What I Learned Last Week 3.7.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

The Rise of Search Funds Beyond US Borders

The article from Caprae Capital Partners explores the growing prominence of search funds beyond the United States, highlighting how the model is expanding globally. Historically concentrated in the U.S., search funds are now gaining traction in countries like Spain, Mexico, the UK, and Brazil, with new markets such as China, Ireland, and South Africa joining in 2023. This shift reflects the model’s adaptability and increasing appeal to entrepreneurs from diverse backgrounds.

Key insights include:

In 2023, a record 59 new international search funds were established.

Spain, Mexico, the UK, and Brazil are leading in first-time search fund launches.

The educational background of searchers is diversifying, with fewer U.S.-MBA graduates (42%) leading international funds.

While still early to measure profitability, international search funds show a 71% success rate in exits.

Industries like technology, manufacturing, healthcare, and logistics are prime targets for international acquisitions.

Investors are eager to replicate the U.S. search fund model globally, creating opportunities for aspiring entrepreneurs.

The rise of international search funds presents a timely opportunity for business leaders looking to explore high-growth industries worldwide.

— — — — — — — — — — — —

The Shifting EtA Landscape: The Rise of Self-Funded Search with HBS Professors Royce Yudkoff & Richard Ruback

This podcast episode from Axial features Harvard Business School professors Royce Yudkoff and Richard Ruback, who discuss the evolution of Entrepreneurship Through Acquisition (EtA). Once a niche focus for elite MBA programs, EtA has now become a mainstream career path for mid-career professionals. The conversation explores the growing preference for self-funded searches, changes in financing options, and the increasing diversity of EtA participants.

Key insights include:

EtA is expanding beyond MBA programs, attracting a broader range of professionals.

Success stories have legitimized EtA as a viable alternative to traditional careers.

The financing landscape has evolved, with SBA loans playing a crucial role.

Institutional capital's entry into the EtA market has affected returns and opportunities.

Self-funded search has emerged as the dominant model, particularly among Harvard MBAs.

Essential skills for success in small business acquisition include commercial acumen, emotional intelligence, and sales expertise.

Mid-career professionals can transition into EtA without quitting their jobs.

Engaging with the business community before purchasing a business is crucial.

The future of EtA points to continued growth and wider accessibility.

The discussion underscores how self-funded searches are reshaping small business acquisitions, making them more accessible to a diverse range of entrepreneurs.

— — — — — — — — — — — —

How to Value ANY Business

This newsletter from Nikonomics provides a no-nonsense guide to valuing a business, particularly for first-time buyers. It emphasizes minimizing risk, focusing on actual cash flow instead of industry multiples, and using a structured approach to determine a fair purchase price. The guide walks through the key steps, from assessing downside risks to plugging financial details into a valuation model.

Key insights include:

Minimize risk—avoid overpaying, understand the potential downsides, and prepare for setbacks.

Don’t rely on industry multiples—they reflect past deals, not the business’s true value today.

Cash flow is king—focus on revenue, expenses, and debt payments to determine a realistic valuation.

Understand the owner’s role—if they are heavily involved, you may need to hire someone, affecting costs.

Factor in seasonality—some businesses see most of their sales in one quarter, requiring careful evaluation.

Bank requirements matter—loan rates, terms, and debt service coverage ratios (DSCR) impact affordability.

Use a structured model—input financial data into a calculator to assess returns before committing.

The newsletter stresses that first-time buyers should be conservative, assume things will go worse than planned, and base valuations on tangible cash flow rather than speculation.

— — — — — — — — — — — —

How Often to Update SMB Investors: Best Practices Guide

This guide from DueDilio outlines best practices for keeping SMB investors informed after acquiring a business. It highlights the importance of regular, structured updates to build trust, encourage strategic reflection, and leverage investor expertise. While quarterly updates are the industry standard, monthly communication is considered the gold standard for more engaged investors.

Key insights include:

Quarterly updates are the baseline standard, aligning with financial reporting periods.

Monthly updates are preferred by many investors and can improve accountability and business performance.

Different stages require different frequencies—quarterly during the search phase, more frequent updates post-acquisition.

Essential content should include an executive summary, financial performance, key wins/challenges, strategic initiatives, and forward outlook.

Communication formats should mix written updates (1-3 pages) with periodic calls or in-person meetings for deeper engagement.

Regular updates provide strategic value by fostering investor trust, forcing self-reflection, and allowing timely intervention.

Consistent, transparent investor communication isn’t just an obligation—it’s a powerful tool for strengthening relationships and improving business outcomes.

🧵 Online Highlights

I scroll, so you don’t have to.

Two PE executives turned a single cold storage warehouse into a $20B logistics empire through aggressive acquisitions, tech innovation, and a 2024 IPO—the biggest of the year…

A simple explainer of EBITDA vs. Net Income…

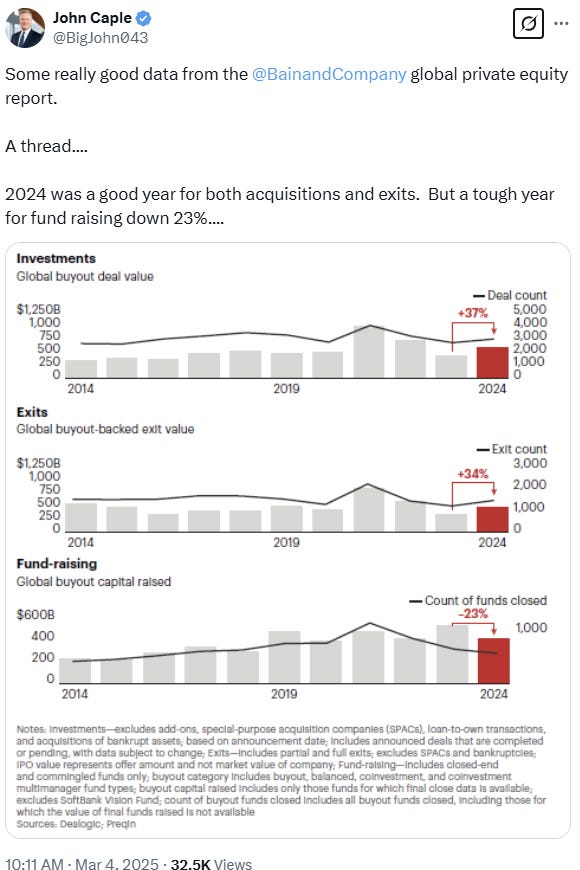

PE fundraising struggled in 2024 despite stronger acquisitions and exits, while direct lending now dominates middle-market LBOs, reshaping private equity dynamics…

SMB multiples are rising, and self-funded searchers can no longer expect to buy solid businesses at 4x EBITDA—bigger deals attract aggressive pricing and competition from well-backed operators…

Raising capital as an Independent Sponsor is a brutal numbers game—expect relentless rejection, endless emails, and exhausting calls before even securing a fraction of the funding needed…

Off-market acquisitions are mostly a waste of time—build broker relationships instead and focus on market-listed deals to close faster and more efficiently…

Cash vs. Accrual is important to understand in financial due diligence…

High-quality small businesses now trade at 5-6x EBITDA, making it tough for searchers relying on high leverage, while strategic buyers and PE firms dominate the space…

🗓️ Events

SBIA West Coast Capital Summit (Mar 25-27) - Los Angeles, CA

London Business School EtA Conference (Mar 28) - London, UK

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

NOVA SBE EtA & SF Conference (Apr 3) - Carcavelos, Portugal

2nd Annual UCLA ETA Search Fund Roundtable (Apr 9) - Los Angeles, CA

M&A Launchpad Conference (May 3) - Houston, TX

Mittelstand Summit 2025 (May 20) - Berlin, Germany

🎵 Listening: “Sweet Disposition“ by Temper Trap, John Summit, Silver Panda 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?