🧐 What I Learned Last Week

A round up of the best content related to M&A, SMB, EtA for week ending Feb 2.

Hello Friends!

This issue of What I Learned Last Week is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

📰 SMB/EtA Articles

The Key Ingredients of a Successful Rollup

Atlas View Equity jumps on the rollup bandwagon and published a great article explaining the strategy, why so many rollups fail, how to position for success, and more.

A rollup is an inorganic growth strategy where a company acquires many small and or local businesses within a single vertical.

The acquired businesses are merged into a single brand and several functions are centralized. The end result, if successful, is a single large national (or global) enterprise with:

Professional management

Unified strategy

Efficient cost structure

Better offering for customers

Rollups have been around for decades, and just about every single industry has either been rolled up or attempted to be rolled up. Industries include dental clinics, car washes, pest control companies, IT services, funeral homes, HVAC services, and many more.

— — — — — —

So far at 7 months...

Jordan Novgrod acquired his first business 7-months ago. DueDilio helped him with the diligence. In his latest blog post, he highlights the ups and downs from the first 7-months of running the business.

This particular point resonated with me personally…

Having trouble working on the business instead of in the business is a real problem that I knew I would have to confront, but it’s harder than I anticipated

— — — — — —

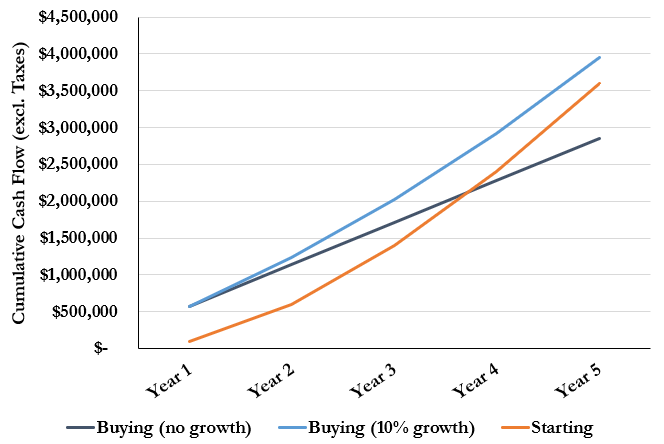

Buying vs Starting a Business

Buy Small Sell High newsletter highlights the decision that all aspiring business owners have to make - do you start a business or buy one?

The buying vs starting decision depends mostly on personal preferences. But for folks like me to whom no idea was ever good enough and the years of uncertainty whether your business model really works or not were an issue I wasn’t going to get past, buying a proven, successful model gave me a chance to swing for the fences, in a safer way.

🧵 Best of Twitter

How to grow a business post acquisition…

Creative ways to increase your deal flow…

Love this post giving an example of how to go from EBITDA to SDE…

For those looking at Amazon businesses…

I firmly believe that a W2 job is the right choice for a vast majority of people…

Just a great post…

A great follow-along…

🤔 Thoughts, Events, Other

Virtual Conference

Buy And Sell A Business is organizing a free virtual conference with some great speakers. Check out the details below…

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel. Local Boston company and I consider the founder (Adam Ray) a friend.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Import Dojo - a newsletter that sends eCommerce and Amazon FBA businesses for sale to your email inbox. They send deals each Wednesday at 9:00 AM CST.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it or subscribe?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.