (Apr 2-3) - Dallas, TX

UCLA Anderson ETA & Search Fund Roundtable (April 3) - Los Angeles, CA

West Coast Capital Summit (Apr 9-11) - Huntington Beach, CA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

INSEAD ETA Conference (May 11) - Fontainebleau Campus, France

M&A Launchpad Conference (May 11) - Houston, TX

IBBA 2024 Annual Conference (May 11-12) - Louisville, KY

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Self-Funded Search Conference (Sept 30-Oct 1) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

🎵 Listening: “Electric Relaxation“ by A Tribe Called Quest

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?