🧐 What I Learned Last Week

Curating the best M&A, SMB, EtA content for week ending 2.17.23.

Hello Friends!

This issue of What I Learned Last Week is brought to you by DueDilio.

DueDilio is a leading marketplace to hire highly vetted M&A due diligence service providers.

Our large and growing network of independent professionals, boutique, and mid-size firms specialize in finance, legal, technology, commercial, and other key areas of business diligence.

We save our clients the time, hassle, and cost of hiring a due diligence professional.

Submit your project.

Review qualified proposals.

Hire a service provider.

Simple and FREE.

📰 SMB/EtA Articles

Red Forest Capital: February 2023

Red Forest Capital is a family office with over 300 search fund investments. They recently released their monthly commentary and an amazing list of resources & content.

— — — — — —

The New Gatekeepers

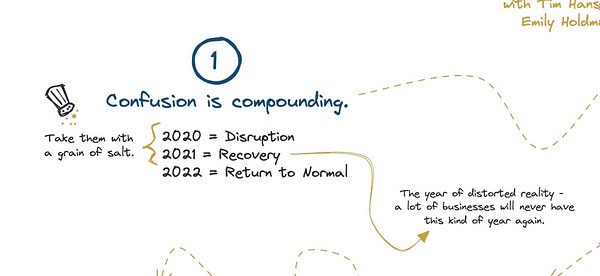

Not directly M&A related but Benedict Evans released his annual presentation highlighting the major tech & economic trends for the year, The New Gatekeepers.

— — — — — —

Citizens 2023 M&A Outlook: Optimism cuts through headwinds

Key Insights

Valuation & company performance outlooks remain positive overall but differ significantly across sectors

Nearly 2/3 of companies say that M&A will be their primary driver of growth in 2023

PE firms and companies both see a slight advantage to sellers in the current M&A environment

Deal confidence is down amid broader uncertainty, but the pipeline of sellers and buyers remains healthy

🧵 Best of Twitter

A great way to frame NWC. Not just about funding operations…

Some things to think about when deciding whether to raise outside capital and from where…

Love this thread…

On navigating uncertainty…

Maximizing chance of success…

Too good…🤣😂

Great questions to ask when looking at a business from an acquisition or investment standpoint…

🧐

🤔 Thoughts, Events, Other

Florida Meetup

I’m going to try and attend this one. Let me know if you can make it.

⚒️ Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these may contain affiliate links. This means that I may receive compensation if you sign-up and use them.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel. Local Boston company and I consider the founder (Adam Ray) a friend.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Import Dojo - a newsletter that sends eCommerce and Amazon FBA businesses for sale to your email inbox. They send deals each Wednesday at 9:00 AM CST.

Kumo - Find every deal in one complete platform. Spend less time sourcing deals and more time closing them. Kumo aggregates 180K+ business listings into one easy-to-use platform.

Cerebro Capital - Cerebro has a network of 1,500+ lenders who can provide debt financing for your acquisition, refi, etc. $500k minimum.

Curators - Proprietary deal sourcing. You need targets that fit your investment criteria, and Curators delivers week after week - we even update your personalized database on a daily basis with new information on best-fit targets.

Deal Flow Scout - Peer-to-peer deal flow exchange. Free, open, transparent.

Deal Sourcing Guide - A directory I put together of online marketplaces, brokers, DFY deal flow, and more.

That’s all for this issue of What I Learned Last Week!

How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it or subscribe?

Let’s connect: LinkedIn, Twitter

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, listings, investments, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.