What I Learned Last Week 5.24.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

PSA: I’m going to be traveling overseas with very limited availability from June 7th to June 22nd. During this time, this newsletter may take a brief pause. Thank you for your understanding.

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X

🤔 Other - Business Buyers Club

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Organic Growth vs. Acquisition - Which One is Best for Your Business?

The article from ExitWise examines the pros and cons of organic growth versus acquisition for business expansion. Organic growth focuses on using internal resources to grow steadily, while acquisition involves rapidly scaling by purchasing other companies.

Key insights include:

Organic Growth: Lower risk, more control, and sustainable but slower.

Acquisition: Rapid growth, access to new markets and technologies, but higher risk and cost.

Strategies: Combining both approaches can be effective, depending on business goals, resources, and market conditions.

— — — — — — — — — — — —

Dealmakers Get Real About AI, Big Data, and Advanced Technology

The "Sourcescrub AI Survey Guide 2024" examines how dealmakers use AI, big data, and advanced technology in their workflows. It highlights that while many believe generative AI (GenAI) is overhyped, a significant number of dealmakers use various tech tools to enhance efficiency and deal-sourcing processes. However, there's a disparity in tech adoption and effectiveness between organizations with sophisticated tech stacks and those with average or below-average capabilities.

Key insights include:

22% of dealmakers rate their tech usage as sophisticated.

Spreadsheets, Google Search, and CRM platforms are the most used tools.

AI is mainly used for rapid market analysis and personalized outreach.

Deal sourcing platforms are crucial for advanced tech adoption.

— — — — — — — — — — — —

Tips For Your First Home Service Acquisition

The article from John Wilson of Owned and Operated provides actionable tips for acquiring a home service business, emphasizing the benefits of buying over building. Key steps include understanding the financial health and due diligence of the target business, leveraging local networks for potential acquisitions, and planning the first 90 days post-acquisition to ensure a smooth transition and successful integration of technology, marketing, and operational strategies.

Key insights include:

Benefits of acquiring an existing business.

Importance of thorough due diligence.

Key considerations for the first 90 days post-acquisition.

— — — — — — — — — — — —

DealMAX 2024 Recap: The Buyer/Seller Balance of Power Shifts

The DealMAX 2024 recap highlights the shifting power dynamics between buyers and sellers in the M&A market. Key discussions included the resurgence of earnouts, the importance of aligning operating partners with deal teams, and the opportunities in distressed investing amid increasing bankruptcies. Panelists noted a trend towards more aggressive buyer terms and emphasized the critical role of legal protections and economic alignment in successful acquisitions.

Key insights include:

Buyers gaining leverage over sellers.

Earnouts becoming more common.

Alignment between operating partners and deal teams is crucial.

Opportunities in distressed investing.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

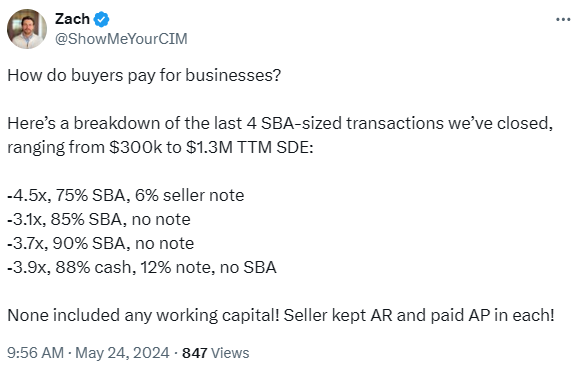

Good examples of deal terms…

Chris always tells it like it is. You get what you pay for. In life and in business…

It helps to understand the business seller’s point of view…

I love a good internet beef. For the past 3-years, every M&A service provider promoted the “Silver Tsunami” as your chance to acquire one of the millions of cash flowing business that baby boomers will be selling. The “Tsunami” never came. It’s marketing. That’s all…

DM Nico if this startup looks interesting to you…

🤔 Other

Business Buyers Club

A few days ago, I received an email from Website Closers introducing a new service aimed at first-time business buyers. For approximately $50 per month, subscribers receive access to a business buying course, a “Certified Business Buyer” badge, a community of fellow acquisition entrepreneurs, personalized broker servicing, priority access to deals, and more.

It’s unclear if this is a money grab or a service that’s actually helpful for first-time buyers. I suspect it’s a bit of both. You can check it out for yourself here.

I attempted to contact Website Closers for additional information, but, as is often the case, I have yet to receive a response.

🗓️ Events

Capital Camp (May 21-24) - Columbia, MO

Midwest Deal Summit (May 29-30) - Chicago, IL

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Nothing Is Ever Free In St. Tropez“ by Jimmy Sax, Michael Ghegan

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?