What I Learned Last Week 4.19.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Maximize Value, Minimize Costs: M&A Legal Solutions Tailored to Your Budget

At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices (And yes, we're based in Vermont). Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

EVERYTHING TO KNOW ABOUT A FRANCHISE DISCLOSURE DOCUMENT (FDD)

The Wolf of Franchises explains the Franchise Disclosure Document (FDD), highlighting its significance for potential franchisees. The FDD, mandated by the Federal Trade Commission, details essential information about the franchise, including financials, obligations, and legal aspects, aiding in informed decision-making.

Key insights include:

FDD is a crucial step before entering a franchise agreement.

It contains 23 items covering the franchise's operational, legal, and financial aspects.

Differentiates between the FDD and the Franchise Agreement.

— — — — — — — — — — — —

PE Deal Trends for Q1 2024

Bloom Equity highlights key points from the recently released Pitchbook 2024 Q1 US PE Breakdown.

Overall

In 2023, US PE dealmaking was down 41.2% from 2021’s all-time peak of $1.2 trillion.

Over the past few quarters, PE deal flow appears to have stabilized. In Q1 2024, the estimated deal count was slightly higher than the past four quarters, but the deal value is lower.

Platform LBO deals continue to be scarce due to their greater dependency on leverage, and their share of all PE deals declined to 19.0% in Q1 2024 from 19.6% for all of 2023.

🧵 Best of X (Twitter)

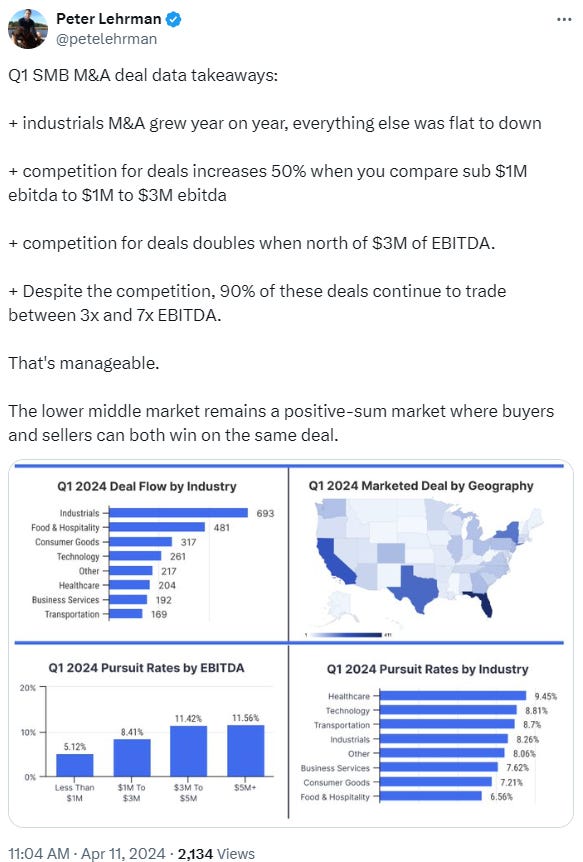

Key takeaways from Axial on Q1 SMB M&A activity…

Keep in mind that construction-related businesses have unique revenue recognition practices and tax returns…

“Silver Tsunami” was a good marketing gimmick…

Be prepared for margin compression and additional CAPEX when acquiring an SMB…

All about the EBITDA…

🗓️ Events

INSEAD ETA Conference (May 11) - Fontainebleau Campus, France

M&A Launchpad Conference (May 11) - Houston, TX

IBBA 2024 Annual Conference (May 11-12) - Louisville, KY

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Self-Funded Search Conference (Sept 30-Oct 1) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

🎵 Listening: “Jolene - Destructo Remix“ by Dolly Parton, Destructo

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?