🧐 What I Learned Last Week 5.26.23

Curating the best M&A, SMB, and EtA-related content.

Hello Friends!

This issue of the newsletter is brought to you by Scott Oldford.

Want to see behind the scenes of building, scaling, buying, and selling online businesses?

Scott Oldford has helped over 200 Entrepreneurs scale 7+ figure businesses and is one of the top business advisors and mentors.

Scott just launched a newsletter dedicated to sharing his journey in managing his portfolio of online businesses.

It’s FREE to sign-up and you can join here.

📰 Articles

The End-Days of Proprietary Deal Sourcing?

Tim Ludwig & Justin Burris of Majority Search write the Letters of Intent newsletter. In this latest issue, they discuss various options for deal sourcing and how they have evolved. In theory, as more transactions are being done with the help of an intermediary, it may limit the effectiveness of proprietary deal sourcing. Not a whole lot of data to prove one way or another but it’s an interesting thought exercise.

— — — — — — — — — — — —

The (Ugly) Truth About The Franchise Industry

“What other industry can you build a billion-dollar brand in just 5 years (without raising venture capital), or become a billionaire, solely by following other people’s business ideas?

I can’t think of a single one besides franchising. The power of this business model is truly unmatched.”

The franchise industry has tremendous potential, demonstrated by successful examples like Crumbl Cookies and Greg Flynn's restaurant empire.

Major issues in the franchise industry include:

Lack of transparency: Franchisors often don't share financial performance data, making it hard for potential franchisees to evaluate investment opportunities

Difficulties in researching franchises: Potential franchisees must often speak to sales reps to access critical data, and the industry is compared to the pre-internet auto industry in terms of information accessibility

Issues with third-party information sources: Franchise directories provide only surface-level insights and often result in unwanted outreach from franchisors. Some franchise brokers may lead buyers to high-commission brands without considering the buyer's financial wellbeing

— — — — — — — — — — — —

What drives your business?

This is a topic I discuss with DueDilio clients all the time. Figure out what really drives the business and points of failure and focus your due diligence efforts on those areas.

The article encourages readers to understand the complex dynamics driving their businesses. It emphasizes the importance of industry structure, illustrating this concept with examples from the restaurant and mattress industries. The author highlights that business drivers can be largely outside of a business owner's control, as shown in a residential roof replacement contractor example.

🧵 Best of Twitter

This is a great, simple framework for evaluating a potential business acquisition…

Assessing the risks and opportunities in a business acquisition…

A great illustration of why you want to go big…

Things to consider when drafting an operating agreement…

Sometimes it’s good to wait before jumping into EtA…

I’ve seen this scenario before. Be careful…

I’ve started a series of threads on incorporating ChatGPT into your M&A process…

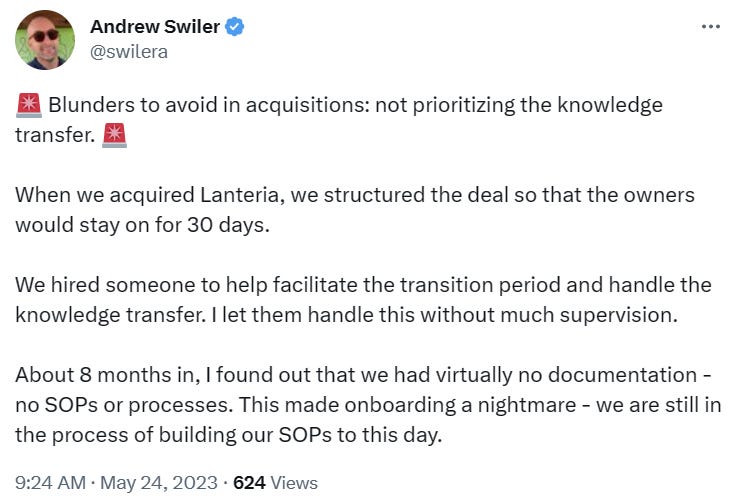

The integration phase of M&A should be discussed more often…

Business lessons from the founder of Tiny. Great thread…

🤔 Thoughts, Events, Other

Due Diligence 101

I've been invited as a guest for a live session hosted by Pipeline Prep, where we'll discuss Due Diligence 101: Key Focus Areas & Costs in front of a live audience.

As founder of DueDilio, I’ve helped hundreds of business buyers with their due diligence projects. In this webinar, I’m going to be sharing some observations and providing some guidance around key focus areas and costs.

The live session will take place on Tuesday, June 6, 2023, at 12pm PT/3pm ET.

Link to sign-up 👉 https://lu.ma/ClosetheDeal

⚒️ Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

DueDilio - #1 marketplace to hire highly vetted M&A due diligence service providers. Your source for finance, legal, tech, and other key areas of due diligence. Submit your project, review proposals, and hire.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel. Local Boston company and I consider the founder (Adam Ray) a friend.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Import Dojo - a newsletter that sends eCommerce and Amazon FBA businesses for sale to your email inbox. They send deals each Wednesday at 9:00 AM CST.

Scott Oldford - If you're interested in gaining insight into the process of building, scaling, acquiring, and selling online businesses, Scott Oldford can help.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it or subscribe?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.