What I Learned Last Week 7.26.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X

🤔 Other - The Case for Small Business Buyouts, BizBuySell is Great

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Demystifying Percentage of Completion Accounting for Investors of Project-Based Businesses

The article explains the Percentage of Completion (POC) accounting method, crucial for project-based businesses like construction, highlighting its reliance on management estimates for revenue recognition over long-term projects. This method can be prone to manipulation, necessitating diligent analysis by investors.

Key insights include:

POC accounting estimates revenue based on project completion and incurred costs.

Management bias and project complexity can affect financial reporting accuracy.

Investors must scrutinize POC financials to detect conservative or aggressive revenue recognition.

Legislative trends and infrastructure spending are increasing the relevance of POC analysis for investors.

— — — — — — — — — — — —

PitchBook Q2 2024 Global M&A Report

M&A’s path to recovery has been solidly tracking upward as private equity’s share of M&A dealmaking has rebounded.

PE’s slice of total M&A deal value hit 41% in Q2, up from 33.5% in the previous quarter. With banks lending again for leveraged buyouts, this has helped lower borrowing costs, and large take-privates have surged.

— — — — — — — — — — — —

Flippa CEO Update: July 2024

The update highlights key trends in the online business M&A landscape for the second half of 2024. Economic factors like interest rates and inflation are affecting smaller deals, while businesses with strong cash flows are prime targets for acquisition. Investor confidence remains cautious post-tech downturn, with high search interest in e-commerce and content publishing. Technological advancements in AI and data privacy changes from Google and Apple are also reshaping the market. Private equity and strategic buyers are increasingly active, focusing on companies with growth potential.

— — — — — — — — — — — —

Small Business Acquisitions Reach Pre-Pandemic Levels

Small business acquisitions have rebounded to pre-pandemic levels, with a 5% increase over the past year and 3% in the last quarter, totaling 2,448 sales in Q2 2024 - according to BizBuySell. The median sale price has risen 25% year-over-year to a record $375,000. This indicates a competitive market with strong business performance, driving higher sale prices. However, future trends remain uncertain due to fluctuating economic conditions.

🧵 Best of X

I scroll, so you don’t have to.

Despite recent private equity interest, 70% of practices remain independent, making the industry ripe for leveraged growth with creative deal structures...

Here's how to navigate limited pre-LOI information and set clear terms to ensure a successful deal….

How to safeguard minority investors…

Not all revenue is created equal, so don’t value it as such…

🤔 Other

The Case for Small Buyouts

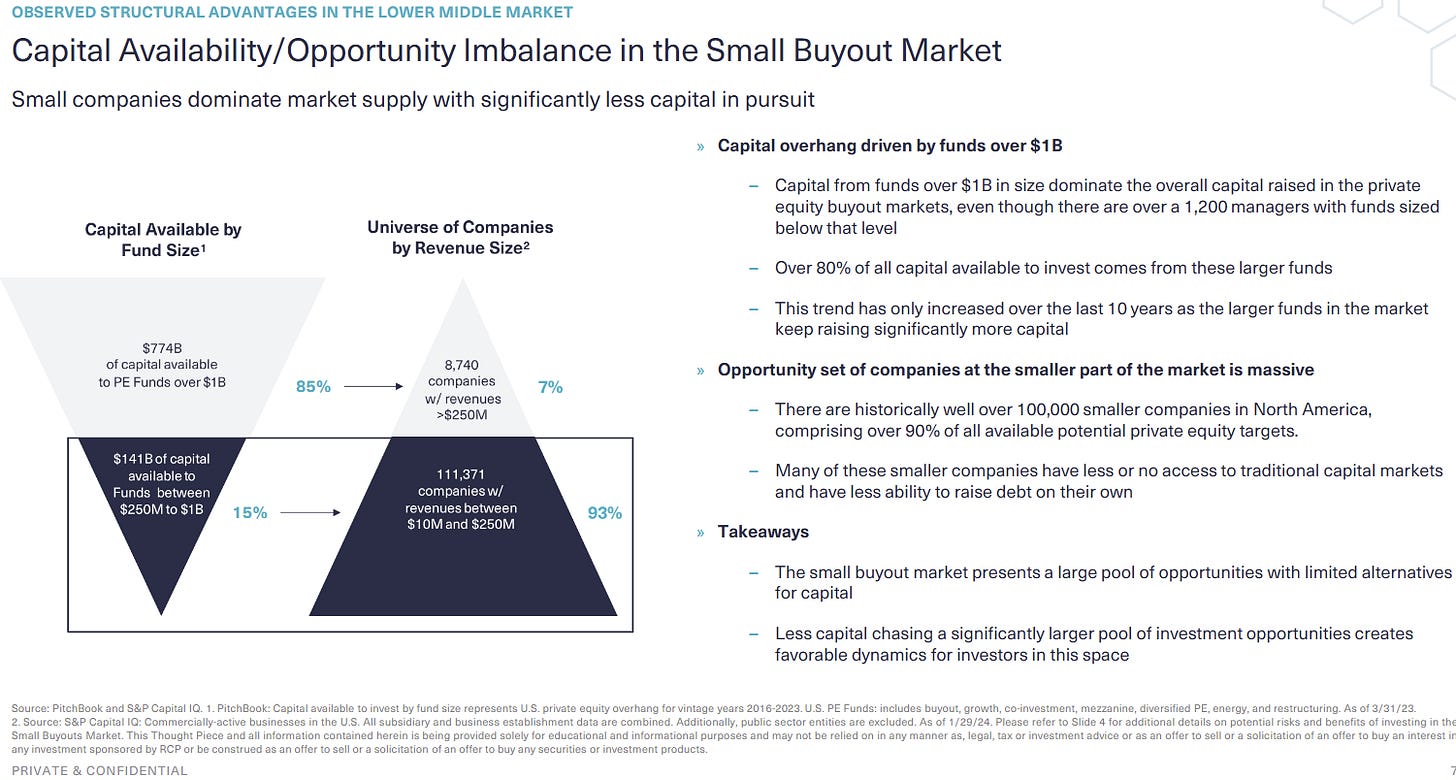

RCP Advisors has published the first installment of a three-part research series highlighting the case for small business buyouts.

In this series, we will leverage more than two decades of proprietary data and research focused on lower middle market transactions to explain why we believe small market buyouts produce the highest and most consistent returns in private equity.

Part I of this series will outline the observed structural advantages in small market buyout transactions that help lead to these higher levels of return. Part II of this series will illustrate how these observed structural advantages drive excess returns, and Part III will outline how small buyout transactions have consistently outperformed other investment areas over long periods of time.

I thought this chart was particularly interesting…

— — — — — — — — — — — —

BizBuySell is Great

There's a common sentiment that BizBuySell is terrible and that good deals can't be found there. I disagree. I've talked to numerous business buyers who found their ideal acquisitions on BizBuySell. Not through proprietary searches, broker websites, networking, or door-knocking—just by browsing BizBuySell.

So, here's a friendly reminder: ignore the negativity. BizBuySell offers some fantastic opportunities.

🗓️ Events

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Always Feel Like“ by Alok 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?