What I Learned Last Week 6.6.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

Quick reminder that I’m constantly updating the Deal Sourcing Guide. Make sure to revisit it from time to time.

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - Dark Side of Acquisitions

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

Buying a Licensed Trades Business Under the New SOP

The guide from SMBootcamp outlines how the new SBA Standard Operating Procedures (SOP) impact the purchase of licensed trades businesses (like HVAC, electrical, plumbing) when the buyer does not hold the required state license. While such deals are still possible, they have become more complex due to new restrictions on seller involvement post-sale.

Key insights include:

Sellers can no longer stay as W-2 employees post-sale unless they retain equity, but this triggers a personal guarantee requirement many sellers reject.

Success of such deals now hinges on state-specific licensing rules—especially whether license holders can be 1099 consultants.

States fall into four categories:

Option A: License-holder must be an equity owner.

Option B: License-holder must be a W-2 employee.

Option C: Either W-2 or equity owner is acceptable.

Option D: Allows 1099 license-holder (simplest for compliance).

Buyers must check their state’s rules early and plan accordingly:

Use the seller as a 1099 for up to 12 months if allowed.

Secure a licensed internal employee, external hire, or equity partner if 1099 is not allowed.

Prepare a plan for acquiring the license themselves if needed.

Lenders will scrutinize licensing plans, financial projections (including extra payroll/licensing costs), and require clear documentation and backup plans.

Deals are still financeable if there's a credible path to maintaining licensure and solid debt service coverage.

— — — — — — — — — — — —

How to Value a Landscape Business

This guide from DueDilio provides an in-depth overview of how to value a landscaping business, either for sale or growth. It emphasizes the importance of factors like recurring revenue, customer retention, financial clarity, and operational independence in determining business value. Valuation methods range from revenue and EBITDA multiples to asset-based and discounted cash flow approaches. Strategic preparation and improvement in financial and operational systems can significantly enhance business worth.

Key insights include:

Valuation typically ranges from 0.5x to 3x annual revenue, or 2x to 5x EBITDA, depending on business size and quality.

Recurring revenue from contracts, especially commercial ones, adds substantial value due to predictability and lower risk.

Strong customer retention, a diverse client base, and geographic concentration are all positive valuation drivers.

Clean financials, consistent profitability, and well-documented operations make a business more attractive to buyers.

Challenges include seasonality, labor dependency, and equipment depreciation, which can reduce valuation if not managed.

Boosting value involves building recurring income, improving financial management, diversifying services, and reducing owner dependency.

Professional valuations and due diligence preparation are crucial for successful sales or attracting investors.

— — — — — — — — — — — —

Leaning Into the Turbulence: Private Equity Midyear Report 2025

The Bain & Co 2025 Mid-Year Private Equity Report explores the impact of economic volatility, particularly tariff disruptions, on private equity (PE) activity. The first quarter showed strong momentum with high-value deals and exits, but April's tariff announcements caused significant slowdowns in both dealmaking and IPOs. PE firms face mounting pressure to improve liquidity and accelerate exits, while fundraising remains highly challenging. Nonetheless, firms can still find opportunity by focusing on operational improvement and proactive strategies.

Key insights include:

Tariff uncertainty caused a sharp drop in deal volume and IPO activity in Q2 2025 after a strong Q1.

Liquidity constraints are intensifying; distributed-to-paid-in capital ratios are below historical benchmarks, pressuring GPs to execute full exits rather than partial ones.

Fundraising struggles persist, with the first quarter lacking any $5B+ buyout fund closings for the first time in a decade.

LPs are shifting allocations toward private credit and infrastructure; interest in US PE is cooling among some international investors.

Proactive dealmaking, operational value creation, and readiness to exit at realistic valuations are critical amid today’s uncertainty.

Generative AI offers new opportunities for efficiency gains, and secondaries provide limited but growing liquidity relief.

Despite volatility, firms that adapt quickly and act decisively could still thrive in the evolving PE landscape.

— — — — — — — — — — — —

What Is Your Why for Launching a Search Fund?

This essay by Jeff Stevens and A.J. Wasserstein explores the foundational question for aspiring search fund entrepreneurs: "What is your why?" The piece emphasizes that launching a search fund is an intensely demanding journey that should be driven by a deep, authentic motivation. It categorizes four primary motivations—status, lifestyle, fulfillment, and wealth—and explains how each affects the structure, strategy, and outcomes of the entrepreneurship through acquisition (ETA) experience.

Key insights include:

Understanding your "why" is essential for aligning your search fund strategy (traditional, self-funded, or accelerator) and business acquisition approach (organic growth, programmatic acquisitions, or holding company).

Status-driven searchers often seek validation, prestige, or recognition. While popular among MBA cohorts, this motive can lead to misaligned expectations and early exits when reality disappoints.

Lifestyle seekers value autonomy, flexibility, and community. They may favor self-funded searches and single-company acquisitions but must recognize that operating a small business can still be highly demanding.

Fulfillment-motivated entrepreneurs are purpose-driven, passionate about operating and improving a business. This is seen as the “purest” why and tends to result in longer holding periods and deeper satisfaction.

Wealth seekers are incentivized by financial returns and may gravitate toward aggressive strategies like programmatic acquisitions. This can yield high rewards but also increase risk and short-termism.

The authors caution that ETA is not an easy path and should not be a fallback or fashionable trend. It requires honest self-reflection and clear articulation of one’s motivations before embarking on the journey.

🧵 Online Highlights

I scroll, so you don’t have to.

M&A deal volume just hit a 20-year low—rising interest rates and economic uncertainty are likely to blame…

Think that “easy fix” is low-hanging fruit? It’s probably harder than you think — and there’s usually a good reason the seller hasn’t picked it…

Confusing SDE with EBITDA? Don’t — one assumes you’re the operator, the other assumes you’re hiring one…

Want to understand how private equity really makes money? Ardian’s new breakdown of LBOs and value creation is a must-read…

From solo hustle to 100% YoY growth — the playbook: buy small, hire smart, know your numbers, and build community.

If your SBA loan term outlasts your lease, you’ve got a problem — match the lease to the loan or secure landlord protections…

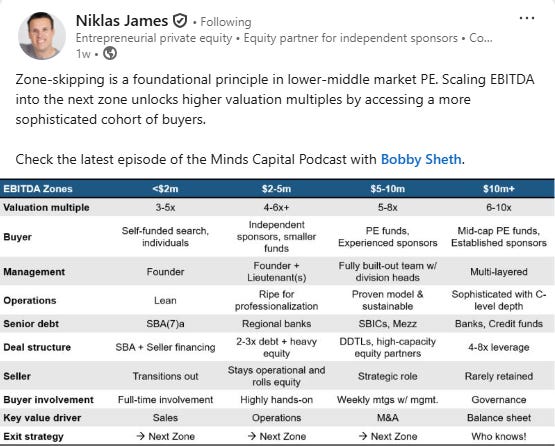

Each EBITDA zone comes with its own class of buyers and valuation dynamics…

Private equity is shifting — deal counts are down, returns are falling, and LPs are still doubling down despite a tougher market, per McKinsey’s latest 92-page deep dive…

🤔 Other

The Dark Side of Buying a Business

This Reddit thread shares a cautionary tale about the less glamorous side of buying a small business, emphasizing how crucial it is to go beyond the surface during due diligence. A buyer of an auto repair business discovered post-acquisition that a significant portion of the shop’s income relied on the seller's personal labor and long-standing community ties — details not fully disclosed before the sale. Though the buyer had other income sources and is managing, the acquisition fell short of expectations.

Key insights include:

Due diligence must go beyond financials—buyers should observe daily operations and understand who really drives revenue.

Seller involvement may be understated—“hands-off” may not mean what it appears, especially in relationship-heavy businesses.

Local relationships are invaluable but non-transferable—you can't buy trust or decades of community ties.

Buyer fatigue can impair judgment—after a long search, buyers may rush into deals without full diligence.

Cultural fit and operational insight matter—beyond numbers, understanding business culture and employee dynamics is critical.

This story is a strong reminder: numbers may close the deal, but people and processes determine long-term success.

🗓️ Events

iGlobal Independent Sponsors & Capital Providers (June 17) - Chicago, IL

Operating Partners Forum (June 25-27) - Napa, CA

Stanford Search Fund CEO Conference (Sept 3-4) - Stanford, CA

Southeast ETA Conference (Sept 5-6) - Charlottesville, VA

iGlobal Independent Sponsors Summit (Sept 29-30) - New York, NY

McGuire Woods Independent Sponsor Conference (Oct 14-15) - Dallas, TX

Main Street Summit (Nov 4-6) - Columbia, MO

M&A Source 2025 Fall Conference (Nov 9-12) - Phoenix, AZ

Booth-Kellogg ETA Conference (Nov 19) - Chicago, IL

iGlobal Independent Sponsors & Capital Providers (Dec 9) - New York, NY

🎵 Listening: “Heartbeat“ by Claptone, Nathan Nicholson 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?