What I Learned Last Week 6.7.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

PSA: I will be traveling overseas with limited availability starting today and returning June 22nd. During this period, the newsletter may take a brief pause. Thank you for your understanding.

In the meantime, I’d like to invite you to visit the updated Knowledge Center on the DueDilio website. It is redesigned and loaded with new articles, checklists, and free templates.

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

How to F*ck Up Due Diligence (a true story)

The article from Chris Munn recounts his flawed due diligence process when acquiring a small business. Despite his financial expertise, he overlooked operational aspects, leading to significant issues post-acquisition. Key lessons emphasize scrutinizing "yellow flags," acknowledging information asymmetry, and understanding that sellers often omit or obscure details.

Key insights include:

The importance of investigating unclear answers from sellers.

Recognizing the inherent information advantage sellers possess.

Understanding that minor discrepancies in due diligence are common.

Learning to balance skepticism with practical decision-making.

— — — — — — — — — — — —

Navigating the SBA 7(a) Maze (Updated)

The article offers a detailed guide on navigating the SBA 7(a) loan process for acquiring businesses, emphasizing the importance of persistence and thoroughness. It covers initial outreach, lender selection, and the various steps leading to bank commitment papers, providing practical insights and personal experiences.

Key insights include:

Outreach Strategy: Contact multiple lenders early in the search process; Live Oak Bank is recommended for its proactive support.

PLP vs. GP Lenders: Preferred Lender Program (PLP) lenders streamline the process, avoiding the need for SBA sign-off, which saves time and reduces deal risk.

Lender Selection: Use national search fund lenders, SBA Lender Match, regional SBA offices, and loan brokers to find suitable PLP lenders.

Loan Steps: The process includes outreach, initial discussions, business-related diligence requests, non-binding term sheets, selecting a term sheet, process-related diligence requests, and finally binding commitment papers.

Diligence and Paperwork: Expect extensive paperwork and be prepared to address issues like business appraisals, equity injection verification, and seller notes.

Closing Conditions: Includes life insurance, business insurance, licenses, equity verification, deal document review, and landlord consent agreements.

Final Note: Despite the complexity, the SBA 7(a) program is a valuable resource for self-funded searchers to secure significant financing with limited personal assets and experience.

— — — — — — — — — — — —

Outbound Email Tools for Proprietary Search

The article discusses tools for executing effective outbound email campaigns in proprietary business acquisition searches. It highlights the benefits and challenges of proprietary searches and recommends several email tools for streamlining outreach, including HubSpot, Outreach.io, Reply.io, GMass, Lemlist, Quickmail.io, Smartlead, Snov.io, and Instinctively.ai. Each tool's features, pros, cons, and ideal use cases are outlined to help users select the best fit for their needs.

Key insights include:

Benefits: Access to exclusive opportunities, less competition, better deal terms.

Challenges: Time-consuming, lower response rates, higher costs.

Tool Features: Email sequences, A/B testing, analytics.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

Maybe some similarities here with the failure of Amazon aggregators…

Curious about SBA loan eligibility and what makes a deal attractive to lenders? Bruce shares critical insights and questions to consider before submitting your LOI…

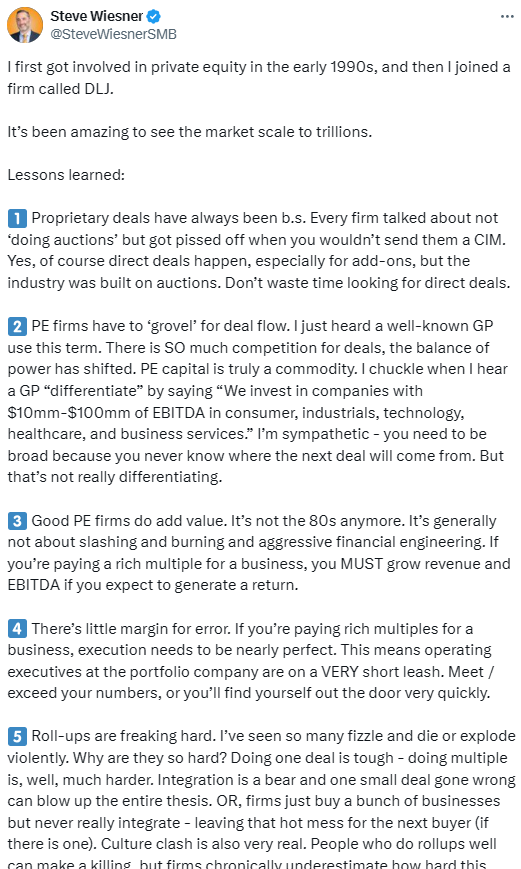

Candid insights from decades in PE, debunking myths and highlighting the realities of deal sourcing, competition, and the impact of debt and interest rates…

Great tips on dealing with an unprepared seller…

A good old-fashioned mailer should be part of everyone’s deal-sourcing strategy…

A lot of debate this week on SMBTwit about the necessity of a QofE. Here are the two most helpful threads…

Not a lot of details yet on this new SBA initiative but something to keep an eye on…

At DueDilio, we’ve received a lot of requests for attorneys familiar with F-reorgs. Something to consider…

Submitting an LOI? Bruce advises: request a year-end balance sheet, calculate working capital, and understand the cash conversion cycle. Set expectations early to prevent deal breakdowns over working capital…

🗓️ Events

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Million Dollar Baby“ by Tommy Richman 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($1M - $10M of revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7 to 10 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?