The Business Inquirer #035

In this issue, I highlight 8 listings including a gardening SaaS, an e-mail verification project, a software deals platform, and What I Learned Last Week.

The Business Inquirer covers the most interesting tech-enabled business acquisition opportunities. Written for entrepreneurs, search funds, investors, and business owners. It’s completely free and you’re guaranteed to learn something new.

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Hello Friends!

Last Friday I published the latest Deal Sourcing Guide by TBI. It’s a comprehensive directory of business brokers, marketplaces, aggregators, DFY deal sourcing, and more. It’s getting a lot of buzz in the community.

Welcome to all the new subscribers! Please visit the About page to learn about this newsletter and what you can expect.

In this week’s issue:

🛒 eCommerce - 2 listings

☁ SaaS - 5 listings

🕸 Content/Marketplace/Service - 1 listing

🧐 What I Learned Last Week

🛒 eCommerce

Jewelry Dropshipping - $7k

For sale is 2-year-old Glitter by Kate Wild Shopify store that sells personalized jewelry using a dropshipping model. Would make a nice starter business for someone looking to learn the ropes.

Dropship model. I think it’s using ShineOn as a supplier.

706 sessions/month;

TTM Revenue: $5,848; Profit: $1,689; Margin: 29%

Asking: $7k; Multiple: 4.14x

✔ What I Like

Simple dropship model. Nice margins. The website looks well done for this niche. The seller would be willing to help. I’m sure you can negotiate the price down a bit. Personalized jewelry is a good niche that’s always in demand…

❓ Questions & Concerns

Could you recreate this store and traffic for less? Is the niche over-saturated? How do you differentiate? CPC is relatively high so have to think of creative advertising channels.

You can view the listing on SwiftExits.

————

Crystals, Rocks, Jewelry - $783k

For sale is a 3-year-old Etsy shop selling crystals, tumbled stones, polished rocks, geodes, and crystal jewelry.

10k 5-Star reviews; 61k Etsy sales; 12.9k Etsy followers;

$31 AOV; 125 SKUs;

TTM Revenue: $527k; Profit: $240k; Margin: 46%

Asking: $783k; Multiple: 3.27x

✔ What I Like

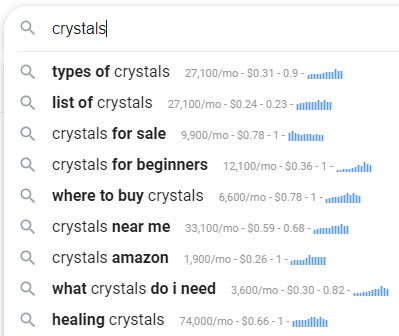

I like this niche as it’s had a steady uptick in demand…

The large number of reviews and followers offer a moat against competitors. Nice margin with a decent AOV. Looking at the chart above, the CPC is not crazy if you’d want to spend some money to advertise. Opportunity to expand to your own store or other distribution channels (Amazon, Walmart).

❓ Questions & Concerns

Not clear who supplies the products. Shipping is done by the seller so you have to hold inventory. Are there any logistical challenges? How concentrated are sales in any particular product? Returns? Is this the top of the market for crystals and the owner is just cashing out? A lot of questions here.

You can view the listing on WebsiteClosers.

☁ SaaS

Food Growing, Home Gardening - $275k

For sale is a 2-year-old SaaS and education platform that helps consumers grow food at home. Very detailed listing with some interesting insights on this industry.

Raised $218k in funding

TTM Revenue: $276k; Profit: $0

Asking: $275k

✔ What I Like

The listing is very detailed and insightful. I like that it’s a SaaS model that’s built for B2C and B2B clients. The educational component is attractive as it allows you to build a community. Clearly, there’s a lot of R&D that’s been put into this project. If someone is in this space already, this could be a great strategic acquisition.

❓ Questions & Concerns

Listing shares a lot of detail around the TAM and the product but it’s not clear who the current customers are, how they were acquired, acquisition costs, etc. Feels like this product may be trying to serve too many markets. I imagine that a professional nursery would need something different from a home consumer - yet the listing says both are potential clients. Even if the tech is solid, you’ll need to throw a lot of $$$ into sales and marketing. This is for an experienced acquirer. For consumers, interest in home gardening is very seasonal…

You can view the listing on MicroAcquire.

————

EdTech Platform - $330k

For sale is a 10-year-old EdTech platform that enables instructor-led classes online. It also supports offline cohort management, collection of fees, video shares, assignments, and custom branding. Maven combined with Class.com.

400+ active customers

TTM Revenue: $142k; Profit: $5k; Margin: 4%

Asking: $330k; Multiple: 66.00x

✔ What I Like

Well-aged business. Broadly, I think EdTech is a great space with a lot of new entrants who are looking for technology solutions. 400 active clients is definitely a sign of validation and PMF.

❓ Questions & Concerns

The listing is not very detailed. Not clear who the clients are or target market. What’s the CAC? I assume there’s no profit because everything is spent on marketing/sales or salaries. Need to dig into this. A lot of questions with this listing.

You can view the listing on MicroAcquire.

————

E-Mail Verification - $50k

For sale is 1-year-old Reacher e-mail verification service. Reacher is an open-source e-mail verification API that checks if an e-mail address is valid.

Tech: Rust, TypeScript, Heroku, React

Avg monthly revenue: $1k; Profit: $950; Margin: 95%

Asking: $50k; Multiple: 4.39x

✔ What I Like

Well-designed website. Appears to have a lot of the features which would be required for this type of service. Has a few clients so there’s some validation. There may be room to negotiate on the asking price. E-mail verification services are in high demand from marketers, content creators, and more…

❓ Questions & Concerns

This is a project, not a business. There’s no marketing playbook. Margins will shrink once you start advertising. This is a very competitive space and not sure how this solution is differentiated. Not an easy business to grow/scale. I am not familiar with the listing vetting process on AcquireBase.

You can view this listing on AcquireBase.

————

WordPress Themes (Spanish) - $35k

For sale is 3-year-old Asi Themes which are a collection of 27 WordPress themes built for the Spanish market.

Priced at 195 euros annually

MRR: $1,400; Profit: $1,390; Margin: 99%

Asking: $35k; Multiple: 2.10x

✔ What I Like

WordPress is a growing ecosystem with themes being in high demand. The themes themselves look good. The Asi Themes website looks professional as well. Sold through their own website and not through ThemeForest = higher margins. Annual subscription model instead of a one-time sale.

❓ Questions & Concerns

Not sure what type of demand there is for WP themes for the Spanish market. I think any theme can be translated with a plugin. They haven’t done any marketing so there’s no insight into the cost of each sale. Probably best as an add-on to an existing portfolio.

You can view the listing on AcquireBase.

————

Notion Website Builder - Open to Offers

For sale is notosite which is a SaaS project that fetches content from Notion docs and readers a custom website on a custom domain. Pre-revenue project.

✔ What I Like

Good starter SaaS for someone to grow. Requires marketing skillset. Some existing competitors to learn from. Look at the playbook for Sheet2Site and others. I’m sure price is very negotiable.

❓ Questions & Concerns

No clients and no validation yet. Could be difficult to figure out the right price for this project.

You can view this listing on SideProjectors.

🕸 Content/Marketplace/Service

Software Deals Platform - $950k

For sale is a 3-year-old software deals platform that generates revenue from affiliate sales. “Groupon” for software for marketers, devs, founders.

Competitors: AppSumo, StackSocial

Built on WordPress & WooCommerce

40-45% gross margin per sale

TTM Revenue: $725k; Profit: $163k; Margin: 23%

Asking: $950k; Multiple: 5.83x

✔ What I Like

Great business model that’s relatively simple to understand. Software cos are always looking for ways to promote their products and have no issues paying high commissions. I’ve always wondered if there’s a way to offer this type of product as a white label to online communities, incubators, accelerators, etc. Just thinking out loud here. Might be possible to negotiate better commission rates.

❓ Questions & Concerns

This is a competitive space with a lot more competitors than just AppSumo and StackSocial. You also have Secret, Starter Story, and many more. This business is all about driving traffic. As advertising costs go up, those margins are going to get squeezed. Valuation seems a bit high but at this point I can say that about every single listing I see.

You can view the listing on MicroAcquire.

🧐 What I Learned Last Week

——

Buy vs build for a starter business

Last week I received some really helpful feedback on the newsletter…

From: anonymous

Message: My biggest issue with this newsletter is that it seems to be geared to people who either have experience running a business or have a lot of money to lose while learning. I would like to see more things (at least two per issue?) geared to people who are taking the plunge into owning their own business and have NO experience. These individuals, like myself, need some kind of relatively easy business that has a low cost and a low learning curve. I would not be able to spend $70,000 on a business and then have no profit while I learned the business for example.

I want to share some quick thoughts on this without diving into the weeds.

In this situation, I actually think it’s better to build vs. buy. This would be the best bang-for-buck to learn business basics before making a bigger investment into acquiring an existing business. Here’s why:

At < $50k you’re really acquiring a project and not a business. Especially in today’s market environment and lofty valuations. Pre-revenue projects are going for ~$15k on MicroAcquire.

It’s a lot riskier to buy something at that lower price point compared to buying a mature business. I can write a ten-volume research paper on why.

You’ll have a very steep learning curve either way. The same as starting something from scratch.

You’re going to be under a lot of stress and pressure to maintain or grow the business because you made an investment in it.

I think the best starter business for someone would be print-on-demand (POD), dropshipping store, or a consulting service if you have some knowledge that others need. Here’s why:

Simple business model. You sell a widget for X that costs you Y.

Very low investment required.

No inventory to deal with.

Don’t need dev or tech skills.

A lot of online content on how to start, operate, grow these types of businesses.

Easy to create an online presence. Shopify, Wix, WordPress, Squarespace, Etsy, Stripe simplify this process so that you don’t need any prior experience.

You learn a lot of basic skills along the way like marketing, advertising, pricing, copywriting, online payments, customer service, customer acquisition, basic accounting, basic tech, outsourcing, and a lot more.

You learn at your own pace and don’t feel pressure to generate profits since your investment is so low. Mistakes don’t cost you as much. You’re doing this to learn.

I speak from experience. This is the path I took by starting a print-on-demand t-shirt store on Shopify. It wasn’t a successful business but it taught me a lot.

On the flip side, there’s a great article from BizNexus on The Advantages of Buying an Existing Business.

With that, I will try to include more “starter” and lower-priced listings in the newsletter. Might not be in every issue but I’ll sprinkle some in here and there.

What do you think? I’d love to get some thoughts from subscribers on this topic. If you’ve never run a business but have $15k - $50k to spend - what’s the best path? Is my advice above valid or am I thinking about this the wrong way? Hit reply, post in the FB Group or leave extended feedback using the buttons at the bottom.

——

Building a micro-SaaS

This is somewhat related to the topic above on starting a new business. Last week I came across this really great guide from Preetam Nath on how to start a micro-SaaS business - Micro-SaaS Guide: Build a Profitable Business in 2021.

Chapters include:

What is Micro-SaaS? And why you should care?

Finding Micro SaaS Ideas in 2021

How to Validate Your Micro SaaS Idea

Build a Minimum Loveable Product for your Micro SaaS

The Right Pricing Models and Strategies for your Micro-SaaS Product

Micro-SaaS Marketing: Getting y our first 10 and 1,000 paying customers

Buy or Sell a Micro-SaaS business

Really impressive guide. Would recommend checking it out.

——

Customer-based valuation

Interesting read on a business valuation approach referred to as customer-based valuation. The idea is to estimate the present-day value of future cash flows of the business by using an LTV of a present and future customer. A modified DCF.

At a high level, it involves two parts:

Calculating the present value of a current customer is and multiplying it by the number of current customers

Calculating the present value of a future customer is (net of costs to acquire the customer) and multiplying it by the number of future customers

I ran into this post yesterday and still trying to get a good handle on the concept to see how exactly it may be applicable.

——

MicroAcquire Academy

MicroAcquire launched a series of YouTube videos that go over various parts of the business acquisition process. It’s always great to see new resources and educational content. The videos are: Startup Valuations, Common Deal Structures, Prepare For An Acquisition, Data Rooms, Example P&L, Attracting Acquisition Offers, Acquisition Timeline, Startups Worth Acquiring, Seller Financing, Letter of Intent, Legal, Due Diligence, Transferring Assets.

——

Traditional vs self-funded search

I’m a fan of the Big Deal Small Business newsletter which follows along one searcher’s journey. The latest post is titled The Math of Traditional vs. Self-Funded and it’s excellent.

If deploying capital & growing a business is your jam, a traditional search is probably a better fit. If buying a cash-flowing, old-school small business for a low multiple and trying to eke out a bit of growth each year sounds exciting, a self-funded approach may yield better results.

——

Shopify targeting tool

It was revealed last week that Shopify plans to launch a new tool to help advertisers target FB and Google ads - Shopify Audiences. My understanding is that Shopify plans to aggregate all shopper data from their 1.7M stores and allow merchants to use that data for ad targeting. Basically, use the pixel data to create lookalike audiences. This is a really interesting move and I’m excited to see how this tool works.

——

That’s all for this issue of The Business Inquirer!

Help us improve with anonymous feedback. How did you like this issue of the newsletter?

If you enjoyed reading this newsletter, why not share it?

Let’s connect: LinkedIn, Twitter, Facebook Group, Calendly

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.