What I Learned Last Week 4.4.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - Tarrifs

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Deal Sourcing Guide (2025)

I’ve updated (and continue to improve) the deal sourcing guide for 2025 to include an overview of 100+ deal-sourcing platforms, tools, and resources.

Key insights include:

A directory of flagship marketplaces (e.g., Acquire.com, Flippa, Empire Flippers) for buying and selling startups and small businesses.

Premier brokerages like Calder Capital, Generational Group, and Transworld offer full-service M&A advisory for different market segments.

AI-powered platforms such as DealFlow Agent, Skarp AI, and Grata streamline sourcing, evaluation, and outreach.

Proprietary deal origination firms (e.g., Scoutly, BizNexus Omnisource, OutFlow) help uncover off-market opportunities tailored to buyer criteria.

Sector-specific platforms target niches like dental practices, digital businesses, or franchises.

Data vendors like Sourcescrub, Cyndx, and udu enhance due diligence and lead generation with private company insights.

End-to-end tools (e.g., Clearly Acquired, Lumeni) integrate sourcing, CRM, and analytics for seamless acquisition management.

An ecosystem of podcasts, newsletters, and communities provides education, insights, and networking for buyers and sellers.

This guide serves as a foundational resource for anyone navigating the small business M&A landscape, from first-time buyers to experienced investors.

— — — — — — — — — — — —

How Tariffs Are Shifting the M&A Landscape in the Lower Middle Market

The article on Axial explores how ongoing and potential tariff changes are reshaping the M&A landscape in the lower middle market. Drawing from Bain & Company's 2025 survey and insights from M&A advisors, it highlights how companies are adapting investment strategies, deal structures, and due diligence processes to address rising costs and supply chain disruptions caused by tariffs.

Key insights include:

40% of firms expect double-digit increases in input costs due to tariffs, prompting shifts in financial forecasting and investment priorities.

Businesses are focusing more on supply chain resilience, tech upgrades, and cost mitigation strategies (e.g., cash reserves, external financing).

Tariffs impact sectors differently—consumer goods and food & hospitality are more exposed due to reliance on imports.

M&A advisors now prioritize tariff-related risk in due diligence, including evaluating supplier diversification and pricing flexibility.

Strategies to counter tariff effects include diversifying suppliers, local sourcing, product redesign, and increased inventory planning.

— — — — — — — — — — — —

There Is No Free Lunch

This piece from the Buy Small Sell High newsletter delivers a sobering counterpoint to the current hype surrounding small business acquisitions, especially as promoted by influencers and online gurus. It critiques the narrative that buying a small business with minimal capital guarantees quick riches, comparing the current enthusiasm to historical bubbles. The core argument is that while owning a small business can be lucrative, the wealth comes from operational resilience, not passive ownership or financial engineering.

Key insights include:

The allure of easy wealth from SBA-financed business acquisitions mirrors past speculative bubbles driven by shortcuts and overconfidence.

Small businesses are not inherently cheap investments—they're complex operations requiring constant oversight, risk management, and problem-solving.

Profitability stems from handling daily operational headaches and business risk, not from passive ownership or strategic insight alone.

Customers usually pay for reliability and convenience, not uniqueness, meaning success relies on consistent execution.

The value created comes from "danger pay"—compensation for enduring stress, uncertainty, and continuous problem resolution, not strategic genius.

The metaphor of buying a small business as captaining a cargo ship underlines the point: you don’t make money owning the vessel—you make it by navigating storms and maintaining it daily.

🧵 Online Highlights

I scroll, so you don’t have to.

Post-closing liquidity is now a critical hurdle in SBA financing—lenders want to see a real safety net, not just a solid deal on paper…

Despite all the buzz about a “gray wave,” only ~5,000 SBA-funded acquisitions close each year. These numbers are close to what BizBuySell reports as well…

Simple but important things to avoid…

Vague working capital terms kill deals—spell out your expectations clearly upfront or risk confusion, conflict, and costly blowups down the line…

In a stock sale, a misaligned EIN can derail everything—always confirm it’s tied to the LLC, not the individual, or risk a post-close mess of licenses, insurance, and more…

🤔 Other

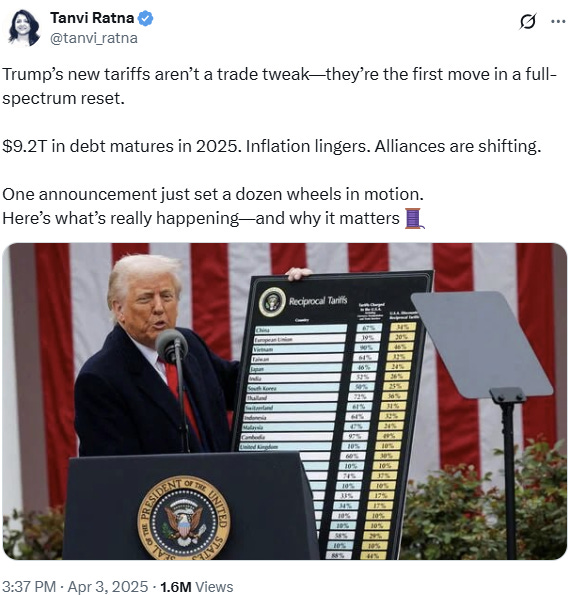

Tarrifs

Tariffs have quickly become the topic du jour—and for good reason. While opinions are flying, the long-term implications remain uncertain. That said, I came across a thread that offers a useful framework worth highlighting…

When it comes to search and EtA, these new tariffs are likely to hit some sectors harder than others. If you're evaluating a business in a tariff-sensitive industry, you’ll need to pay close attention to its supply chain and cost structure during due diligence.

Here are key areas to focus on as you continue your search:

Guidance on Navigating the New Tariffs:

Assess Supply Chain Exposure: Evaluate the target company's reliance on imported goods, especially from countries facing higher tariffs like China and the European Union. Increased costs due to tariffs can significantly impact profitability.

Analyze Customer Base and Pricing Power: Determine if the business has the ability to pass increased costs onto customers without losing competitiveness. Businesses with strong brand loyalty or unique products may fare better in this regard.

Review Financial Health: Conduct a thorough analysis of financial statements to understand current profit margins and assess how additional costs from tariffs might affect overall financial stability.

Sectors to Approach with Caution:

Retail and E-commerce: Businesses that rely heavily on imported goods, such as clothing, electronics, and household items, may face increased costs that are difficult to pass on to price-sensitive consumers.

Manufacturing: Companies dependent on imported raw materials or components may experience higher production costs, affecting margins and pricing strategies.

Agriculture and Food Production: Farms and food businesses that export products or rely on imported equipment and supplies could be impacted by both tariffs and potential retaliatory measures from other countries.

Due Diligence Questions to Consider:

Supply Chain Analysis: What percentage of the company's supplies or products are imported, and from which countries? Are there alternative suppliers not affected by tariffs?

Cost Absorption Capacity: Can the business absorb increased costs, or will it need to adjust pricing? What strategies are in place to manage these changes?

Market Position and Competition: How does the company's pricing compare to competitors who may have different supply chain exposures?

Legal and Compliance Review: Are there any contractual obligations or regulatory considerations related to international trade that could be affected by the new tariffs?

Customer and Supplier Contracts: Do existing agreements allow for renegotiation of terms in response to increased costs due to tariffs?

By thoroughly evaluating these aspects, you can better assess the viability of a small business acquisition in the current tariff environment and develop strategies to mitigate associated risks.

🗓️ Events

HoldCo Conference (Mar 31-Apr 3) - Sundance, UT

SMBash (Apr 2-4) - Dallas, TX

NOVA SBE EtA & SF Conference (Apr 3) - Carcavelos, Portugal

2nd Annual UCLA ETA Search Fund Roundtable (Apr 9) - Los Angeles, CA

M&A Launchpad Conference (May 3) - Houston, TX

Mittelstand Summit 2025 (May 20) - Berlin, Germany

🎵 Listening: “Who We Are“ by Alon 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?