What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter

Hello Friends!

This issue of What I Learned Last Week is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

📰 Articles

Axial published an inside look at M&A fees for 2022.

Key highlights for this year’s report:

Most firms said they kept their M&A fee levels the same in 2022 as in 2021 for deals of similar size and complexity.

More than half of the advisors said their revenue from M&A fees will be higher in 2022 than in 2021.

Most firms said they are about as profitable in 2022 as in 2021. Of the rest, more said profitability increased than said it declined.

The number of firms that don’t charge a retainer or work fee in addition to a success fee increased to 19%.

Three-quarters of firms said there was no change in the pressure to cut fees in 2022. Only 12% of firms said the pressure increased.

— — — — — —

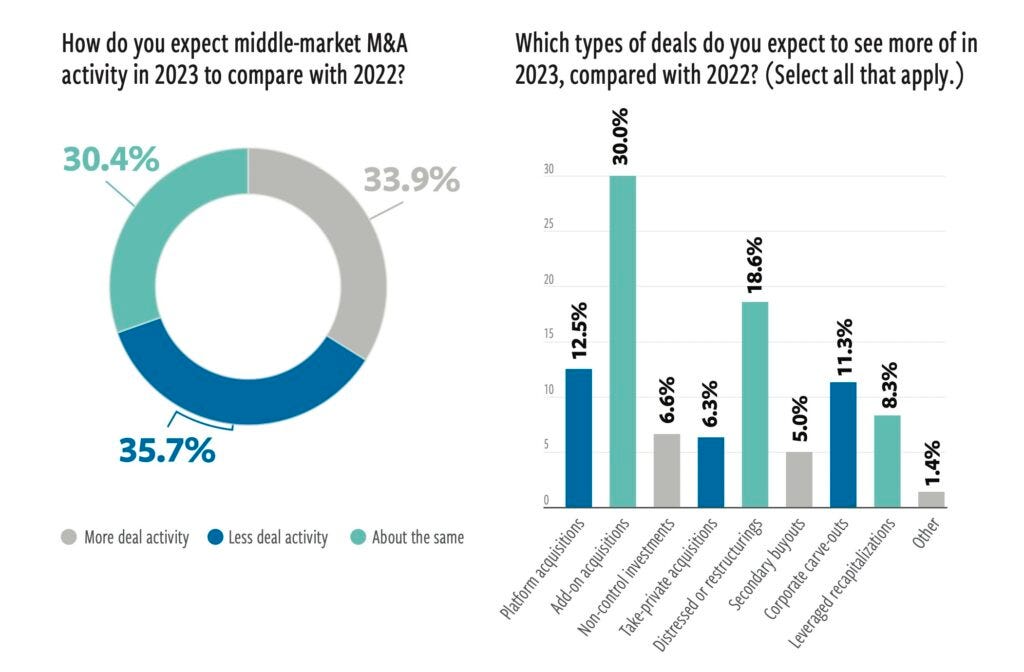

Middle Market Growth highlights a survey of middle market private equity firms to gauge the pulse of M&A activity for 2023.

With a Recession Looming, PE Angles for Opportunities in 2023

— — — — — —

Marketplace Pulse writes about the strength of Amazon e-commerce M&A despite the struggles of aggregators.

Amazon seller acquisitions declined only slightly in 2022 despite slow e-commerce growth and rising interest rates. Seller valuations have decreased, but more buyers that don’t call themselves aggregators allowed strong businesses to stay in demand.

According to conversations with investment bankers, brokers, and aggregators, the number of acquisitions in 2022 was smaller than in 2021 by 10-20%.

Many of those acquisitions were at valuations lower than in 2021. Businesses valued at upfront multiples 6x and above (excluding inventory) in 2021 were trading at 4-5x by the end of 2022. Yet those previously valued at 4-5x were relatively unchanged, selling at 3.5-4.5x. However, businesses in the 2-3x range in 2021 this year mainly attracted buyers focused on distressed assets. After the range of multiples widening for most of 2021, it has since narrowed.

Amazon Seller M&A Market Active Despite Aggregator Struggles

— — — — — —

Mineola Search Partners published a lengthy blog post on the five top theses when acquiring a SaaS business.

The purpose of this blog post is to present and evaluate 5 different approaches that buyers might consider in their pursuit of a software business. Though this list of approaches is by no means exhaustive, it does capture those that I tend to see most frequently. What I hope you’ll take from reading this post is that no single approach is perfect, and that each set of benefits inherent to each investment thesis comes at some sort of a cost.

Evaluating 5 Very Different Approaches to Acquiring a Software Company

🧵 Twitter

One of the best in the M&A game walks you through maximizing your chance of success…

Good thread for those interested in investing in self-funded searchers…

Great discussion on the pulse of the economy and what people are seeing…

Due diligence questions to ask…

How to think about customer concentration risk from business buyers and lenders perspectives…

Know how to communicate and sell your capital raise…

🤔 Thoughts, Events, Other

Podcast

I recently had the pleasure of sitting down with attorney David Sterrett on his podcast. Take a list below.

Roman Beylin, CEO of DueDilio talked to us about his innovative due diligence marketplace for M&A deals. You can listen here: https://bit.ly/3V3e77X

— — — — — —

ChatGPT

There’s been a lot of hype recently around ChatGPT. If you’re not familiar, it’s basically an online chatbot that utilizes the latest AI model to answer questions. You can learn more about it on Wikipedia or by simply visiting the website.

I had a chance to play around with it and it’s impressive. I won’t pontificate whether this is some sort of monumental breakthrough. I just want to encourage you to sign-up (it’s free) and give it a try.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

ProjectionHub - Access to 50+ CPA-developed financial projection templates. 25% discount using code “duedilio” at checkout.

Logology - Best automated logo & brand identity tool I’ve come across.

OpenPhone - The best VoIP phone solution that I have found. I use this for DueDilio. You get a $20 credit if you sign-up.

Eloquens - Knowledge marketplace. I’ve purchased a few templates from them.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.