What I Learned Last Week 8.11.23

Curating the best M&A, SMB, and EtA-related content since 2020.

Hello Friends!

In this week’s issue of What I Learned Last Week:

📰 Articles

🧵 Best of Twitter

🤔 Other

🗓️ Events

⚒️ Tools & Resources

💡 How I Can Help

This issue of The Business Inquirer is sponsored by DueDilio.

DueDilio is a leading marketplace to hire highly vetted M&A due diligence service providers.

Our large and growing network of independent professionals, boutique, and mid-size firms specialize in finance, legal, technology, commercial, and other key areas of business diligence.

We save our clients the time, hassle, and cost of hiring a due diligence professional.

Submit your project.

Review qualified proposals.

Hire a service provider.

📰 Articles

Q2 SaaS M&A Report: Continually Strong

Bloom VP gives a great overview of the recently released Software Equity Group Q2 SaaS M&A Update Report. The data is from publicly traded SaaS companies but the takeaways are also applicable to the lower middle market.

— — — — — — — — — — — —

Bridging the Price Gap: Negotiation Tactics for Small Business Transactions

BizBuySell goes over the various tactics to bridge the valuation gap between buyer and seller.

Bump The Lease Rate on Seller Owned Real Estate

Hire the Seller as a Consultant

Seller Note

Offer an Earnout

Seller Note with the Right to Offset

Premium Interest Rate Above Market on a Seller Note

— — — — — — — — — — — —

Sealing the Deal: Breaking Down the LOI

Axial does a nice job of explaining the key elements of an LOI. You can download professionally written LOI templates from the DueDilio Template library.

— — — — — — — — — — — —

How to Build a Killer M&A Deal Team

CFO Secrets does a deep dive into the role of various M&A advisors in corporate M&A transactions. DueDilio can help you assemble your team in about 36 hours, for free.

🧵 Best of X (Twitter)

Having a good grasp of the sales cycle is important. Here’s some really great data on the typical sales cycle in technology…

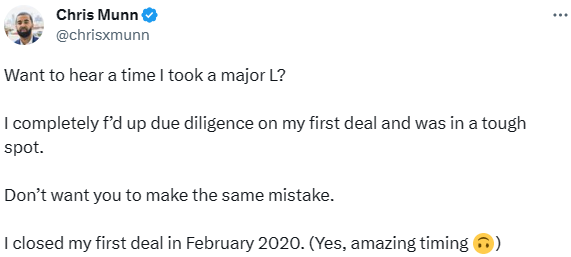

Sellers lie. Use every tool at your disposal to protect yourself. Proper due diligence, reps & warranties insurance, forgivable seller note…

Coke vs. Pepsi, Apple vs. Android, Pizza Hut vs. Domino's, and whether it’s better to pursue smaller vs. larger SMB deals are all timeless debates. Each side has its own pros and cons...

A good case for focusing on businesses with > $500k in profit…

Emmanuel outlines some excellent lessons in choosing the right investors, filling the knowledge gaps, and more…

A proper QofE is like a protective shield…

🤔 Other

New Marketplace

Another week, another marketplace launch. On Wednesday I received the launch e-mail for Vetted Deals, a content website marketplace.

🗓️ Events

Tales From The Search: First 100 Days From Searcher to Operator (Aug 15) - Virtual

Southeast ETA Conference (Sept 8-9) - Durham, NC

HoldCo Conference (Sept 18-20) - Cleveland, Ohio

Austin SMB Meetup (Sept 28) - Austin, TX

Buy Grow Sell Summit 2023 (Sept 5-6) - Virtual

EtA Forum Asia Pacific (Sept 14-15) - Sydney, Australia

The Self-Funded Search Conference (Sept 30 - Oct 1) - Dallas, TX

Booth Kellogg EtA Conference (Nov 1) - Chicago, IL

Main Street Summit (Nov 8-9) - Columbia, MS

Capital Camp (May 21-24) - Columbia, MO

How did you like this issue of the newsletter?

⚒️Tools & Resources

I want to share some tools & resources that I have found helpful. Please note that some of these are paid sponsors of the newsletter.

PrivSource - PrivSource helps you source deals and connect with transaction partners without ever paying a success fee.

X5 Deals - Proprietary deal sourcing. They do the outreach and send you relevant, actionable deals directly into your inbox.

Rejigg - Platform that connects searchers/investors directly with owners of off-market software businesses ($500k - $15m revenue) considering exits. All deals are sourced by the Rejigg team, ~5 added per week.

Acquisition Lab - The Premier Accelerator for Buying a Business created by Walker Deibel, Author of Buy Then Build: How Acquisition Entrepreneurs Outsmart the Start-up Game. They combine world-class education, a vetted community, extensive group coaching, and resources to provide the first do-it-with-you buy-side advisory service.

BizNexus - Marketplace + off-market origination in one platform. The marketplace averages about 10k active listings & pre-CIM opportunities, and the off-market origination focuses on data & multi-channel.

Search Fund Coalition - community for the Entrepreneurship Through Acquisition ecosystem. Monthly events and meetups for acquisition entrepreneurs.

Deal Sourcing Guide - a comprehensive list of business marketplaces, brokers, deal origination firms, and more.

💡 How I Can Help

Whenever you’re ready, here are a few ways for us to work together…

Schedule 1:1 consulting on deal sourcing, due diligence, M&A ecosystem, newsletters, entrepreneurship, or anything else you’d like to discuss

Promote your brand to business buyers, investors, SMB owners, and other M&A participants by sponsoring this newsletter

Assemble your M&A deal team with DueDilio

If you enjoyed reading this newsletter, why not share it?