What I Learned Last Week 8.16.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - Business Buyout

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Navigating the High Cost of Capital in Private Equity

The article from Bloom Equity Partners discusses how high capital costs, driven by rising interest rates, inflation, and economic uncertainty, are reshaping private equity (PE). PE firms are facing higher borrowing expenses, leading to reduced deal-making and delayed exits. To adapt, firms are shifting to smaller, less leveraged deals, focusing on operational improvements, and exploring alternative financing. There's an increased emphasis on active portfolio management and interest rate hedging as firms navigate this challenging environment.

Key insights include:

Shift to smaller, low-leverage deals.

Focus on operational value creation.

Exploration of alternative financing.

Increase in active portfolio management and interest rate hedging.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

When it comes to signing a second NDA, don't get stuck in the weeds — just make sure there are no hidden surprises and move forward…

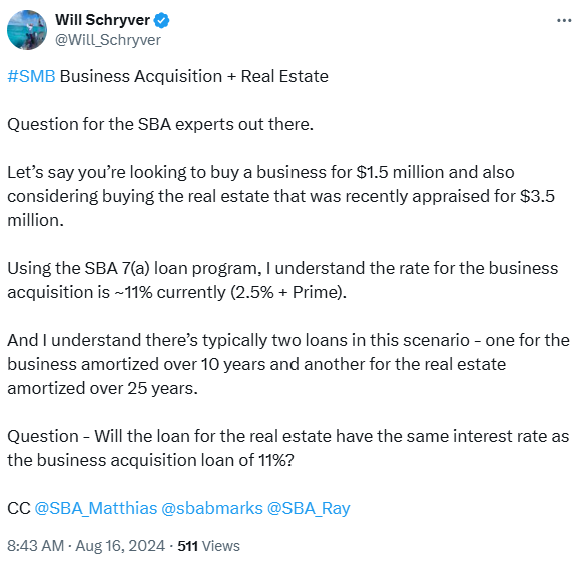

Thinking about using an SBA 7(a) loan for both a business acquisition and real estate purchase? Here’s what you need to know about potential interest rates and loan structures…

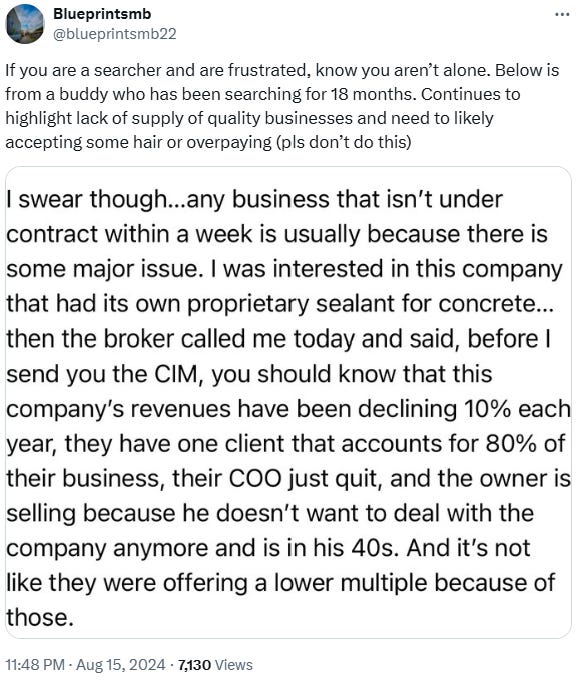

Some wild stories out there. In this situation, appears the biz broker is not helping the owner…

Want to drive organic revenue growth? Start by mastering customer retention and pricing optimization — your current customers are your most valuable asset…

Tune in for the latest insights on the SMB market…

Some excellent points on tax planning as part of the M&A process…

When it comes to working capital in business acquisitions, transparency and preparation are key — bring your own WC and factor it into the purchase price to avoid deal killers down the road…

🤔 Other

Wife has opportunity to buy business from retiring boss. I would need to invest. What does this look like?

This Reddit post discusses a situation where the user's wife has an opportunity to buy the business she works for. The user is seeking advice on the potential risks, financing options, and the feasibility of such a decision. The discussion highlights various considerations like evaluating the business's financial health, securing financing, understanding the demands of business ownership, and assessing whether the purchase aligns with their long-term goals. Reddit users suggest thorough due diligence and possibly consulting with a financial advisor before making any decisions.

🗓️ Events

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Fans“ by Kings of Leon 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?