The Business Inquirer - #6 (12/7/2020)

In this issue I first provide a newsletter update then highlight a sunglass brand, DTC teeth whitening, SaaS for Amazon, and what I learned last week.

Every week I highlight interesting online businesses which are for sale adding my own commentary. This newsletter is for those who are interested in business, finance, and entrepreneurship. Subscribe below to receive it directly in your inbox.

Hello Friends!

In this week’s e-mail:

Newsletter Update - Newsletter Stats, Facebook Group, Future

eCommerce - Sunglass Brand

DTC - Charcoal Teeth Whitening Strips

SaaS - Amazon Product Research Tool

What I Learned Last Week

Newsletter Update

I had the idea for this newsletter in late October, first issue went out Nov 2, and we’re now on our 6th issue on Dec 7. I figure now is a good time to provide a quick update and share some numbers.

We’re now over 225 subscribers…

Here are some more detailed statistics…

Thank you to all who subscribe. Please continue to read and share the newsletter. Let me know how I can add more value to you.

Facebook Group

If I was a betting man then I’d say that we’ve probably reached peak newsletter and peak Facebook Group for the simple reason that I recently started both.

Having said that…

Please join The Business Inquirer Facebook Group. Here’s what I’m thinking for this group:

Networking.

We’re a small group with an interest in online businesses. We’re good people to know. Join the group and introduce yourself.Collaboration.

I want to get 2 or 3 subscribers together, buy a modestly priced business, grow it, and sell it - all in public, documented. That will happen. But, it doesn’t have to happen with me and it doesn’t have to happen just once. Post in the group if you’re open to collaborating with others on an acquisition.Content.

I’ll post content in the group. Tips, tricks, interesting articles, personal thoughts, etc. Do let me know what types of content you find most valuable and unique.Ideas.

I do (almost) daily business ideation. I’ll share those business ideas in the FB group.

The Future

I am currently thinking through my goals for 2021. I want to grow this brand/publication. I want to add more value and nurture this entrepreneurial community. If you have ideas, would like to be involved - do reach out.

eCommerce - Sunglasses Brand (Asking: $210k + inv)

Description

For sale is a Shopify ecommerce store selling trademarked sunglasses. Main product are floating sunglasses but they’ve also sold snow goggles, beanies, and other accessories. The business does carry inventory which would cost the buyer $90k. Sellers acquired the business in 2017 and operate a handful of other brands.

Details

Built on Shopify

Trademarked brand name

Most visitors come from FB ads, Google, e-mail, and SMS.

36% repeat purchase rate

65k active e-mail list

Amazon account but haven’t focused much on that channel.

Offers lifetime warranty on sunglasses

$90k in inventory that would need to be transferred to a 3PL or buyers warehouse

100% Y/Y profit gains

Gross Revenue: $313,160

Net Income: $100,413

Margin: 32%

Asking: $210,000 + $90k inventory

Multiple: 2.09x

🤓 Why I’m Highlighting This Business

The valuation seems cheap at first glance but of course we’d need to see how much they spend on advertising, sourcing, CAC, etc. From personal experience - I use two sunglass brands which I love (Goodr, Blenders) and my wife and I each order at least 2 pairs per year. Just from that, I think the cheap sunglass business is a good place to be. Keep in mind that my assumption is that these are “cheap” sunglasses. I don’t know that for sure as there’s an NDA.

People are always searching for cheap sunglasses but really interesting that we’re seeing lower highs (to put this in finance terms)…

It’s a crowded space with relatively high CPC so customer LTV is important…

✅ What I Like:

Sellers run multiple brands and probably experienced

Multiple looks cheap or at least reasonable. Margin of safety

Clear marketing & distribution channels with growth potential

Can add a lot of adjacent products

Plenty of suppliers

Easy to market on TikTok/IG/YouTube

Large TAM, 65k email list, 36% repeat purchase

Floating on water is a differentiator

Trademarked brand name

❌ What I Don’t Like:

Listing is under NDA so I don’t have a lot of details

Multiple is cheap for a reason. Have to discover what that is and whether it’s an issue.

Sunglass space is crowded with a lot of competition and high CPC

Sellers seem to be experienced. Why are they selling?

Lifetime warranty. (Why? What if Duracell offered a lifetime warranty? You think that’s smart?)

I don’t like any business where I have to manage inventory but that’s a personal preference

I don’t know if “floating on water” is a big enough differentiator for sunglasses

Is this an industry where you just have to spend more than the next guy on advertising?

32% margin seems pretty low

🚀 How I Would Grow This:

Immediately get rid of the lifetime warranty. No one would notice 60-day vs. lifetime (I think).

Reach out to cool adjacent brands like Chubbies, Howler Bros, Meripex, Birdogs, Bonobos and do collaborations and cross-promotions.

Broadly - I’d stay away from competing on CPC. Better to find influencers, affiliates, content marketing.

Explore ways to drive cost down to increase margin. I think you want 40-50% margin for this business.

I don’t know the AOV here but I’d try to increase that by offering items at check-out (cleaning clothes, anti-fog spray, holders, etc)

You can view the listing on QuietLight Brokerage

DTC Charcoal Teeth Whitening (Asking: too much)

Details

For sale is Hugh, a DTC teeth whitening brand using premium, natural ingredients for teeth whitening strips. Business is fully developed with products, suppliers, website, business plan. Started in 2019, the founder built all the pieces but abandoned the project due to personal circumstances. Business is turnkey, has some minimal revenue and expenses.

Details

Launched in 2019, abandoned in 2020 for personal reasons

Built on Shopify

Agency managed for 2.5 months achieving $7k in sales

Includes all brand assets, suppliers, etc

7.8k FB followers, 2k e-mail list, 600 IG followers

Asking: $15k (auction). BIN: $29k

🤓 Why I’m Highlighting This Business

Let’s ignore the asking price for a bit. I actually think this business could be interesting for someone who either has an adjacent business or wants to easily get into the DTC space.

Teeth whitening is a growing interest…

✅ What I Like:

Price here is clearly negotiable

Branding and website look great

Professional agency was able to get $7k in sales in 2.5 months (of course need details, etc)

Turnkey so you’d just have to spend marketing dollars

If you get this for the right price and get steady revenue, you can sell it for a nice multiple and ROI

Charcoal has proven benefits

❌ What I Don’t Like:

Maybe seller is delusional and thinks $29k BIN price is acceptable

Appears you’d have to carry inventory here

I don’t know what’s unique about this business

Requires capital for a marketing push

No proof that one of the benefits of charcoal is teeth whitening

🚀 How I Would Grow This:

Unless this is an industry you’re really into - I would just flip it. I think this would be a good 12-18 month project for a quick flip.

At the end of the day, you’re just getting some branding and a list of suppliers. Offer the seller something around $5k - $10k for the “business” and see if they bite.

Speak to the agency who did $7k in sales in 2.5 months. If there’s a chance to negotiate the right economics, grow the business, get a track record, and then sell.

You can view the listing on Flippa.

SaaS - Amazon Research Software (Asking: $3.4M)

Note: Business under NDA so limited information available.

Description

For sale is a leading Amazon research software which helps Amazon store owners conduct market research and grow their stores.

Details

Integrates with multiple 3rd party software providers

12,200 customers

SBA eligible

22% revenue growth per quarter since 1Q17

MRR: $119,000

Yearly Revenue: $1,268,000

Yearly Profit: $1,016,000

Net Margin: 75%

Asking: $3,354,000

Profit Multiple: 3.3x

🤓 Why I’m Highlighting This Business

Amazon is a growing platform with close to 3,000 new sellers listing their products every day (globally). Anytime there’s a tool for sale which is utilized by this growing customer base - it’s interesting. I think it’s safe to say that the business is something similar to Jungle Scout which has over 400,000 customers.

You can view the listing on FE International.

🧐 What I Learned Last Week

Triller probably did not get the ROI it wanted

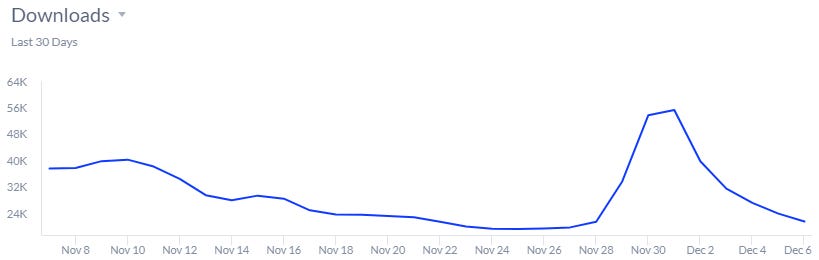

On Saturday November 28th I watched the Mike Tyson vs. Roy Jones Jr. PPV fight along with 1.2M - 1.5M others. Triller was one of two (+Weedmaps) official sponsors of the fight. For those who are not aware, Triller is basically the US version of TikTok. They paid north of $50M for the sponsorship so I was curious what type of boost Triller would see. I asked my friends at Apptopia to send me some data. Verdict: Doesn’t seem like much. Normal daily download rate is around +20k which jumped to +54k for a few days. Is that worth $50M?

——

Why don’t business sellers capitalize on their email list?

If you recall in a past newsletter, there was a shady influencer marketing company which sold likes, views, comments, engagement. They have a 40k email list of fashion influencers. I reached out to the seller and asked how much they would want just to purchase the e-mail list. My interest in this list stems from owning a personal branding business. I feel like there are a lot of influencers, especially ones who would be purchasing likes/views, who could use some help with personal branding. So I made an offer to the seller for him to use his list and promote my business with a revenue share. I haven’t received a response yet. That’s also when the light bulb went off. Why don’t more people do this? Is this a viable marketing strategy?

There are a lot of businesses for sale with huge e-mail lists. They already want to sell the business and move on. Why not give them a chance to make some additional revenue?

Example: You have a business which sells shoe cleaner. You go on broker websites and see someone who is selling a sneaker marketplace or a shoelace business. They have an e-mail list of 10k people. You reach out to the seller and ask them to promote your shoe cleaning business to their email list. You give them an affiliate code and pay them 30% commission on any sale. They are much more likely to take this deal and help you compared with you just reaching out to someone random who is not selling their business. Right?

Does everyone already do this and I’m late to the party? I think there’s a business idea here to connect business sellers with e-mail lists and brands who may want to just buy the list or do promotions.

Anyone want to explore this with me?

——

OnlyFans could be a billion-dollar media giant

Interesting article on Bloomberg regarding OnlyFans. The website which has traditionally catered to adult performers wants to go mainstream. It’s pushing for musicians, gamers, and athletes to join and sell subscriptions.

“When Beyoncé rapped about us on the ‘Savage Remix’ and Cardi B joined the platform, that’s when we really started to see the growth accelerate,” said Tim Stokely, 37, the company’s founder and chief executive officer. According to Stokely, OnlyFans is adding as many as 500,000 users a day and paying out more than $200 million a month to its creators.

This is what “hockey stick growth” looks like…

——

How to value a website or internet business

I recently came across this article from 2019 written by FE International outlining the various methodologies on valuing a business. It’s a good read even if it’s just a reminder of what we already know.

One interesting takeaway from the article is to not put a lot of weight on online valuation tools (CheckWebsitePrice, SitePrice, NetValuator and Webuka).

Don’t be mistaken in thinking online valuation tools always undervalue websites for sale. Often they are just as inaccurate in the other direction. These calculators are not able to properly value websites because they simply don’t have enough information to give an accurate valuation. Because of this, you are never going to get a fair and accurate representation of what your website is actually worth.

Conclusion? Don’t use them.

——

That’s all for this issue of The Business Inquirer!

If you enjoyed reading this newsletter, why not share it?

As always, please don’t hesitate to contact me with any questions, comments, or feedback. I also check all comments in the web version of this newsletter.

Let’s connect: E-Mail, LinkedIn, Twitter

Join The Business Inquirer Facebook Group.

Important Disclaimer: This newsletter is provided for informational & educational purposes only, and should not be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, it has not been independently verified. The Business Inquirer makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any business, tax, or investment decisions. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.