What I Learned Last Week 4.18.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - Seller Due Diligence

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Valuing Businesses with Volatile EBITDA: Strategies for Smart Buyers

The article from DueDilio provides a comprehensive guide for buyers evaluating businesses with a sudden spike in EBITDA, especially right before a sale. Such growth may be genuine or artificially inflated, and distinguishing between the two is essential to avoid overpaying.

Key insights include:

Investigate the reasons behind EBITDA growth—look at revenue drivers, cost changes, customer mix, and accounting methods.

Use conservative valuation methods like 3-year or weighted average EBITDA rather than relying solely on the latest year.

Employ deal structures like forgivable seller notes, earnouts, or holdbacks to tie seller compensation to future performance.

Talk with lenders early, as many will not underwrite based on a single strong year and may discount volatile earnings.

Dive deep in due diligence—validate growth, customer data, margin analysis, and cash vs. accrual accounting.

Maintain a balanced approach: remain optimistic but skeptical, and use structure to protect against downside risk while staying competitive.

— — — — — — — — — — — —

M&A Fee Guide | 2024-2025

The 2024–2025 M&A Fee Guide, a collaboration between Axial, Firmex, and Divestopedia, offers detailed insights into the fee structures and engagement terms of M&A advisors operating in the lower middle market. This guide is based on anonymized data from hundreds of engagement letters submitted by advisors on the Axial platform, providing a comprehensive overview of current market practices.

Key insights include:

Success Fees: For sell-side mandates, success fees typically range from 4% to 6% for deals under $10 million, decreasing to 2% to 4% for transactions exceeding $25 million.

Retainer Fees: Approximately 70% of advisors charge a monthly retainer, with common rates between $5,000 and $15,000. Some advisors offer a portion of the retainer as a credit against the success fee upon deal closure.

Engagement Terms: The standard duration for exclusive engagements is 6 to 12 months, with provisions for automatic extensions if a LOI is in progress.

Termination Clauses: Many agreements include tail periods ranging from 12 to 24 months, during which the advisor is entitled to a success fee if a deal closes with a party introduced during the engagement.

Buy-Side Mandates: Buy-side engagements often feature lower success fees, typically between 1% and 3%, and may include milestone payments tied to specific deal stages.

— — — — — — — — — — — —

The SMB M&A Pipeline: Q1 2025

The Q1 2025 edition of Axial's SMB M&A Pipeline provides a detailed overview of early-stage deal activity on its platform, focusing on lower middle market transactions.

Key insights include:

Deal Volume: A total of 2,534 deals were brought to market in Q1 2025, marking an 8.62% decrease compared to the same period in the previous year.

Industry Performance: The Industrials sector was the only one to experience year-over-year growth in deal flow, while the Transportation sector saw the most significant decline, with a 29.88% drop.

Pursuit Rates: Healthcare deals had the highest pursuit rates, indicating strong buyer interest, whereas Food & Hospitality and Consumer Goods sectors, despite high deal volumes, ranked lower in buyer engagement.

Market Dynamics: The discrepancy between deal volume and pursuit rates in certain sectors suggests a cautious approach from buyers, who are prioritizing quality and strategic fit over sheer deal availability.

— — — — — — — — — — — —

A Young Generation Goes to Work for Mom and Dad Inc.

The WSJ article explores a growing trend of young adults entering family businesses, driven by a tighter job market and a generational shift in business succession planning. As baby boomer and Gen X business owners near retirement, more are turning to their children to carry on their legacy. This could be a headwind for deal flow in the future.

🧵 Online Highlights

I scroll, so you don’t have to.

Great example of the self-funded search model and why it’s attractive…

Search is a lonely, brutal grind—this post is a raw reminder that even with the right deal, bad luck can crush years of effort…

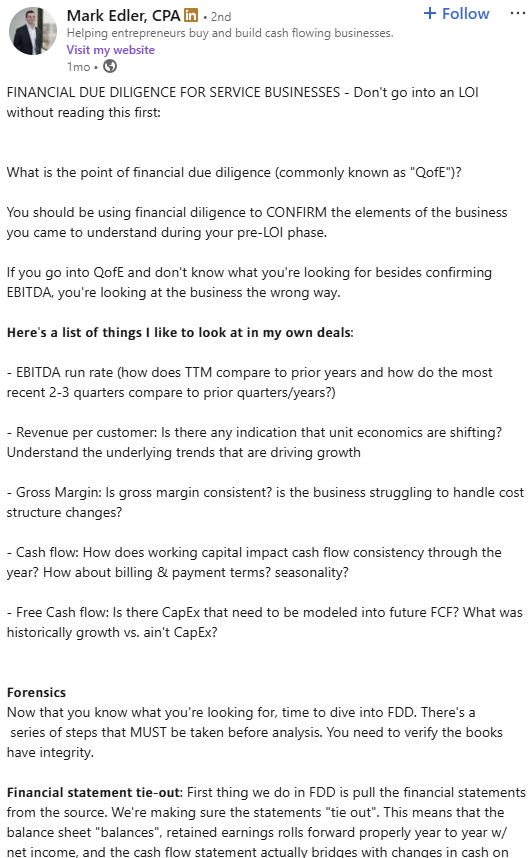

If your QofE is just about confirming EBITDA, you're doing it wrong—use financial due diligence to validate your thesis, spot red flags, and truly understand the business…

Buying a small business is harder than it looks—this post busts 9 common myths that trip up first-time buyers…

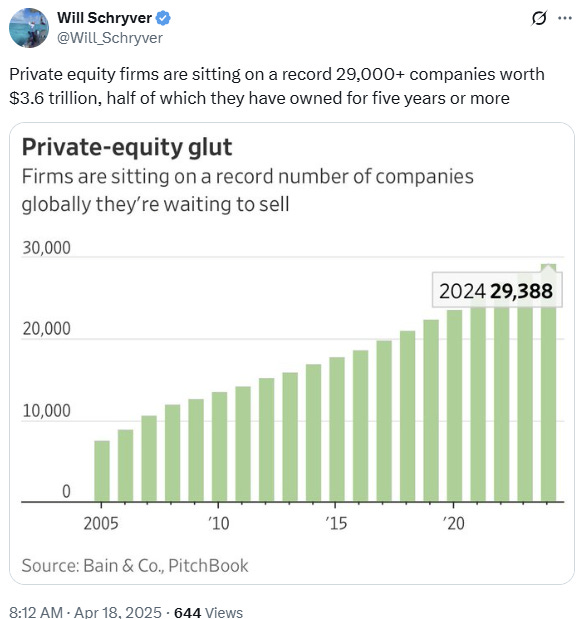

The silver tsunami didn’t hit—but with $3.6T in aging PE-owned companies, another wave may be coming…

On keeping the seller engaged…

🤔 Other

Seller Due Diligence

I want to share a recent note I received from a DueDilio client:

I've been in a bit of a whirlwind with this deal. Long story short, I ended up dodging a major bullet. After digging into the personal history of one of the sellers, I uncovered a string of red flags: tax fraud, check fraud, undisclosed LLCs, bankruptcy—you name it.

That single background check saved the buyer months of headaches and potentially millions in losses. Background screening isn’t glamorous, but it’s the highest‑ROI diligence step you can take before you spend real money on legal, QofE, or site visits.

Pro‑Tips for Buyers

Cross‑check seller info against state business registries—not just federal databases.

Match addresses on corporate filings with those on tax returns and utility bills.

Ask the broker (in writing) if they’re aware of any unpublicized legal or financial issues.

Document your findings; it strengthens your position if you renegotiate or walk away.

💡 Need a vetted investigator? DueDilio can match you with licensed background‑check specialists who work in the SMB M&A space.

🗓️ Events

Wharton ETA Summit (Apr 17-18) - Philadelphia, PA

M&A Launchpad Conference (May 3) - Houston, TX

INSEAD ETA Conference (May 10) - Fontainebleau, FR

Mittelstand Summit 2025 (May 20) - Berlin, Germany

🎵 Listening: “Original Sin“ by Sofi Tukker 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?