What I Learned Last Week 9.1.23

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Smash.vc

Buying a business with the SBA?

Would having a capital partner help?

At Smash.vc, they do two things:

Buy minority stakes in existing small businesses.

Partner with entrepreneurs trying to acquire new ones.

If you're actively looking to buy a cash-flowing business using an SBA loan, hit them up if you'd like a partner.

They contribute capital, give advice, or help with growth when asked... but stay out of the way the rest of the time.

Silent partners there to help when necessary, nothing more.

If interested👉 go say hi.

📰 Articles

EBITDA Gymnastics

CFO Secrets does a deep dive into the types of EBITDA adjustments that you can see in a Quality of Earnings Report. Long read but a good one.

BTW - DueDilio has 50+ highly vetted Quality of Earnings service providers on our platform. Whether your budget is $5k or $25k, we can connect you with the right QofE provider.

— — — — — — — — — — — —

Five exits by the age of 39 🤯

Imagine completing 5 successful business exits before hitting 40. Incredible! This is an awe-inspiring story spotlighted in The Wise Exit newsletter.

Ben got his start in the business world as a college student at Baylor University.

In his senior year, he founded Simply Interactive - a “e-learning” company that created interactive digital training programs for businesses.

His first venture, it would also be his first glimpse of the power (and exit-potential) of B2B software applications.

Genentech, the company he was interning at that year, would be his first large customer, and many more Fortune 500 companies (including Dell, Rand, Michelin, and Exxon) would soon follow.

His success in acquiring this caliber of client quickly caught the attention of another, larger e-learning company, Agile Interactive, which would purchase Simply Interactive in 2011.

It was Lamm’s first taste, and it would be the first of four exits that he would achieve over a 7-year period.

🧵 Best of X (Twitter)

A client of DueDilio has successfully closed three deals using 100% seller financing, and the outcomes have been excellent. However, it's important to note that such instances are more the exception rather than the standard practice in the industry…

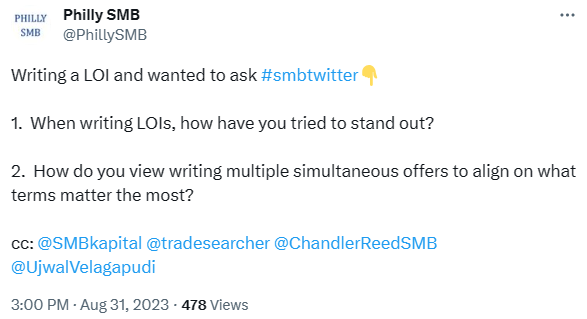

Excellent discussion on how to stand out from the herd…

How to properly structure a hold co…

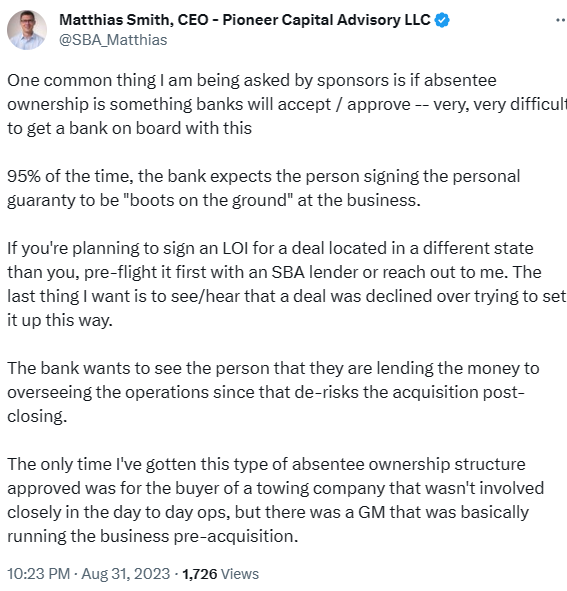

For those dreaming of a passive, absentee-run business acquisition using SBA…

Hate to see these types of stories but they’re important to learn from…

Good tips for independent sponsors on structuring their term sheets…

May be an interesting opportunity…

This is the goal…

🤔 Other

Quality of Earnings Reports

A QofE is one of the most requested types of financial due diligence that we see at DueDilio. A big issue I see is that there is no standard definition of what’s included and the differences between a lite scope and full scope QofE. The confusion is understandable since each QofE service provider has their own deliverables. Below is an explanation I recently gave to a DueDilio client that I think you may find helpful as well:

A Quality of Earnings (QofE) report is an in-depth examination of the most critical elements of a company's financials. The report typically focuses on the quality, sustainability, and consistency of earnings, and it can vary in scope depending on the requirements and budget of the client.

Here's a general breakdown of what might be included in a lite scope QofE versus a full scope. Please note that this can vary depending on specific industry standards and client needs.

Lite Scope QofE:

Proof of Cash: Examining the reconciliation of reported cash to the bank statements.

Asset Quality: Analyzing the quality of assets, including aging accounts receivable and inventory analysis.

Revenue Quality: Assessing the quality and sustainability of revenue streams.

Income Statement Analysis: A high-level review of the income statement to identify unusual items or trends.

Net Working Capital Analysis: A review of working capital needs and trends.

Debt & Debt Like Items: Identifying and understanding all company debt and obligations.

Full Scope QofE (Includes Everything in Lite Scope plus):

Financial Benchmarking Analysis: Comparing key financial metrics against industry peers or standards.

Capital Intensity (CAPEX) Analysis: Analyzing capital expenditure trends and requirements.

Customer Concentration: Examining dependencies on key customers.

Product Concentration: Assessing dependencies on key products.

Vendor Concentration: Analyzing dependencies on key vendors.

Projection Model (SBA): If applicable, reviewing or building financial projections, often required for loans.

Business Plan (SBA): If applicable, reviewing the business plan, often required for SBA loans.

Industry Analysis: Analyzing the industry landscape, including competitors and market trends.

Key Man Risk Analysis: Assessing risks related to dependency on key personnel.

Tax Matters: Reviewing tax compliance, positions, and potential risks.

🗓️ Events

Buy Grow Sell Summit 2023 (Sept 5-6) - Virtual

Southeast ETA Conference (Sept 8-9) - Durham, NC

EtA Forum Asia Pacific (Sept 14-15) - Sydney, Australia

HoldCo Conference (Sept 18-20) - Cleveland, Ohio

Austin SMB Meetup (Sept 28) - Austin, TX

The Self-Funded Search Conference (Sept 30 - Oct 1) - Dallas, TX

Booth Kellogg EtA Conference (Nov 1) - Chicago, IL

Main Street Summit (Nov 8-9) - Columbia, MS

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($500k - $10m revenue) considering exits. All deals are sourced by the Rejigg team. Their team adds 7-10 new deals each week

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?