What I Learned Last Week 7.11.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🤔 Other - Competing Against PE

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

How to Value an E-Commerce Business

This comprehensive guide from DueDilio outlines how to accurately value an e-commerce business, whether for sale, investment, or strategic planning. It emphasizes using financial metrics like SDE, EBITDA, and revenue multiples while also considering qualitative factors such as brand strength and customer metrics. The article breaks down common valuation methods, factors influencing multiples, advanced techniques, and actionable steps for improving a business's value before a sale.

Key insights include:

E-commerce businesses are valued using SDE (2.0x–4.0x), EBITDA (3.0x–10x), or revenue multiples (0.3x–0.5x), depending on size and growth stage.

Key value drivers include financial performance, customer lifetime value, operational efficiency, brand equity, and growth potential.

Valuation methods vary: SDE suits small owner-operated stores, EBITDA for larger operations, and DCF or revenue multiples for subscription or high-growth models.

Strategic improvements such as financial cleanup, automation, brand building, and channel diversification can boost valuation significantly.

Subscription and private label models command higher valuations due to recurring revenue and stronger brand control.

Avoid pitfalls like mixing personal expenses, overestimating add-backs, or relying heavily on one platform (e.g., Amazon).

Due diligence preparation—covering financial, operational, and legal aspects—is critical to avoid valuation downgrades during the transaction process.

Market timing and economic trends influence achievable multiples; businesses should align exit plans accordingly.

🧵 Online Highlights

I scroll, so you don’t have to.

Want a clean SBA close? Nail these add-back rules first…

Killer infographic for home services…

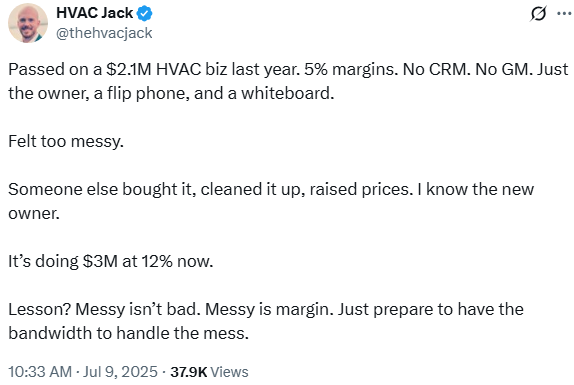

Don’t fear the chaos — that’s where the upside is…

High CAPEX could be a moat, not a red flag..

Make sure to model the NWC correctly…

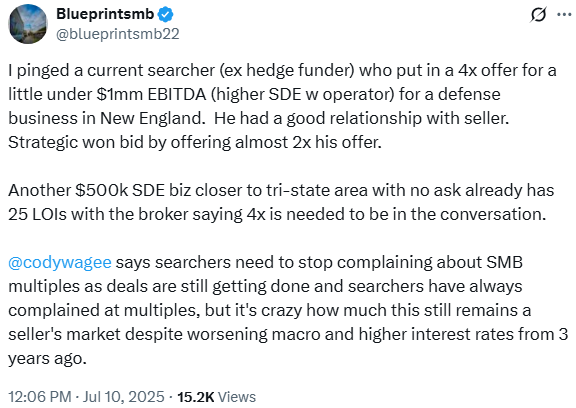

In case there’s any doubt, it’s still a seller’s market…

🤔 Other

Competing Against Private Equity

Calder Capital recently hosted a webinar titled “How Individual Buyers Can Compete Against Private Equity”.

The webinar outlined strategic approaches for individual buyers to compete with institutional investors in the increasingly competitive small business M&A landscape. Emphasizing proprietary outreach and SBA-backed financing, the session demonstrated how non-institutional buyers can effectively source and close acquisitions, particularly through off-market deals and personalized engagement.

Key insights include:

Institutional investors dominate listed deals, making off-market outreach crucial for solo buyers.

Calder Capital uses a robust proprietary CRM and outreach tactics, achieving over 40% engagement within two weeks.

Personalized, human-centric communication helps individual buyers stand out from private equity firms.

SBA financing levels the playing field with flexible, low-capital structures, supported by firms like Pioneer Capital Advisory.

The average search process involves six LOIs and can take 8–9 months, requiring persistence and emotional intelligence.

Best practices include narrowing focus to two key criteria, building a strong advisory team, prioritizing seller alignment, and being ready for setbacks.

🗓️ Events

Stanford Search Fund CEO Conference (Sept 3-4) - Stanford, CA

Southeast ETA Conference (Sept 5-6) - Charlottesville, VA

iGlobal Independent Sponsors Summit (Sept 29-30) - New York, NY

McGuire Woods Independent Sponsor Conference (Oct 14-15) - Dallas, TX

Main Street Summit (Nov 4-6) - Columbia, MO

M&A Source 2025 Fall Conference (Nov 9-12) - Phoenix, AZ

Booth-Kellogg ETA Conference (Nov 19) - Chicago, IL

iGlobal Independent Sponsors & Capital Providers (Dec 9) - New York, NY

🎵 Listening: “I Can’t Wait“ by Analog Players Society 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?