What I Learned Last Week 5.23.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - EMail Lead Gen, How SBA Lenders Evaluate Acquisitions, Business Owners Making $400k+

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Who Will Buy Your HVAC Business?

The article from Axial analyzes the growing interest in HVAC businesses from a range of buyers, driven by the sector’s recurring revenue, consistent demand, and consolidation potential.

Key insights include:

Interest in HVAC acquisitions is rising sharply, with a 140% increase in new HVAC-focused buyers from 2020 to 2023, and a projected 57% growth in 2025 alone.

The $1M–$5M EBITDA range is the most attractive to buyers, balancing maturity and broad appeal across buyer types.

Private equity firms favor companies with $3M–$10M EBITDA, aiming for established operations suitable for platforms or tuck-ins.

Independent Sponsors are the most active buyer type, with 27% of all HVAC deal intents, due to their flexibility and wide-ranging strategies.

Corporations, Holding Companies, and Individual Investors are more inclined toward sub-$1M EBITDA businesses, often for entry-level investments or bolt-ons.

— — — — — — — — — — — —

Key Takeaways from the 6th Student-Led ETA Conference at LBS

The 6th Student-Led ETA Conference at London Business School explored essential themes in the world of Entrepreneurship Through Acquisition (ETA), with a focus on funding models, market dynamics, tech integration, leadership, and operational strategies. Speakers provided practical insights for aspiring CEOs and searchers navigating acquisition and business growth.

Key insights include:

Traditional vs. Self-Funded Search: Traditional searchers gain investor trust early and carry institutional credibility, while self-funded searchers enjoy greater flexibility but face capital access challenges. Each model suits different entrepreneurial goals.

ETA in Emerging vs. Established Markets: Mature markets offer more investors and higher competition; emerging markets offer lower competition but require strong local investor support. Strategic alignment with regional acquirers can optimize exit opportunities.

Technology Use in ETA: Tech should support—not replace—human interactions, particularly in the search phase. Post-acquisition, gradual tech integration aligned with culture boosts efficiency. However, people and processes are the primary drivers of value creation.

Operational Excellence from the C-Suite: CEOs must deeply engage with operations, uphold culture by removing toxic influences, and continually develop their leadership and crisis management skills. Board alignment is crucial for strategic cohesion.

Becoming a Successful CEO: The first year should focus on learning and stabilizing. Key actions include gaining financial control, employee engagement, and early momentum through small wins. Long-term success depends on cash flow management, strategic planning, and disciplined use of leverage.

🧵 Online Highlights

I scroll, so you don’t have to.

Creative retention bonuses helped one buyer win a deal — others can copy the playbook…

Put rights are on the rise in ETA deals—smart buyers need a clear plan now for how they’ll fund investor exits in years 5–7…

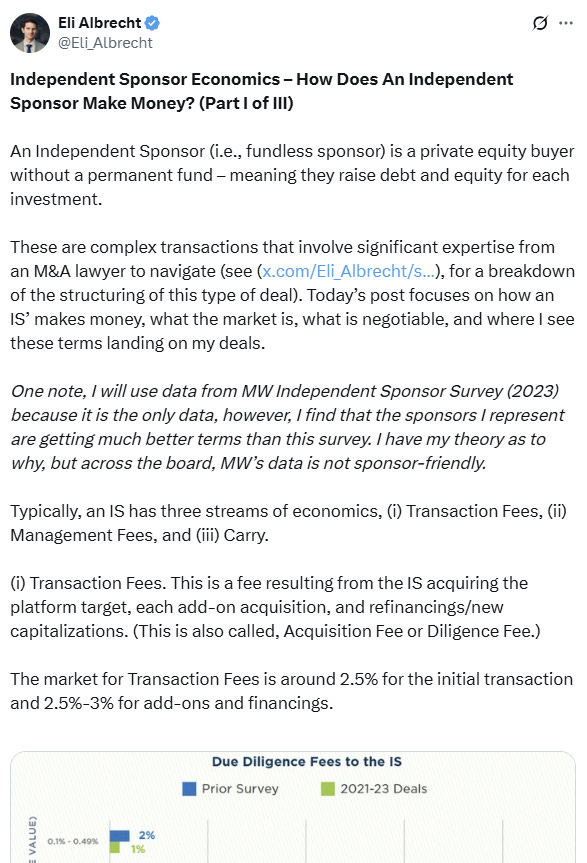

Independent sponsors earn through deal fees, management fees, and carry — but many are being pressured to roll their fees. Good discussion…

Here’s the other side of that argument…

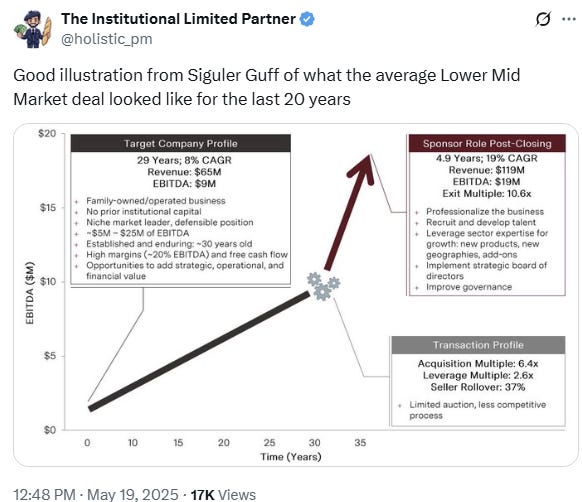

LMM economics…

How to properly integrate an acquisition…

Great resource to discover KPIs for many industries…

🤔 Other

E-Mail Lead Gen

The Reddit thread on r/LeadGeneration offers a range of cost-effective strategies and tools for generating targeted email leads without relying on expensive platforms like Apollo.io or ZoomInfo. Contributors share tips for scraping, enrichment, outsourcing, and using underrated tools to achieve high-volume lead generation efficiently. Discussion is very relevant for deal sourcing as well sales/marketing.

Key insights include:

Scraping Techniques: Google Maps, LinkedIn, Facebook, and business directories (via tools like Apify and LeadSwift) are popular sources. Scrapers can extract contact details and be enriched with LinkedIn or local business data.

Affordable Tools: Tools like Skrapp, D7 Lead Finder, Airscale, and Snov.io are commonly used to collect and verify emails. D7 offers high volume at low cost but often includes generic emails.

Manual + Outsourced Workflows: Many users start by manually scraping and validating leads, then train Upwork freelancers to scale the process affordably.

Freemium and Workarounds: Users leverage Apollo scrapers on Apify or seek discounted Apollo access through community contacts. Airscale is highlighted for bypassing export limitations and adding enrichment.

Email Quality vs. Volume: Several users emphasize balancing quantity with lead quality, recommending validation tools and cautioning against relying solely on generic email formats.

Creative Channels: Some explore direct Instagram DM automation and emphasize content-driven outreach for better engagement and response rates.

This discussion is a rich resource for budget-conscious lead generators seeking practical, community-tested workflows.

— — — — — — — — — — — —

How SBA Lenders Evaluate Acquisitions

In a Reddit post, an experienced SBA loan advisor (u/sbaloansHQ) shares key insights into how SBA lenders actually evaluate business acquisition deals. The thread is packed with practical advice and clarifies common misconceptions, especially for first-time buyers.

Key insights include:

Cash Flow Over Revenue: Lenders focus on strong cash flow that covers debt service after owner compensation—based on tax returns, not verbal claims or non-GAAP metrics.

Relevant Experience: Buyers need to demonstrate operational readiness or a plan to fill skill gaps. Simply being entrepreneurial isn't always enough without a clear transition strategy.

Transparent Deal Structure: Lenders require clarity on the financial structure, including down payment, seller financing, and working capital sources. Vague investor backing doesn't count unless it's documented.

Seller Involvement Is Crucial: Lack of seller training or transition support is a major red flag, especially in service-based or customer-centric businesses.

Credit Score Myths Debunked: SBA doesn't set a strict minimum credit score—lenders assess the full credit profile. Scores as low as 600 can be acceptable if the rest of the package is strong.

Passive Ownership Models: While SBA prefers active ownership, investor or strategic structures can work if the applicant demonstrates control and involvement in business decisions.

Pre-approval Strategy: Having a clear plan, documented financials, a strong operator (if not the buyer), and a thought-out post-acquisition roadmap enhances lender confidence and deal success.

This thread is an excellent primer for anyone navigating the SBA loan process to acquire a small business, offering actionable insights directly from an industry insider.

— — — — — — — — — — — —

Business Owners Making $400k+

This Reddit thread features a diverse range of small business owners discussing how they generate $400K or more annually, sharing their business types, operational models, and scaling strategies. It's a valuable glimpse into the practical realities and creative niches that drive high-performing small businesses.

Key insights include:

Service-Based Niches: Many successful businesses focus on specialized, recurring services—like kitchen exhaust cleaning, security/cleaning services, landscaping, and niche trades (plumbing, fire suppression, court reporting).

Product Sales & E-commerce: Owners of single-person software products, Amazon audio product sellers, and multi-platform e-commerce brands reported strong results from leveraging automation, marketplaces, and established product lines.

Franchises & Local Services: Franchise hair salons, party rental services, liquor stores, and boutique hotels stood out as high-revenue operations, often scaled with multiple locations or smart reinvestment.

Professional Services: Several users run highly profitable operations in law, accounting, medical billing, and private practice, benefiting from skill-based barriers to entry and consistent demand.

Manufacturing & Distribution: Some shared successes in cabinet making, CNC machinery import/sales, and custom promotional product manufacturing—demonstrating value in blending craftsmanship with B2B fulfillment.

Automation & Tech: One standout example was a fully automated gym run with zero employees, leveraging proprietary software and self-service systems to manage operations and revenue passively.

Overall, many emphasized the importance of niche selection, operational efficiency, long-term consistency, and reinvestment as key drivers of profitability.

🗓️ Events

iGlobal Independent Sponsors & Capital Providers (June 17) - Chicago, IL

Stanford Search Fund CEO Conference (Sept 3-4) - Stanford, CA

Southeast ETA Conference (Sept 5-6) - Charlottesville, VA

iGlobal Independent Sponsors Summit (Sept 29-30) - New York, NY

McGuire Woods Independent Sponsor Conference (Oct 14-15) - Dallas, TX

Main Street Summit (Nov 4-6) - Columbia, MO

M&A Source 2025 Fall Conference (Nov 9-12) - Phoenix, AZ

Booth-Kellogg ETA Conference (Nov 19) - Chicago, IL

iGlobal Independent Sponsors & Capital Providers (Dec 9) - New York, NY

🎵 Listening: “Already Home“ by Jay-Z, Kid Cudi 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?