What I Learned Last Week curates the most interesting content relating to business acquisitions, operations, entrepreneurship, finance, and more. WILLW is a publication of The Business Inquirer.

Let’s connect: LinkedIn, Twitter, Facebook Group

Hello Friends!

This issue of What I Learned Last Week is brought to you by DueDilio.

DueDilio is a leading online marketplace focused on M&A due diligence.

We connect business buyers, sellers, intermediaries, and private investors with pre-vetted due diligence service providers.

Our large and growing network of verified independent professionals, boutique and mid-size firms, and subject-matter experts specialize in finance, technology, legal, commercial, and other key areas of business diligence.

Submit your project. Review qualified proposals. Hire service provider.

📰 Articles

Battery Ventures published the results of their latest cloud spending survey where they interviewed 100 CIOs controlling roughly $29B in tech budget. Some good news here for those selling into this space. A lot of great charts and insights in this one.

We found 35% of survey respondents expected their overall tech budgets to stay flat in 2022, while a surprising 54% expected their tech budgets to increase. Less than two percent of the respondents expected their budgets to contract by more than 10%. All of those more-cautious buyers were at companies spending less than $100 million annually on technology.

— — — — — —

VC firm Andreessen Horowitz (a16z) is far away from the SMB world but I thought their recent article/case study on moving upmarket was interesting and relevant.

So how do you prepare to move upmarket? Get crisp on your product value framework, use that framework to define your enterprise ideal customer profile (ICP), then align your product roadmap and sales motion to make sure you can service that ICP’s needs.

Getting Ready to Move Upmarket

— — — — — —

Axial published a great article about earnouts. Earnouts are very common in the SMB acquisition world as they offer a simple way to bridge a business valuation gap between the buyer and seller.

The key elements of an earnout are:

The financial goals that must be met in order for the seller to receive additional compensation (usually stated as a share of gross sales or earnings)

The timeframe in which these goals must be met and the accounting assumptions used to establish performance milestones

The amount of additional compensation that will be paid if the goals are met and the named recipients of the earnout from the seller’s organization

— — — — — —

Another insightful article from Axial analyzes business broker activity in the lower middle market.

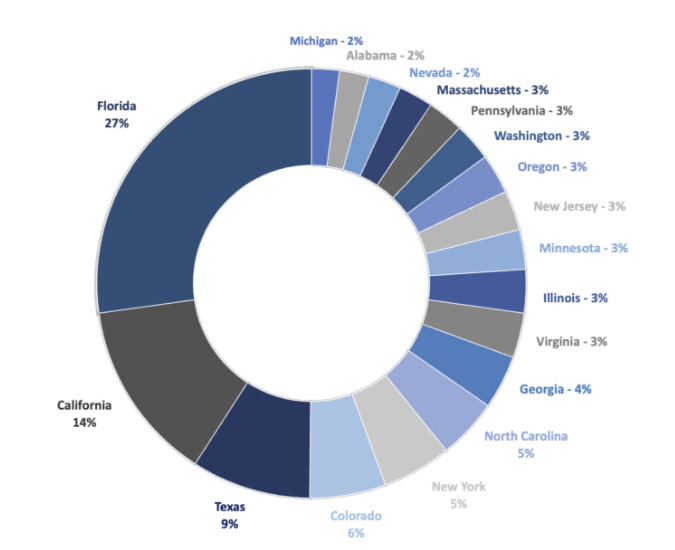

Geographic Representation

Broker-originated new deal activity by state, 1H 2022

Industrials dominate LMM broker-assisted mandates

Broker trends consistent with overall deal activity in 2022

Analysis Reveals Business Broker Impact on LMM M&A

🧵 Twitter

Good thread on not overcomplicating your due diligence checklist. Visit the DueDilio Knowledge Center and download a few examples…

My personal preference is to steer clear of these types of businesses but this is a great thread for anyone who’s interested in this space…

You have to know the basics…

Don’t limit yourself to just offline businesses…

Another good primer on basic financial analysis…

I’ve highlighted a lot of IT MSPs in this newsletter. Seems like they are indeed popular acquisition targets…

🤔 Thoughts, Events, Other

Moving to Miami

A bit of personal news - my wife and I are moving down from Boston to Miami next week. I can’t say it was a difficult decision but certainly something that we thought about for a while weighing the pros and cons. I’ll be sharing some of my observations in future newsletters.

If you’re in the Miami area, reach out and say “hello”.

🛠 Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

BizNexus - Proprietary deal flow, deal aggregator, and exit prep. Local Boston company and I consider the founder (Adam Ray) a friend.

PrivSource - Deal aggregator for lower and middle-market listings.

The Website Flip - a newsletter that sends content sites for sale to your email inbox. They send deals each Wednesday and Friday.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.