🧐What I Learned Last Week 6.23.23

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

This issue of the newsletter is brought to you by Scott Oldford.

Want to see behind the scenes of building, scaling, buying, and selling online businesses?

Scott Oldford has helped over 200 Entrepreneurs scale 7+ figure businesses and is one of the top business advisors and mentors.

Scott just launched a newsletter dedicated to sharing his journey in managing his portfolio of online businesses.

It’s FREE to sign-up and you can join here.

📰 Articles

Relationships, Discipline, and Consistency: An Entrepreneur’s Guide to Strategic Acquisitions

Ryan Goral runs G-Spire Group which helps entrepreneurs looking to grow through acquisitions. Their latest blog post highlights how Mike Loftus built a $5 million landscaping business, Connor's Landscape, through strategic acquisitions. Loftus prioritized long-term sustainability, small acquisitions aligning with his goals, and a healthy employee base. He emphasized building trusting relationships with sellers and advisors and retained 90% of his employees over five acquisitions. Loftus' strategy, along with his growth mindset and risk tolerance, contributed to his success.

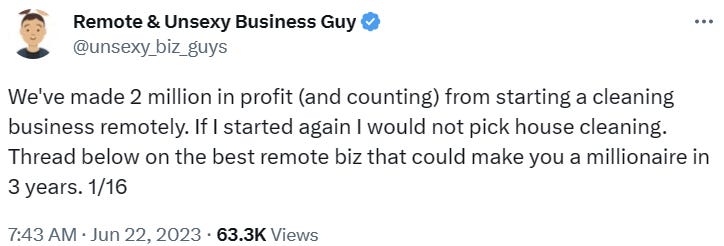

🧵 Best of Twitter

Focusing on stale, old, weak, and simple businesses…

Great discussion on the independent sponsor model…

Opportunities in pressure washing business…

AR does not equal cash flow. Ask sellers these questions…

The awful downside of a PG…

Reminder to include a margin of safety in your deal…

A bit of Friday fun - a wild motorcycle race POV video…

🤔 Thoughts, Events, Other

55% Off Buy Then Build

This weekend you can save 55% on Buy Then Build Masterclass Bundle using the code: BTBVACAY55. Good deal for those looking to get into the M&A game. Not an affiliate link.

— — — — — — — — — — — — — — — — — —

Conferences & Meetups

The Business Acquisition Virtual Summit (July 26-28) - Online

Southeast ETA Conference (Sept 8-9) - Duke University in Durham, NC.

HoldCo Conference (Sept 18-20) - Cleveland, Ohio.

Austin SMB Meetup (Sept 28) - Austin, TX

Capital Camp (May 21-24) - Columbia, MO

⚒️ Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

DueDilio - #1 marketplace to hire highly vetted M&A due diligence service providers. Your source for finance, legal, tech, and other key areas of due diligence. Submit your project, review proposals, and hire.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market software businesses ($500k - $15m revenue) considering exits. All deals are sourced by the Rejigg team, ~5 added per week.

Scott Oldford - If you're interested in gaining insight into the process of building, scaling, acquiring, and selling online businesses, Scott Oldford can help.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

🚀 Interested in partnering or advertising with us? Get in touch here.

How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it or subscribe?

Let’s connect: LinkedIn, Twitter