What I Learned Last Week 5.17.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Portfolio Construction & The Lower Middle Market

The article from Permanent Equity discusses principles of portfolio construction, especially in the context of investing in the lower middle market. It emphasizes the need for clear investment objectives, prudent risk management, and balanced diversification tailored to the specific challenges of small, private companies.

Key insights include:

Defining clear investment objectives to guide decision-making.

Avoiding investments that could jeopardize overall financial stability.

Ensuring sufficient but not excessive diversification.

Taking calculated risks with appropriate compensation.

Recognizing the increased correlation of investments during volatile periods.

— — — — — — — — — — — —

The state of healthcare dealmaking at McGuireWoods HCPE

Lead PitchBook analyst Rebecca Springer reports back from the 20th annual McGuireWoods Healthcare Private Equity and Finance conference, where both PE portfolio companies and firms were in high attendance. Key takeaways from the latest Industry Research analyst note include:

Healthcare deal activity is picking up but has yet to materialize into announcements as dealmaking proceeds haltingly.

The future of physician practice management investing is in flux as valuations and growth expectations reset.

PE firms are bullish on pharma services, despite life sciences’ greater volatility and concentration risk.

— — — — — — — — — — — —

Employee Stock Ownership Plan

A Reddit user sought advice on selling a $50M family business, considering ESOP (Employee Stock Ownership Plan) as an option. The discussion highlighted pros and cons, with varying opinions on its impact compared to a traditional sale.

Key insights include:

ESOPs can offer tax benefits and preserve company culture, but may complicate governance.

Private equity (PE) may harm the business more than an ESOP.

ESOP structures require careful financial and legal planning.

Balancing immediate financial gain with long-term employee benefits is crucial.

ESOPs might not maximize exit value but can ensure continuity for employees.

🧵 Best of X

I scroll, so you don’t have to.

Peter shares some great pursuit data from Axial. EtA is maturing and competing with (and sometimes beating) private equity…

Surprised to see the “no competition” comment. Agree that there’s a lot of opportunity out there, especially at a slightly higher multiple…

Each searcher’s experience is different. Ujwal’s observations based on his search…

Some of the costs Matthias outlines are a bit elevated but overall he’s right. Deal costs for a $500k deal are going to be comparable to a $2M deal. Keep this in mind…

These Tweets from Bruce are gold…

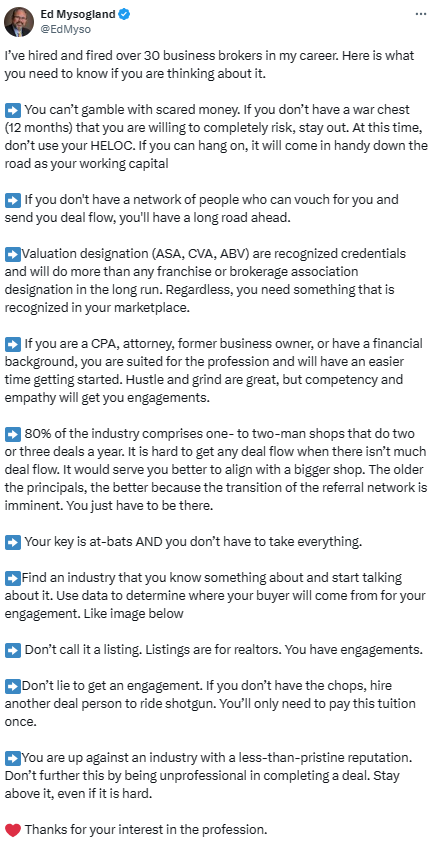

I pulled up an IBIS report on Business Brokers in the US. It did not paint a good picture. If you’re still interested in pursuing this career, Ed shares some great advice…

🗓️ Events

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Snap Your Fingers“ by Laurent Simeca

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Check this out if you’re looking to raise acquisition funds. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?