What I Learned Last Week for 1.12.2024

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of X (Twitter)

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by Snowball

Build Your Snowball. Compound what matters.

Snowball is a private community of experienced entrepreneurial investors creating meaningful wealth.

How?

1. By building companies for the long term.

2. By investing directly in the SMB ecosystem.

3. By creating a life where personal growth, health, and strong relationships compound over the decades.

If you’re looking for a like-minded community of accomplished doers, a place for SMB deal flow, and a place for long-term thinkers... you’ve found it.

👋 Join the club at Snowball

SnowballClub.com

📰 Articles

What is SDE? We explain seller’s discretionary income, plus why it matters for your sale

The article on "They Got Acquired" provides an in-depth explanation of Seller's Discretionary Earnings (SDE), highlighting its importance in valuing small businesses for sale.

SDE Concept: SDE represents the total potential earnings for a business owner, including net profit and personal benefits categorized as business expenses.

Calculation Method: It involves adjusting net profit by adding back owner-specific expenses to reflect the true profitability of the business.

Significance in Sales: SDE is crucial for determining a business's value, helping potential buyers understand what they can earn.

Influence on Valuation: Adjusting personal and non-essential expenses can significantly impact the calculated SDE, thereby affecting the business's sale price.

— — — — — — — — — — — —

10 Commandments Of A Profitable Operation

The article "10 Commandments Of A Profitable Operation" by Joshua Schultz offers strategic guidelines for enhancing business profitability and efficiency.

Systemization and Training: Emphasizes the importance of creating efficient systems and providing comprehensive staff training.

Health and Safety: Prioritizes maintaining a healthy and safe work environment.

Value Maximization: Focuses on increasing value-added activities and reducing non-value-added ones.

Problem-Solving and Proactivity: Encourages proactive approaches and continuous problem-solving to improve operations.

🧵 Best of X (Twitter)

Discussion around minimizing tax hit post-sale…

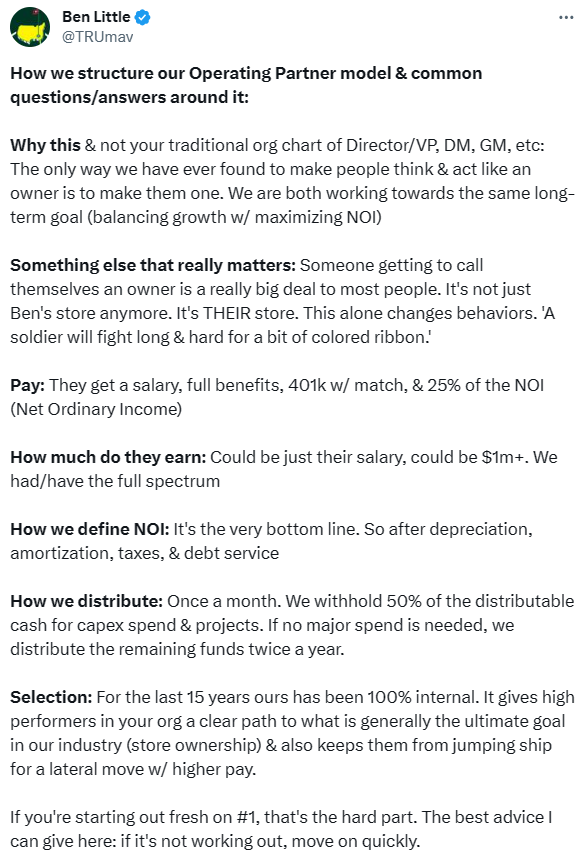

On structuring an operating partner model…

M&A thesis for roofing and exteriors industry…

Pick the right search model for you…

On investing in search deals…

Allocating the purchase price to minimize taxes…

M&A thesis for the behavioral and mental health space…

🤔 Other

SMBootcamp Digital Cohort

Two of the most popular ETA programs cost close to $10k now. I honestly think they are worth the price but it’s also good to see some lower-cost options come on the market. One of those options is highlighted in the Tweet below. Not an endorsement but something to be aware of…

— — — — — — — — — — — —

Buy a Boomers Business Now!

Recently came across this great discussion on Reddit with almost 800 comments.

🗓️ Events

University of Michigan ETA Conference (Jan 18-19) - Ann Arbor, MI

MIT ETA Conference (Feb 16) - Cambridge, MA

Wharton ETA Club (Spring 2024) - Philadelphia, PA

SMBash 2024 (Apr 18-20) - Salt Lake City, UT

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing for a great price. They do the outreach and send you relevant, actionable deals directly into your inbox.

Interexo - Curated deal flow and data solutions. Since 2016 Interexo has been M&A industry’s trusted source for deal flow, with extensive coverage of industry data, from Private Equity to Lenders, Hedge Funds, Brokers, and more.

Smash.vc - Whether you're looking to sell minority stakes in your business to take some chips off the table, looking for a partner to acquire an asset, or needing capital to complete an SBA deal, we'd love to chat with you.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?