What I Learned Last Week 8.9.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

Hampton 2024 State of SaaS Report

Hampton is a private community for high-growth founders and CEOs. This report is compiled from a member survey. The full report is only shared with community members but I am sure there are some great nuggets in this publicly available version as well.

What you will learn:

✅ How funding impacts time-to-$1M ARR (hint: it's not what you think)

✅ Why some companies are achieving 120%+ net revenue retention

✅ R&D investment relative to retention rates

✅ LTV:CAC ratios broken down by sales motion

✅ What successful SaaS leaders are focusing on for growth in the next 12 months

✅ And Much More!

— — — — — — — — — — — —

The SMB Blueprint

As a business owner, I found this issue of The Blueprint helpful. The newsletter provides small business operators with tactical insights for scaling their operations. It emphasizes the importance of creating a culture of urgency to accelerate business success, highlighting the pitfalls of procrastination and superficial solutions. The guide includes step-by-step instructions for fostering urgency, leveraging tools, and making swift, impactful decisions. Additionally, the newsletter touches on automating dashboards with AI and applying Johnson's Rule for efficient task scheduling.

Key insights include:

Cultivating a sense of urgency is essential for rapid business growth.

Daily actions and leadership engagement are crucial for maintaining momentum.

Automating data presentation and prioritization can enhance efficiency and customer satisfaction.

— — — — — — — — — — — —

Top 10 Non-Dilutive Financing Options for Business Acquisitions

The article explores ten non-dilutive financing options for small business acquisitions, which allow buyers to maintain full ownership without giving up equity. These options include seller financing, traditional bank loans, asset-based lending, revenue-based financing, grants, invoice financing, purchase order financing, equipment financing, merchant cash advances, and economic development programs. Each option offers different benefits, such as flexible repayment terms and the preservation of ownership, but also comes with specific considerations, such as higher interest rates or stringent collateral requirements.

Key insights include:

Seller financing: Flexible terms and aligned interests.

Traditional bank loans: Competitive rates, but require collateral.

Asset-based lending: Leverages business assets without equity loss.

Revenue-based financing: Adjusts repayment based on revenue.

Grants: Non-repayable but competitive.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

Maximizing tax benefits in a business acquisition starts with knowing how to navigate asset allocation rules…

Thinking about forming a holding company? Here's what you need to know to protect your assets, optimize taxes, and secure financing…

Good discussion. Some pros and cons of handling your own sale if under $100M…

Some changes to the SBA guaranty fee…

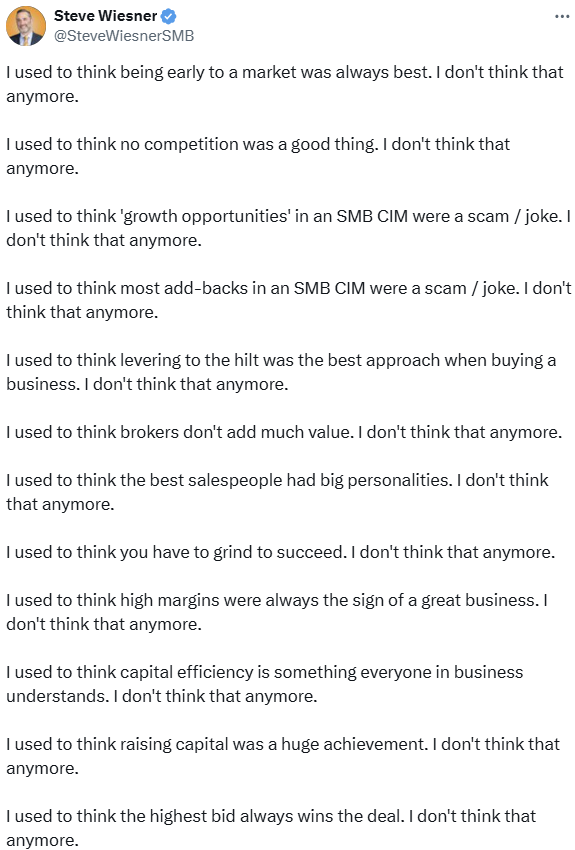

A really good post. Would love to know the story behind each line…

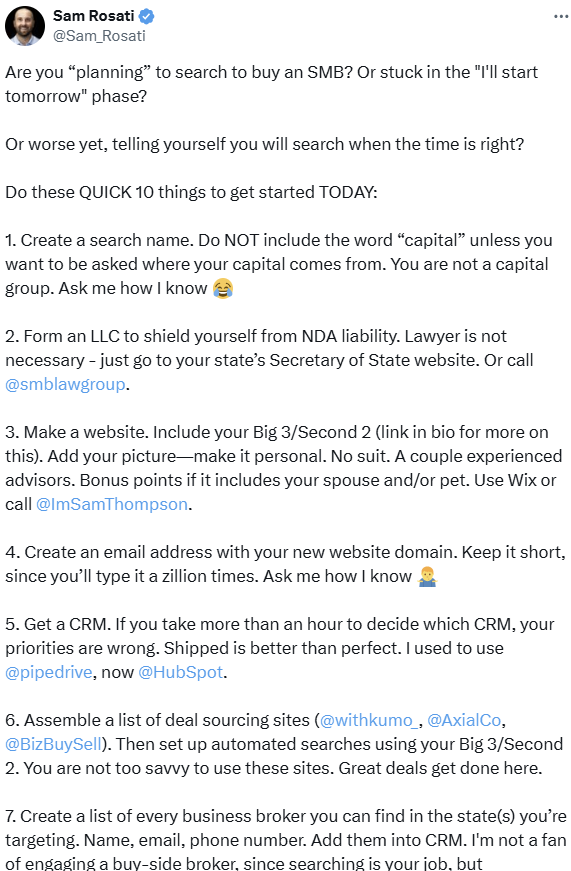

Quick start guide for searchers…

🗓️ Events

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “Out of Touch - Avangart Remix“ by Daryl Hall & John Oates, Avangart Tabldot 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?