What I Learned Last Week 5.31.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

PSA: I will be traveling overseas with limited availability from June 7th to June 22nd. During this period, the newsletter may take a brief pause. Thank you for your understanding.

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - Secret Discount, RollUpEurope

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

AI unlocks the small businesses legacy SMB tech can't acquire

Not directly related to M&A but as an entrepreneur, I thought this was a good read.

The article discusses how AI-first "do it for me" software is poised to revolutionize the SMB sector, which has historically faced challenges with technology adoption due to difficult unit economics and retention issues. Traditional SMB tech often fails to deliver sufficient ROI, leading to low market penetration. AI, however, offers a solution by providing high ROI at a lower cost, making advanced growth tools accessible and effective for SMBs.

Key insights include:

Market Challenges: Traditional SMB tech has struggled with low adoption rates and poor retention due to insufficient ROI and high costs of goods sold (COGS).

AI Advantage: AI-driven tools can automate complex tasks at lower costs, offering high-value services such as website building and call answering without the high expenses associated with human labor.

Do-It-For-Me Concept: The "do it for me" approach allows SMBs to benefit from advanced tech without the need for deep operational involvement, driving higher adoption and satisfaction.

Strategic Framework: Successful AI solutions should focus on vertical-specific tools and brands to become comprehensive, end-to-end solutions for SMBs, leveraging data to enhance business stickiness and defensibility.

Industry Potential: Sectors like healthcare, hospitality, legal, home services, and aesthetic services are particularly well-suited for AI-driven "do it for me" solutions due to their operational complexities and need for efficient, cost-effective technology.

— — — — — — — — — — — —

The Impact of the Health Over Wealth Act on Mergers and Acquisitions

The proposed Health Over Wealth Act significantly impacts M&A in the sub $10 million market. This legislation aims to enhance healthcare access and affordability, affecting valuations, due diligence, market activity, and risk management for small businesses.

Key insights include:

Valuation Dynamics: Potential increase in interest for companies improving healthcare efficiency.

Due Diligence: Heightened scrutiny of healthcare-related liabilities.

Market Activity: Stimulated demand for healthcare products/services.

Risk Management: Reassessment of strategies to adapt to new regulations.

Opportunities: Innovation and growth for businesses addressing healthcare affordability.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

Home Equity Line of Credit (HELOC) is a popular strategy to protect your assets. Choosing the right provider is becoming harder…

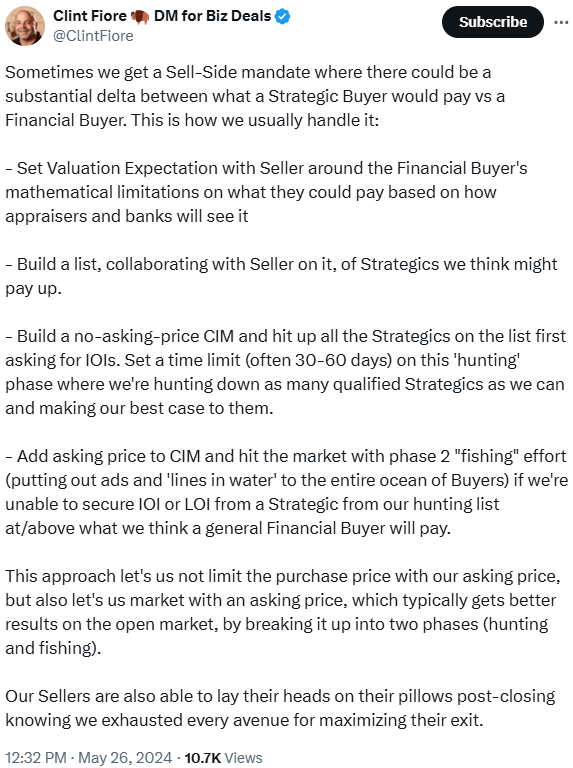

Prime example of how a good business broker works for their client…

There’s no reward without risk…

I love seeing all the business-buying influencers shift their positions. Great thread from an OG…

First, learn business skills and then acquire a business. Seems like many are doing it the other way around…

Insightful discussion…

🤔 Other

Secret Discount

Secret is a marketplace offering discounts on commonly used software like HubSpot, Airtable, QuickBooks, and many more. I'm a big fan of their platform and have personally saved a lot of money using it. I just received an email with a discount code for 50% off an annual subscription this weekend only. Use code: HALFOFF50.

— — — — — — — — — — — —

RollUpEurope

This morning, I had the opportunity to connect with one of the founders of RollUpEurope. They are building the largest community for serial acquirers with a focus on tech. Whether you're involved in search funds, permanent HoldCos, bootstrapped rollups, conglomerates, or PE-backed platforms, RollUpEurope welcomes you.

If you're based in Europe or interested in the ecosystem, I highly recommend joining this newsletter and community.

🗓️ Events

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Push It“ by Rick Ross

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?