What I Learned Last Week 5.2.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Building Through Search

The investor presentation for Kingsway Financial Services (NYSE: KFS) outlines the company's strategy of using the Search Fund model—also known as Entrepreneurship Through Acquisition—to build a portfolio of high-quality, asset-light B2B and B2C service businesses. Kingsway is unique as the only publicly traded U.S. company fully employing this model. It emphasizes decentralized management, strong operator talent, and a tax-advantaged structure with significant net operating loss (NOL) carryforwards.

Key insights include:

Strong Historical Returns: Search Funds have delivered median returns of 35.1% since 1984, according to Stanford GSB.

Favorable Market Dynamics: A “Silver Tsunami” of retiring business owners creates a rich acquisition pipeline with limited private equity competition.

Disciplined Acquisition Model: Targets businesses with $1–3M EBITDA, paying 4–6x multiples, often using a 50/50 debt-equity split.

Proven Track Record: Highlighted by the 10x return on the PWSC acquisition and growth in other holdings like Ravix, DDI, and SPI.

Growth Flywheel: Cash flow from acquired businesses funds future acquisitions, driving compounding growth.

Tax Benefits: $622M in NOLs from legacy operations can offset future earnings.

Ambitious Goals: Plans to complete 2–3 acquisitions per year with a minimum 30% IRR hurdle rate.

— — — — — — — — — — — —

'Mini private equity' is exploding, but there are risks.

Search funds—vehicles for entrepreneurship through acquisition—are gaining traction, especially among young MBAs, but come with high risks and intense personal demands. While success stories exist, half of all search funds fail, and even successful entrepreneurs often endure significant stress and prolonged uncertainty.

Key insights include:

About 50% of search funds fail, with 37% never acquiring a business and others failing post-acquisition.

Even successful searchers face challenges like missed paychecks and constant on-call pressure, affecting work-life balance.

Exiting doesn’t guarantee freedom—65% of searchers who sell must stay on with the acquirer, often under new leadership and with mixed satisfaction.

Emotional and financial burnout is common for those clinging too long to underperforming businesses.

Peer groups, mentors, and structured support (like accelerators or investor guidance) are vital for both operational and emotional stability.

Note: You can use 12ft to bypass the paywall.

— — — — — — — — — — — —

Q1 2025 Global M&A Report

PitchBook released their 1Q 2025 report that highlights M&A activity throughout the globe.

Global M&A activity showed strong headline figures in Q1 2025, with deal value reaching over $1 trillion across over 12,000 transactions. But beneath the surface, caution is setting in. Growing economic uncertainty—driven by recession risks, trade tensions, and shifting political dynamics—is beginning to weigh on market sentiment. Valuations remained mostly flat, with North American and European median EV/EBITDA multiples holding at 9.6x and 8.9x, respectively—levels that signal a market returning to pre-pandemic norms, but well below the frothy highs of 2021. Meanwhile, public market multiples continue to lag, and the brief IPO optimism seen early in the year has faded amid renewed volatility. As sector-specific pressures rise and momentum in key areas like materials and healthcare softens, the rest of 2025 may see dealmaking become more selective and defensive.

🧵 Online Highlights

I scroll, so you don’t have to.

Don’t just model the upside — stress test your deal to find where it breaks..

Independent Sponsor economics look great on paper — but you only get paid if you close, perform, and survive the grind…

Buyer beware: mislabeled ‘addbacks’ like bonuses and overtime can sink your deal — and cost you months and tens of thousands…

From investment banker to sewer parts CEO — owning a small business isn’t glamorous, but it will challenge, humble, and transform you…

After a costly legal battle, Calm Fund’s founder warns: contracts are only as strong as your legal budget — and using AI might be your best defense compared to expensive lawyers…

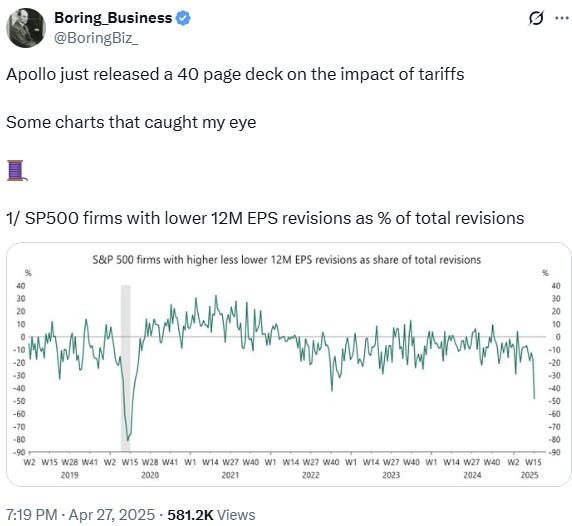

Warning signs everywhere: rising credit stress, falling tourism, and weakening consumer outlooks suggest storm clouds ahead for the U.S. economy…

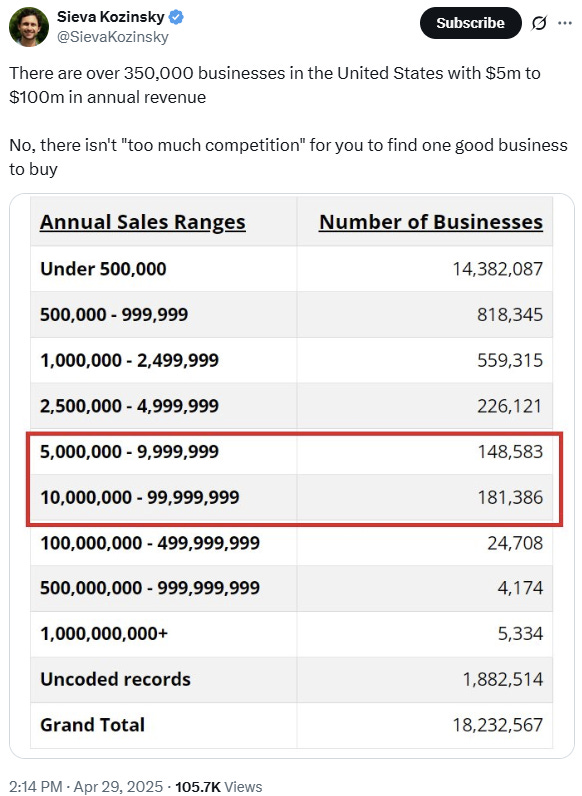

There’s a large opportunity set for business buyers…

Great thread for discovering new tools…

Pricing power should be part of your due diligence process…

🗓️ Events

M&A Launchpad Conference (May 3) - Houston, TX

INSEAD ETA Conference (May 10) - Fontainebleau, FR

Mittelstand Summit 2025 (May 20) - Berlin, Germany

Main Street Summit (Nov 4-6) - Columbia, MO

🎵 Listening: “Bad Dreams“ by Teddy Swims 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?