What I Learned Last Week 6.20.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Business Services Report 2025

The report from Middle Market Growth offers a comprehensive overview of M&A trends and investment opportunities in the business services sector, with a strong focus on IT services, cybersecurity, research and data analytics, and marketing. It emphasizes how these areas are increasingly seen as stable, essential, and ripe for innovation, particularly through artificial intelligence and vertical specialization. Despite macroeconomic uncertainty, cautious optimism prevails for continued growth in 2025.

Key insights include:

Resilience of Business Services: The sector is attracting investment due to minimal tariff exposure, growing reliance on outsourcing, and AI-driven efficiencies.

IT & Cybersecurity: These services are now viewed as essential, not discretionary, with high recurring revenue and customer retention. Investors favor firms with niche vertical expertise and sticky customer bases.

Research & Data Analytics: Driven by economic uncertainty, this segment is seeing demand for sector-specific insights. AI is enhancing efficiency, but human expertise remains critical.

Marketing Services: As ad tech and data analytics become ubiquitous, the need for balancing digital tools with human connection is essential. M&A is up, especially in digital video, retail media, and programmatic ad tech.

AI Adoption: While currently low, AI adoption is expected to rise, offering competitive advantages in operational efficiency, deal sourcing, and portfolio management.

Private Equity Trends: There's a shift toward hybrid models blending VC speed with PE discipline, and retail investors are expected to play a larger role in capital formation.

Valuations and Deal Flow: Companies with strong growth, vertical focus, and effective use of tech command premium valuations, especially in the $100M-$250M TEV bracket.

Challenges: Tariffs, economic volatility, and talent shortages (particularly in cybersecurity) remain concerns, but long-term sector fundamentals remain strong.

— — — — — — — — — — — —

Is Home Services Still a Good Bet? A Veteran Operator’s Take on a Saturated Market

The podcast from Mineola Search Partners features Collin Hathaway, founder of Skylight Capital, as he shares his journey in private equity and operating companies in the home services industry.

Key insights include:

The home services industry was less competitive in 2008; today it's saturated with private equity interest and consolidation plays.

He stresses growing businesses “the right way” over financial engineering or rapid roll-ups.

He values simplicity in deal structures and company operations, highlighting the importance of decentralized models.

Raising capital is an art of confidence, honesty, and clarity; he champions leading with bad news to build investor trust.

— — — — — — — — — — — —

U.S. Bank Small Business Survey

The 2025 U.S. Bank Small Business Survey reveals a generational shift in business ownership, with 36% of Gen Z and Millennial owners planning to acquire businesses from retiring owners, while many older owners remain unprepared—only 54% have succession plans. Despite economic and operational pressures, optimism persists among younger leaders. Meanwhile, small businesses are increasingly adopting generative AI and digital tools, though many find the tech landscape overwhelming.

Key insights include:

A succession gap exists: 62% of older owners find planning overwhelming, and over half lack the resources to do it effectively.

Economic stress remains high—98% are concerned about the broader economy, while inflation and funding issues are also pressing.

Nearly 6 in 10 businesses are using or plan to adopt Gen AI, mainly for content, data, and marketing, with low associated costs.

63% feel overwhelmed by the number of digital tools, and 82% want to consolidate them.

Despite challenges, 80% of owners would start their business again, driven by autonomy, passion, and legacy.

Younger owners are more optimistic about the economy (74% vs. 52% of older generations) but often entered entrepreneurship due to job scarcity.

— — — — — — — — — — — —

Brad Jacobs’ Quadrant: How to Evaluate Big, Messy, Worthwhile Bets

This article reframes traditional Entrepreneurship Through Acquisition (ETA) strategies by drawing from Brad Jacobs' investment philosophy. Instead of favoring clean, low-risk businesses, Jacobs seeks large, messy companies with solvable operational problems—those that offer scale and transformation potential. His framework, “The Jacobs Quadrant,” plots businesses by size and complexity, encouraging entrepreneurs to evaluate opportunities based on their potential for scalable impact, not just simplicity and safety.

Key insights include:

Traditional ETA favors small, simple businesses that are easy to diligence and manage, but often have limited growth potential.

Jacobs targets the "BBQ Brisket" quadrant: large, operationally messy businesses with fixable problems and high upside.

He views operational mess not as a red flag, but as a source of mispricing and value, if it’s addressable with process, people, or systems.

Entrepreneurs must distinguish between cosmetic vs. structural issues to underwrite “solvable complexity.”

This approach requires different mindsets and capabilities—especially a willingness to embrace ambiguity and complexity for higher returns.

The model challenges ETA operators to ask: are you optimizing for safety and continuity, or for transformation and scale?

🧵 Online Highlights

I scroll, so you don’t have to.

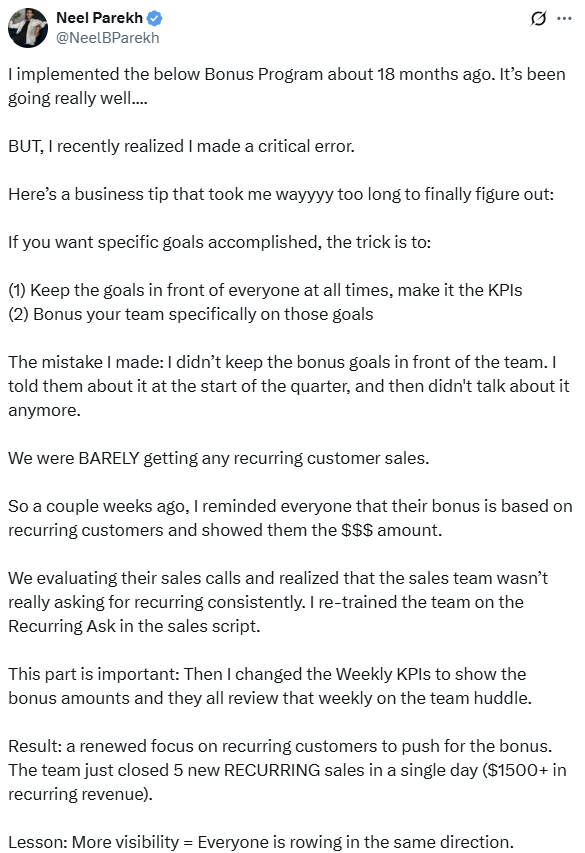

Want better results? Tie bonuses to specific goals and keep them front and center — visibility drives accountability…

Bought a $1.1M business with slim profits — turned it around by fixing bloated ops, aligning incentives, and replacing hustle with systems…

Most franchises are traps—spot these five red flags before you buy, or risk paying royalties for broken promises…

A couple of intriguing acquisition opportunities…

Looking for a solid business broker? Here’s a trusted, nationwide list from someone who’s been in the trenches…

New SBA rule: if your GM isn’t a U.S. citizen or green card holder, your business may be ineligible for a loan — fire them or reassign and wait 6 months…

This is how you model a roll-up…

🗓️ Events

Stanford Search Fund CEO Conference (Sept 3-4) - Stanford, CA

Southeast ETA Conference (Sept 5-6) - Charlottesville, VA

iGlobal Independent Sponsors Summit (Sept 29-30) - New York, NY

McGuire Woods Independent Sponsor Conference (Oct 14-15) - Dallas, TX

Main Street Summit (Nov 4-6) - Columbia, MO

M&A Source 2025 Fall Conference (Nov 9-12) - Phoenix, AZ

Booth-Kellogg ETA Conference (Nov 19) - Chicago, IL

iGlobal Independent Sponsors & Capital Providers (Dec 9) - New York, NY

🎵 Listening: “Sweet Memories“ by CID, Kaskade, Black V Neck 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?