What I Learned Last Week 7.28.23

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue:

📰 Articles

🧵 Best of Twitter

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of the newsletter is brought to you by Online Business Invest.

The Online Business Invest is a newsletter run by an elite team of entrepreneurs who have generated billions in revenue.

They reveal strategies for acquiring & scaling online businesses.

Join their free newsletter and get a private, behind-the-scenes look at their deals.

It’s FREE to sign-up and you can join here.

📰 Articles

The Latest SaaS Pricing Trends

Bloom Equity Partners highlights the key insights from a recently released SaaS trends report from Vendr. If you’re focused on acquiring or operating a SaaS business, this is an important read.

— — — — — — — — — — — —

Qualifying Conversations

If you’re including proprietary outreach as part of your M&A strategy then you know how important that first conversation is with the business owner. David Lamore of Maverick provides a guide for that first conversation.

🧵 Best of Twitter

This is a great framework to quickly assess the long-term viability of a business. ChatGPT can perform this type of analysis relatively quickly…

This is such an important part of due diligence, especially for a Main Street business. Ask this question multiple times, in multiple ways…

Strategically adjusting your pricing is one of the quickest revenue growth levers you can pull…

These lessons can be applied to most types of service businesses…

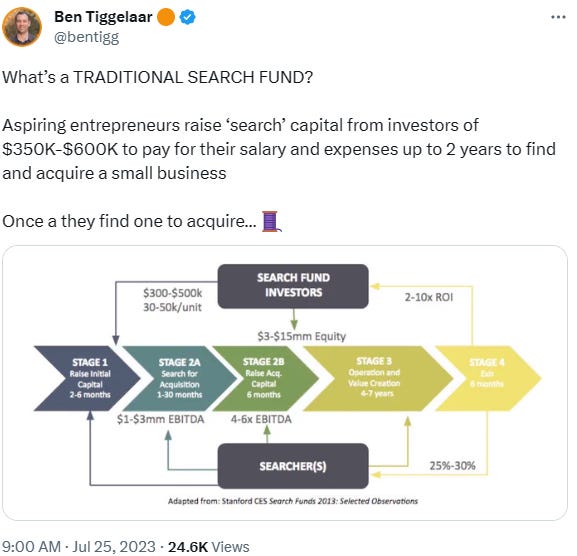

We see the term “Search Fund” used often but what is it? Ben does a great job breaking it down…

Interesting observations from the latest HoldCo survey…

Whether you’re buying or starting a business, these concepts are important to remember…

There are riches in niches 😅

🤔 Other

New Marketplace

I was recently introduced to the team behind Smobi, a marketplace to buy and sell businesses using technology and data. They are a Y-Combinator-backed startup that’s basically looking to disrupt BizBuySell. I wish them the best of luck and will be following along their journey.

On a similar note, it’s interesting to see one of the most prestigious startup incubators enter the SMB M&A space. Here’s what it could mean…

High Potential Market: Y Combinator, renowned for its focus on innovative and potentially high-impact startups, likely views the SMB M&A market as underserved or ripe for disruption. This could be due to factors such as increasing SMB activity, more business owners looking for exit strategies, or a gap in the market for more accessible, efficient, or affordable M&A services.

Digital Transformation: The investment could signify a belief in the further digitization and automation of M&A activities. Traditional M&A processes can be complex, time-consuming, and expensive. A startup could potentially streamline this process, making it more efficient and accessible for SMBs.

Value in the Team or Technology: Y Combinator's investment could reflect a belief in the startup's team, technology, or business model.

Diversification: Investing in an SMB M&A startup may reflect Y Combinator's desire to diversify its portfolio. By supporting a startup in this space, Y Combinator expands its influence and potential returns across a broader range of industries and sectors.

🗓️ Events

Southeast ETA Conference (Sept 8-9) - Durham, NC

HoldCo Conference (Sept 18-20) - Cleveland, Ohio

Austin SMB Meetup (Sept 28) - Austin, TX

The Self-Funded Search Conference (Sept 30 - Oct 1) - Dallas, TX

Main Street Summit (Nov 8-9) - Columbia, MS

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market software businesses ($500k - $15m revenue) considering exits. All deals are sourced by the Rejigg team, ~5 added per week.

Scott Oldford - If you're interested in gaining insight into the process of building, scaling, acquiring, and selling online businesses, Scott Oldford can help.

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Access or share deal flow with your peers through Deal Flow Scout

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter