What I Learned Last Week 9.27.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other - Surprisingly Profitable Businesses

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by:

Close Your Deal Quickly and Efficiently: M&A Legal Solutions Integrating Automation and Project Management

At Sterrett Law, we’ve developed a streamlined process using cutting-edge automation and project management techniques to maximize speed and efficiency. Using templates and a client-centered collaborative process we’ll keep your deal on track and on time.

Ready to make your next move? Schedule your free consultation today!

📰 Articles

I summarize, so you capitalize.

International Search Funds 2024

IESE has just published its updated international search fund report, analyzing 320 funds across 40 countries on five continents. It's exciting to note that the number of new fund launches (59) and acquisitions (31) have reached record highs, nearly 50% above previous peaks. The report also highlights first-time acquisitions in countries like New Zealand and Paraguay, marking new milestones in the search fund landscape.

— — — — — — — — — — — —

Private Equity Roll-Ups of Accounting Firms Could Run into Trouble

The accounting profession faces challenges with recruitment but has gained popularity with PE investors. PE firms see stable audit revenues and market consolidation opportunities. While cross-border mergers promise streamlined decision-making, they face complications. Concerns exist that PE could harm audit quality by prioritizing short-term gains. Unclear exit strategies for investors further complicate the landscape, though PE could fund beneficial tech investments in accounting.

Key insights:

PE owns or is bidding for major accounting firms.

Cross-border mergers simplify decisions but face obstacles.

PE may risk audit quality with short-term goals.

Future exits are uncertain.

— — — — — — — — — — — —

The Half Way Point

Patrick Dichter reflects on his journey halfway through a five-year goal of growing an accounting firm that he acquired. Revenue expanded from $1.2M to $3.4M, with challenges like client churn and slow revenue growth in 2023. He questions expanding into other industries but remains focused on hitting $5M. Patrick emphasizes the importance of strong operations, leadership structure, and resisting "shiny object syndrome."

Key insights:

Focus on operational improvements and team structure.

Challenges with acquisitions and client retention.

Adapting growth strategies and leveraging momentum.

🧵 Best of X (Twitter)

I scroll, so you don’t have to.

This deep dive reveals how poor debt structure and cash flow realities can turn a promising offer into a deal that just doesn't work…

This thread reveals 4 must-have provisions — like tax distributions and buy/sell agreements — that could save you from partner disputes and phantom income headaches…

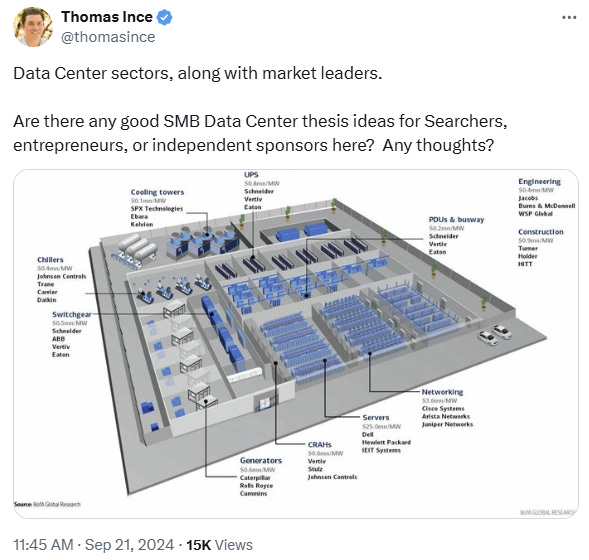

Data centers are all the rage. Explore how Searchers can benefit…

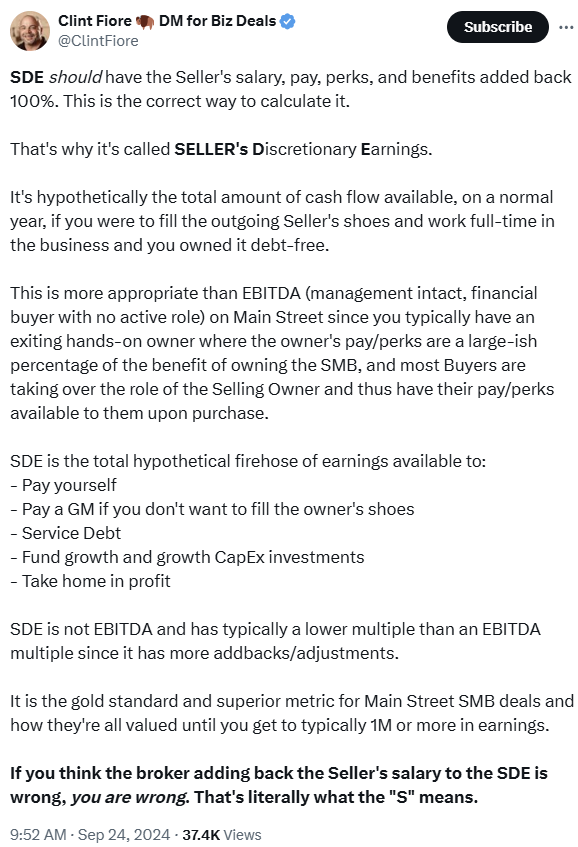

SDE includes the seller's salary and perks for a reason—it's the key metric for valuing Main Street businesses…

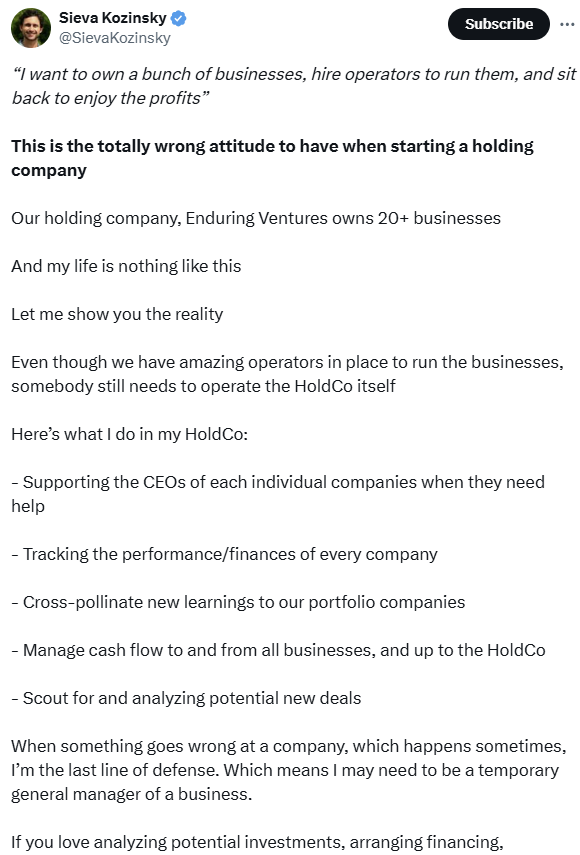

Thinking of owning a holding company for passive income? This thread breaks the myth—running a HoldCo means being hands-on with CEOs, finances, and deals, not just sitting back and enjoying profits…

🤔 Other

What are some surprisingly profitable businesses?

In this Reddit discussion, users shared ideas on surprisingly profitable businesses, focusing on niche markets and essential services. Key examples include small concrete jobs, handyman services, car washes, consulting, and trades like plumbing and landscaping. Many noted that specializing in a single skill with efficient tools and employees can yield significant profits. Other popular ideas included senior care, junk removal, car detailing, and self-storage. Some businesses offer high margins due to low competition or essential, recurring services.

Key insights:

Niche trades (e.g., concrete, plumbing) are highly profitable.

Handyman and senior care services thrive due to increasing demand.

Car washes, self-storage, and consulting have low overhead but high returns.

🗓️ Events

Southeast EtA Conference (Sept 6-7) - Washington D.C.

Independent Sponsor Forum (Sept 12) - Chicago, IL

Self-Funded Search Conference (Sept 14-15) - Dallas, TX

Main Street Summit (Oct 9-10) - Columbia, MO

Annual M&A Institute (Oct 10-11) - Dallas, TX

Rice EtA Conference (Oct 13-14) - Houston, TX

McGuireWoods Independent Sponsor (Oct 15-16) - Dallas, TX

Texas & The South M&A and Business Symposium (Oct 16-18) - Dallas, TX

HBS ETA Conference (Oct 19) - Cambridge, MA

National Summit for Middle Market Funds (Oct 27-29) - Palm Beach, FL

Booth-Kellogg EtA Conference (Nov 4) - Chicago, IL

HoldCo Conference (Mar 31-Apr 3 2025) - Sundance, UT

🎵 Listening: “I Feel Love“ by Mr. Belt & Wezol, Bendah, Limited Life 🎵

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors or affiliates of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market small businesses ($200k - $3M EBITDA) considering exits. All deals are sourced by the Rejigg team. Their team adds 15 to 20 new deals each week.

Kumo - 100,000+ deals sourced from thousands of brokers and marketplaces. Plus, AI-powered listings, robust data & analytics, and more.

DealFlowXchange - The premier private capital funding community for raising and deploying capital. Use discount code DUEDILIO for 20% off your lifetime membership.

Sterrett Law - At Sterrett Law, we offer Manhattan and Boston experience at Vermont prices. Specializing in deals under $10 million, we're your go-to partner for navigating the complexities of mergers and acquisitions without the hefty price tag

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Secret - Say goodbye to overspending on SaaS. With Secret, you get access to up to $1,000,000+ in savings on the best software to run your search, operate, and scale your business.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?