What I Learned Last Week 7.4.2025

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

🎆 Happy 4th of July to those who are celebrating! 🎆

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Online Highlights

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is brought to you by:

Connecting Deal Sponsors with Investors

Are you an accredited investor looking to allocate to attractive SMB deals? Get notified of new opportunities.

Have a deal under LOI and need equity capital to close? Post your deal on CapitalPad.

CapitalPad is an investing platform allowing searchers to raise capital for SMB acquisitions, and allowing investors to finally get access to this hard to find asset class.

Get started here: CapitalPad.com

📰 Articles

I summarize, so you capitalize.

10 Charts That Capture How the World Is Changing

Not exactly M&A related, but a great read nonetheless. The blog post from Digital Native offers a broad, data-driven snapshot of current global trends across technology, health, business, and culture. Through ten insightful charts, it illustrates how AI is accelerating workplace transformation, reshaping healthcare, and fueling business efficiencies, while also showing parallel societal shifts like rising health consciousness, media consumption changes, and political dynamics among Gen Z.

Key insights include:

AI use in the workplace has nearly doubled in two years, with rapid adoption especially among white-collar workers.

AI is enabling businesses to increase revenue while reducing headcount, highlighting a new era of operational efficiency.

U.S. consumers are increasingly focused on protein and health products, signaling broader wellness trends beyond AI.

AI in medicine is proving more accurate than doctors, which may redefine medical practice norms.

ChatGPT’s user growth and engagement rival leading social platforms, reinforcing its role as both a tool and content platform.

Original content is struggling at the box office, as franchises and known IP dominate viewer attention.

Hims' stock plummeted after losing access to weight-loss drug supply, illustrating risks of dependency on third-party products.

Gen Z’s political leanings may be more reactionary than ideological, shifting based on dissatisfaction rather than deep partisanship.

AI companies may target labor spend as a market benchmark, with potential to automate large swaths of knowledge work.

Tech giants’ dominance is stabilizing, but new players like OpenAI and Broadcom hint at future disruption in the top 25 companies.

🧵 Online Highlights

I scroll, so you don’t have to.

Retroactive deductions, bigger write-offs, and better cash flow — here’s what just changed…

Assume nothing. Clarity beats chaos in the first 90 days…

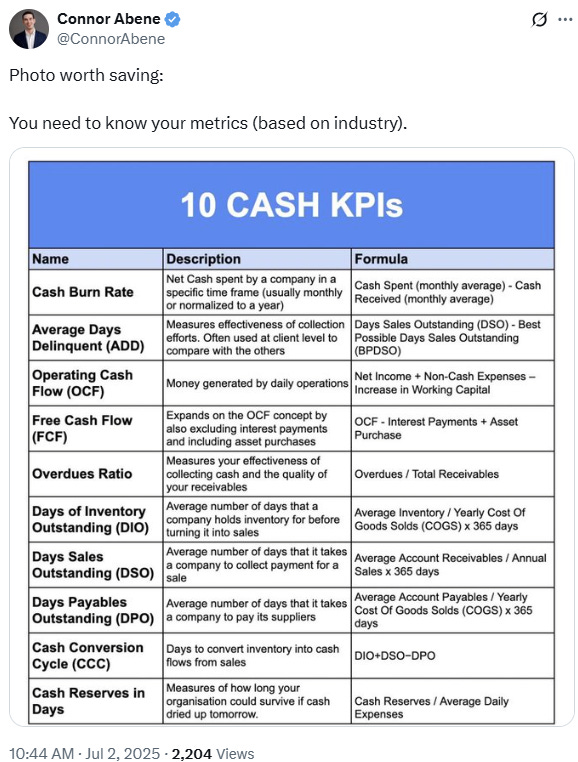

Profit ≠ cash — and cash is what keeps the business alive...

Happy 4th of July!

🗓️ Events

Stanford Search Fund CEO Conference (Sept 3-4) - Stanford, CA

Southeast ETA Conference (Sept 5-6) - Charlottesville, VA

iGlobal Independent Sponsors Summit (Sept 29-30) - New York, NY

McGuire Woods Independent Sponsor Conference (Oct 14-15) - Dallas, TX

Main Street Summit (Nov 4-6) - Columbia, MO

M&A Source 2025 Fall Conference (Nov 9-12) - Phoenix, AZ

Booth-Kellogg ETA Conference (Nov 19) - Chicago, IL

iGlobal Independent Sponsors & Capital Providers (Dec 9) - New York, NY

🎵 Listening: “American Pie“ by Don McLean 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the tedious and time-consuming job of deal sourcing so you can spend more time on DD and closing.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide (2025) - Discover 100+ platforms to supercharge your deal flow and find your perfect acquisition target—from flagship marketplaces to AI-powered deal sourcing tools, all updated for 2025.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?