🧐 What I Learned Last Week 4.21.23

Curating the best M&A, SMB, and EtA-related content.

Hello Friends!

This issue of What I Learned Last Week is brought to you by DueDilio.

DueDilio is a leading marketplace to hire highly vetted M&A due diligence service providers.

Our large and growing network of independent professionals, boutique, and mid-size firms specialize in finance, legal, technology, commercial, and other key areas of business diligence.

We save our clients the time, hassle, and cost of hiring a due diligence professional.

Submit your project.

Review qualified proposals.

Hire a service provider.

Simple and FREE.

📰 Articles

What’s the market like now for selling a business? (April 2023)

They Got Acquired polled a few M&A experts, brokers, and business buyers for insights on whether right now is a good environment for business sellers. Some of the answers reminded me of this scene from Wolf of Wall Street…

From my seat - deal activity has dropped a lot over the last few weeks. This could be due to tax season or perhaps other factors. I’ve seen a few similar observations recently…

— — — — — — — — — — — —

GP BULLHOUND SECTOR UPDATES Q1 2023

GP Bullhound released their Q1 2023 sector updates on software, digital services, Fintech, digital media, and digital commerce.

— — — — — — — — — — — —

Tech Recipe: Growing your business with ChatGPT

EADS Bridge Holdings dives into ChatGPT and how it could be used to grow a business.

— — — — — — — — — — — —

Seasonal businesses are tough

Sieva is one of the co-founders of Enduring Ventures and writes The Business Academy substack. In the latest issue, he talks about the pitfalls of a seasonal business and why he avoids them (poor cash flow cycle, high NWC needs, etc).

🧵 Best of Twitter

QofE is one of the most important pieces of M&A due diligence. It can help a buyer spot inflated financials…

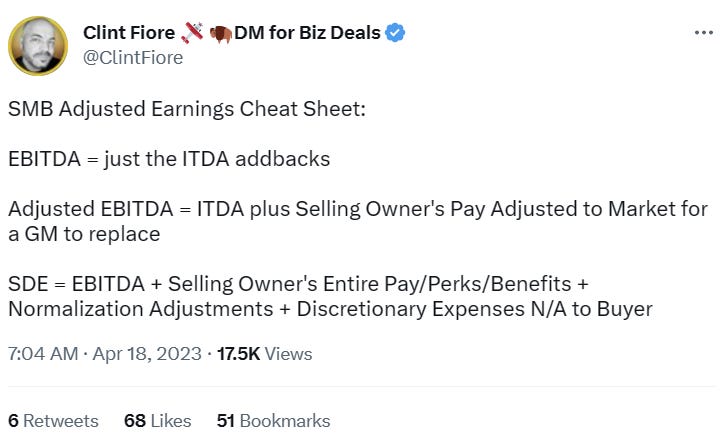

EBITDA and SDE are not the same…

If you can’t measure the results, don’t do it…

Find businesses that have a moat…

Don’t sell features & benefits…

Great QofE discussion for larger transactions…

Some “easy wins” in a newly acquired business…

Real talk…

🤔 Thoughts, Events, Other

⚒️ Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

DueDilio - #1 marketplace to hire highly vetted M&A due diligence service providers. Your source for finance, legal, tech, and other key areas of due diligence. Submit your project, review proposals, and hire.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel. Local Boston company and I consider the founder (Adam Ray) a friend.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Import Dojo - a newsletter that sends eCommerce and Amazon FBA businesses for sale to your email inbox. They send deals each Wednesday at 9:00 AM CST.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it or subscribe?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.