What I Learned Last Week 4.11.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

What Exactly Search Fund Investors Do - and Don’t Do - for Entrepreneurs

The latest Yale School of Management case study offers a comprehensive analysis of the roles and limitations of search fund investors in the ETA space. It presents the entrepreneur-investor relationship as a nuanced and evolving dynamic, shaped by mutual goals but also bounded by differing responsibilities and limitations. Investors are essential partners, providing more than just capital, but they are not catch-all supporters. Entrepreneurs are cautioned to enter this relationship with both appreciation and clear-eyed expectations.

Key insights include:

Core Contributions by Investors:

Provide capital in two key phases: the search and acquisition.

Offer pattern recognition from extensive ETA experience.

Serve on boards, balancing governance and advisory roles.

Act as mentors, guiding without micromanaging.

Enable access to the broader ETA community and exclusive networking events.

Share valuable personal and professional networks.

Limitations of Investors:

Do not source deals—this is the entrepreneur’s job and a key test of their capability.

Do not engage in daily operations or customer acquisition.

Cannot guarantee job security; CEOs can be replaced if underperforming.

May have different incentives, particularly tied to their fund’s performance and timing.

Are not obligated to invest in the acquisition phase even after backing the search phase.

— — — — — — — — — — — —

New SBA regs threaten small business M&A

The article from Federal News Network warns that new SBA regulations, set to take effect on January 17, 2026, could severely reduce the value of small government contractors in M&A transactions. These rules prevent acquirers of small businesses from exercising option years on contracts if the post-acquisition entity no longer qualifies as "small." This shift poses a serious challenge for owners—particularly those near retirement—looking to sell their companies.

Key insights include:

Buyers of small GovCon firms may lose access to significant contract backlogs post-acquisition if they don't meet SBA size standards.

The new rule particularly impacts multiple award contracts with more than one recipient.

Contracts awarded directly or where the seller is the sole awardee on an IDIQ or BPA are not affected.

If the acquirer is a small business before the purchase but not after, they can still access the backlog, but only under specific conditions post-regulation.

This change could significantly lower acquisition offers, undermining retirement plans for many small business owners.

— — — — — — — — — — — —

Holed up in Utah for 3 days with 100 HoldCo owners. What did I learn?

The piece from Alex Prokofjev of RollUpEurope reflects on insights gained at the 2025 HoldCo Conference in Utah, a gathering of 100+ HoldCo owners and SMB acquirers. Alex shares lessons on sourcing deals, AI's impact on M&A, and the human side of acquiring founder-led businesses.

Key insights include:

To win deals in 2025, acquirers need a sharp industry thesis and a compelling personal story, not just capital.

Family offices get better deal access than search funds; specificity and credibility help bridge that gap.

AI is flooding the market with outreach and scraping tools, creating noise and making genuine buyer-seller connections harder.

Emotional intelligence and trust-building often outweigh price in seller decisions.

The US HoldCo scene is highly sophisticated, with ambitious rollups across diverse sectors like auto repair and mortgage servicing.

🧵 Online Highlights

I scroll, so you don’t have to.

Venture capital is waking up to a new playbook: buy boring businesses, bolt on tech, and scale them like startups…

Advisory boards sound great—but for SMBs, one-off experts and hands-on mentors deliver far more bang for your buck…

The impact of tariffs must be part of your due diligence…

SBA loan limits may double to $10M under a new bipartisan bill—potentially unlocking bigger deals for small business buyers…

Choosing a 3PL? Skip the flashy quotes—understand true costs, location strategy, and how to avoid getting ripped off on postage and fulfillment…

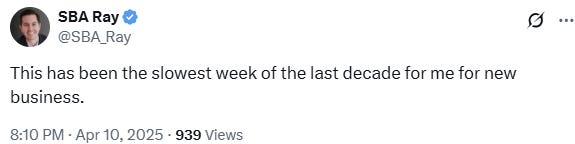

If you’re seeing less deal flow, you’re not alone…

🗓️ Events

Wharton ETA Summit (Apr 17-18) - Philadelphia, PA

M&A Launchpad Conference (May 3) - Houston, TX

INSEAD ETA Conference (May 10) - Fontainebleau, FR

Mittelstand Summit 2025 (May 20) - Berlin, Germany

🎵 Listening: “America“ by Neil Diamond 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?