What I Learned Last Week 5.16.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - “DueDilio is Hiring” — Except We Weren’t, Employee Communication, Using AI

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

IBBA Market Pulse Highlights Q1 2025

The Q1 2025 Market Pulse report outlines trends in business ownership transitions, seller sentiment, and deal financing within the U.S. Main Street and Lower Middle Market sectors. It highlights increased seller confidence, shifting deal structures, and consistent valuation trends.

Key insights include:

Seller confidence has grown since Q1 2023, continuing an upward trend in perceived market favorability.

Cash at close has declined across most deal sizes, while seller financing has become more prominent, signaling a shift in buyer-seller deal dynamics.

The majority of business owners (60%) started their own business, with 23% purchasing from third parties.

Median valuation multiples have remained relatively stable, showing modest year-over-year changes.

Good chart on valuation multiples:

— — — — — — — — — — — —

How AI Is Changing M&A: Insights from Axial Dealmakers

The article from Axial explores how artificial intelligence is transforming mergers and acquisitions (M&A) by streamlining processes and enhancing efficiency. A recent survey of Axial members reveals widespread adoption of AI tools across various stages of the deal lifecycle, from sourcing to execution.

Key insights include:

Widespread AI Adoption: 74.2% of respondents currently use AI in deal sourcing or marketing, with an additional 9.7% planning to adopt it within the year.

Primary Applications: AI is predominantly used for market research (80.6%), email drafting, buyer targeting, and creating CIMs or teasers.

Perceived Competitive Edge: 60% of dealmakers believe AI offers a moderate to significant advantage in M&A activities.

Diverse Tool Usage: Professionals employ a range of AI tools, including general-purpose platforms like ChatGPT and specialized software such as Diligent and Deliverables.AI.

Future Outlook: Experts anticipate that AI will increasingly handle tasks like CIM creation, buyer research, and letter of intent (LOI) analysis, further integrating into M&A workflows.

Concerns About AI: The main apprehensions regarding AI use are overreliance leading to diminished human judgment (38%), accuracy of AI outputs (34.5%), and data confidentiality (20.7%).

Overall, the integration of AI in M&A is enhancing operational efficiency and reshaping traditional practices, with professionals recognizing its growing role in the industry.

— — — — — — — — — — — —

What to Know About Exclusivity Clauses in Letters of Intent

The article from SMB-Transactions delves into the critical role of exclusivity clauses in Letters of Intent (LOIs) during small business mergers and acquisitions (M&A). While much of an LOI is non-binding, the exclusivity provision is typically binding and serves to protect the buyer's interests during due diligence and negotiation phases.

Key insights include:

Purpose of Exclusivity: Prevents the seller from soliciting or engaging with other potential buyers, ensuring the buyer has a dedicated period to conduct due diligence without competition.

Scope of Provision: Should explicitly state that the seller will cease marketing the business and terminate ongoing negotiations with other parties.

Duration: Typically spans 60–90 days, providing sufficient time for due diligence and drafting of the purchase agreement.

Inclusion of Affiliates: The clause should encompass the seller's affiliates and representatives, including brokers, to prevent indirect solicitation.

Seller Exceptions: Sellers may request the right for brokers to continue marketing during exclusivity, which can undermine the buyer's position and should be carefully negotiated.

Negotiation Strategies: Buyers should be cautious of sellers who may intentionally delay negotiations to entertain better offers, emphasizing the importance of a well-defined exclusivity clause.

In essence, a robust exclusivity clause is vital for buyers to safeguard their investment of time and resources during the M&A process, ensuring a fair and focused negotiation environment.

— — — — — — — — — — — —

Young Canadians Buying Boring Businesses

The article from Globe & Mail discusses a growing trend among young Canadians who are investing in traditional, cash-flowing businesses such as laundromats and car washes. These ventures offer steady income streams and are seen as more accessible and less risky compared to tech startups or other high-growth enterprises.

Key insights include:

Attraction to Stability: Young entrepreneurs are drawn to the predictable revenue and operational simplicity of service-based businesses.

Digital Integration: Many are modernizing these traditional businesses by incorporating digital payment systems, online booking, and enhanced customer experiences.

Community Engagement: These ventures often serve local communities, allowing owners to build strong customer relationships and brand loyalty.

Lower Entry Barriers: Compared to tech startups, these businesses require less capital and offer quicker paths to profitability.

Shift in Entrepreneurial Mindset: There's a noticeable move towards valuing sustainable, long-term income over rapid, high-risk growth.

This trend reflects a broader shift in entrepreneurial strategies, emphasizing practicality and resilience in business choices.

🧵 Online Highlights

I scroll, so you don’t have to.

A unicorn business listing…

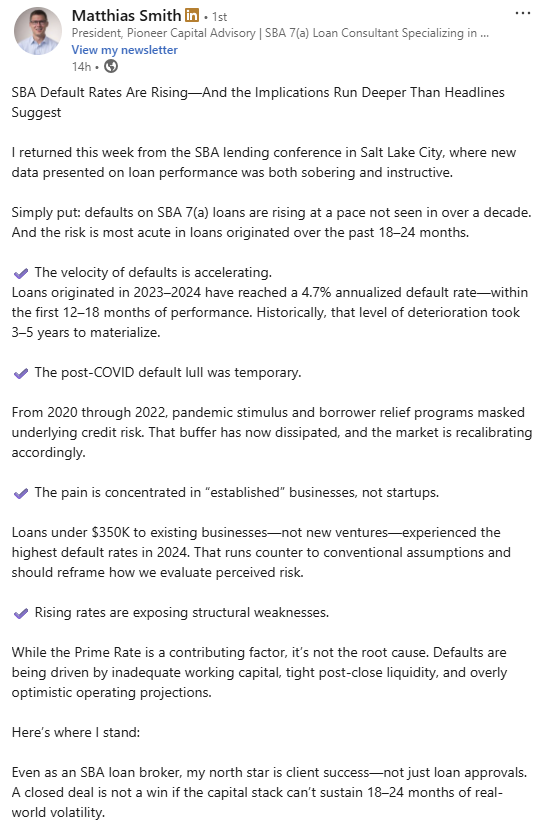

SBA loan defaults are spiking—buyers relying on outdated playbooks risk walking into deals that can’t survive real-world volatility…

100% bonus depreciation is (maybe) back through 2029—creating a major tax win and clear planning window for buyers investing in capital-heavy businesses…

Most home service deals include rolled equity, earn-outs, or seller notes to bridge valuation and align incentives…

The biggest risk in buying a business isn’t the deal—it’s you; success comes from buying a business that needs your specific skills, not just chasing what’s hot…

Tips on nailing your employee communications…

Veteran entrepreneur exposes the truth behind business guru advice…

Don’t double count—if working capital is excluded from the deal, it must be reflected in the valuation, or you're overpaying…

🤔 Other

“DueDilio is Hiring” — Except We Weren’t

Here’s a business problem I never expected…

Last week, I noticed a sudden spike in traffic to the DueDilio website. Then came a flood of phone calls to our business line. Then a wave of LinkedIn messages. And finally, a steady stream of emails asking if DueDilio was hiring.

It turns out a scammer had been using the DueDilio name in a text message phishing campaign. The messages read something like: “DueDilio is hiring for part-time workers. Click here to apply.”

Beyond being a major distraction, this caused real monetary harm. Many people Googled “DueDilio” and clicked our promoted ad—leading to hundreds of dollars in wasted Google ad spend.

Not an issue I had ever anticipated as a business owner.

— — — — — — — — — — — —

Employee Communication

Reddit user: Selling my small business in 4 weeks... so scared to tell my employees

A Reddit user preparing to sell their business of 20 years expressed anxiety about informing their 95 employees, as the buyer wants them told two weeks before closing. The post sparked extensive discussion among business owners, M&A professionals, and employees about the timing and ethics of disclosing a business sale.

Key insights include:

The overwhelming consensus advises waiting until the deal is finalized and funds are secured before informing employees, to avoid risks like resignations or renegotiations.

Several contributors shared cautionary tales where early disclosure led to employees quitting and buyers backing out.

Some stress transparency and ethical responsibility, especially if employees' jobs may be impacted, though still often recommend waiting until after closing.

Experienced professionals advise involving legal counsel, using NDAs with key staff if early involvement is essential, and planning a smooth, positive announcement with clear messaging post-close.

Emotional aspects of selling, like guilt and employee loyalty, are acknowledged, but many assert that protecting the deal and business stability must come first.

— — — — — — — — — — — —

Using AI

There’s a growing wave of controversy around the use of AI—not just in everyday life, but increasingly in M&A circles too. Here’s one example:

On a personal note, this week, I was temporarily banned from Searchfunder for using AI to help write my post responses.

I use AI in nearly every part of my life:

Publishing this newsletter

Running DueDilio

Generating content

Responding to emails

Planning vacations

Creating workout routines

Troubleshooting health issues

…and a lot more.

Of course, there’s nuance to all of this. But the core questions I keep coming back to are:

Is AI-generated content automatically worse than human-written content?

Is it inherently inaccurate?

Is it less helpful?

If the answer to any of these is “yes,” then sure—let’s ban all AI content and maybe throw its users in jail while we’re at it.

But if the answer is “no”—or even “it depends”—then we need a more thoughtful approach than knee-jerk bans and blanket assumptions.

AI is a tool. Like any tool, it can be used well or poorly. The focus should be on the quality and accuracy of the content, not the method of its creation.

🗓️ Events

M&A Source 2025 Spring Conference (May 19-21) - Orlando, FL

Mittelstand Summit 2025 (May 20) - Berlin, Germany

Main Street Summit (Nov 4-6) - Columbia, MO

M&A Source 2025 Fall Conference (Nov 9-12) - Phoenix, AZ

🎵 Listening: “Mammy Blue“ by Andrew Dum 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?